There are some factors helping to change the perception. For example, international pressure on the region’s hydrocarbon-dependent economies; the financial industry adopting various green bonds or other socially responsible investment funds; or governments that have set the long-term goals and net zero targets that companies have to comply with. According to the Lombard Odier survey 2022, 81% of HNWIs in the Middle East were thinking about ESG issues when looking at potential investments.

Commitment to Green Energy

At the 2022 United Nations Climate Change Conference, held in November 2022 in Sharm El Sheikh, Egypt (referred to as COP27), substantial funding commitments from the Middle East Green Initiative or the Arab Coordination Group have been apparent. This means billions in funding for an energy transition in line with Net Zero long-term investments. At the same time, the Gulf states, which are historically hydrocarbon-reliant economies, noted that the transition has to be realistic in recognising the need to supply affordable energy to other global economies. They have to consider the need for global energy security too.

A Good Example of Saudi Arabia

One of the most advanced Middle East countries in the field of ESG investments is Saudi Arabia. In accordance with Saudi Aramco’s goal to achieve net-zero emissions by 2050, the company introduced a USD 1.5 billion sustainability fund in October 2022. Since this mostly state-owned petroleum and natural gas company is the second-largest in the world by revenue, its goals are ambitious. The fund aims to invest in technologies that will significantly reduce greenhouse gas emissions across its assets, complementing existing solutions and those in the development pipeline.

There are more projects to be looked at in Saudi Arabia. The world’s largest single-site solar power plant will be built in Saudi Arabia, in Al Shuaibah, Mecca province. The solar-power facility is expected to start operations by the end of 2025, with a generation capacity of 2,060 MW. Investments in clean energy projects are expected to rise, assisted by high oil prices in 2023–24, as Saudi Arabia seeks to add 15 GW of renewable energy capacity in 2022–23, supporting the government’s climate objectives and economic diversification strategy.

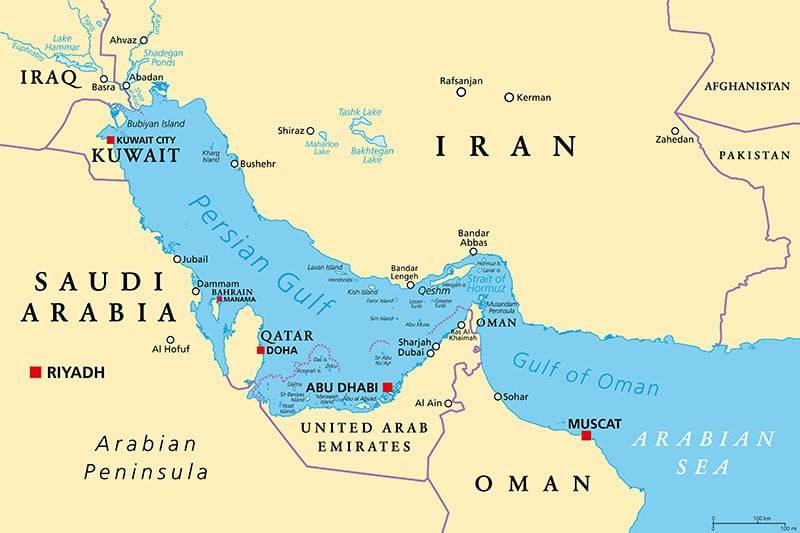

The first wind farm in the Kingdom is in Dumat Al-Jandal and entered into service in August 2022. It is the largest in the Middle East, with a capacity of 400 MW, and provides power to 70,000 homes. The kingdom also plans to build a 500-megawatt floating offshore wind farm in the Gulf, which is expected to be completed in 2027.

Wind and solar Plants

As for the UAE, it is one of the leading countries in this field, as part of the country’s Energy Strategy 2050, which aims to increase its clean share in the energy mix to 50%. It has built the first wind turbine to generate electricity on Sir Bani Yas Island, which is located 250 kilometres southwest of Abu Dhabi. The plant has a production capacity of 850 kW of energy per hour. The Mohammed bin Rashid Al Maktoum Solar Park in Dubai is one of the world’s largest solar energy projects, aiming for a total capacity of 5,000 MW by 2030. Another one, the Shams 1 Solar Power Plant, is a 100 MW concentrated solar power plant, one of the largest projects of this kind in the world. A sustainable urban development project focused on renewable energy and clean technologies was built in Masdar City, Abu Dhabi.

Oman also has great wind energy potential, with strong wind flows along its long coastline, which stretches for more than 2,000 kilometers. The Sultanate has a 50-MW wind farm in the Dhofar region and plans to build more wind farms across the country.

As for Egypt, it aims to reach 42% of renewable energy with electricity generation capacity by 2035, including 14% of electricity derived from wind energy. The World Bank estimated the potential of offshore wind in the economic zone of the Suez Canal at about 166 GW.

Companies in the Middle East are responding with increasing interest to new demands for changed thinking and stronger action on climate issues. They are showing greater transparency about how their operations affect the environment through increased public reporting. Still, investors in the Middle East are becoming more conscious of the potential risks and opportunities associated with ESG factors. This shift in mindset is driven by increasing awareness of global climate change, social inequality, and corporate governance issues.

We think you might like

Sustainable investing represents a paradigm shift in the business world. It recognises the importance of responsible corporate behaviour and sustainable development alongside profit generation. Rather than focusing solely on financial returns, ESG investing gives equal weight to a company’s environmental impact, social responsibility and governance structure. In essence, it’s a way for investors to make […]