While you may not be specialised in the technology side of your firm’s operations, it is worth understanding the basics of cloud security. Your clients read the news, and the next time a cyberattack makes headlines they may wonder if you – and they – will be next. The information in this article will give you a solid foundation for putting their minds at ease.

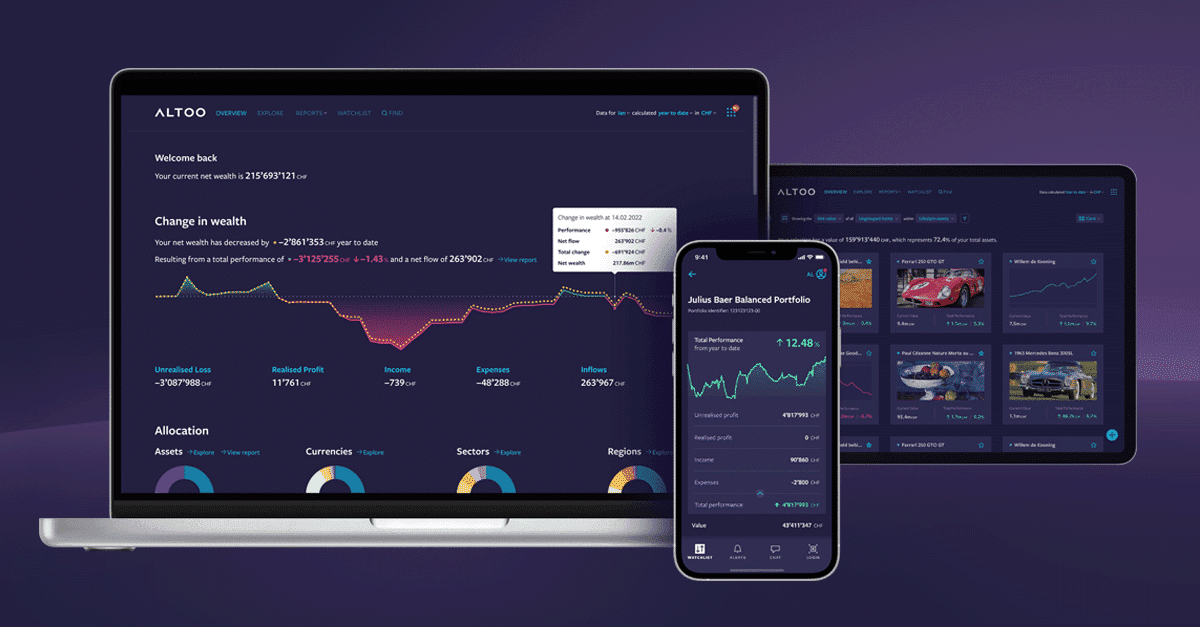

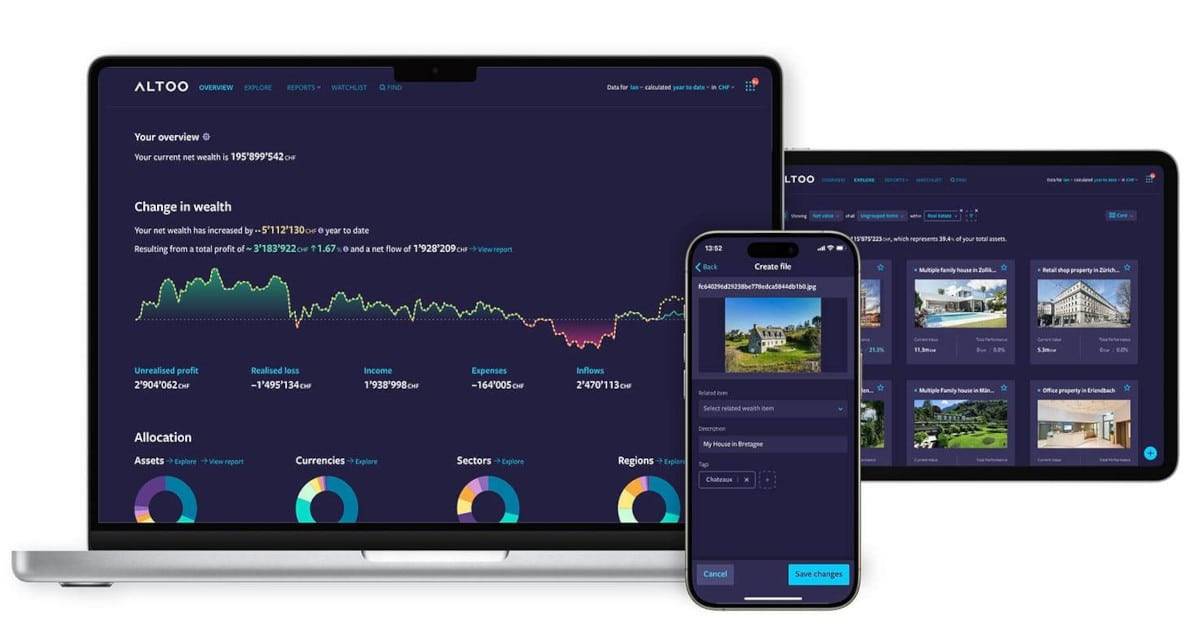

Experience the power of the Altoo Wealth Management Platform, where affluent individuals and their families can effortlessly consolidate and expertly manage their vast array of assets. With our cutting-edge technology, you can now streamline your financial portfolio with utmost precision and logic.

In today's fast-paced world, wealth and asset management has become increasingly complex and time-consuming for private individuals. The more bank relationships you have and the more diverse your individual portfolio, the harder everything becomes to manage — especially if you’re trying to do it manually. Advanced wealth management platforms like Altoo are helping people like you manage their financial portfolios across banks in near real time through the power of bank connectivity.

Digitalisation is making headlines for reshaping how business gets done in practically every industry. The pressure is on to skill up and take advantage of the associated opportunities. This article outlines the best competencies for wealth managers to develop in this digital era and the most efficient way to translate them into business value.

If you’re using Excel spreadsheets for wealth management, you may have wondered about the value of

a wealth management platform, and at what point it makes sense to investigate the options.

These days, digitalisation is transforming the entire financial industry. What does that mean for professionals in the business of managing assets on behalf of wealthy and ultra-wealthy individuals? This article examines the importance of modern digital solutions for private bankers and independent asset managers in assisting them to deliver exceptional client service.

According to current statistics, your wealthiest clients are likely to have a rather uniform personal profile. According to research from Wealth-X, the global population of ultra-high net-worth individuals (UHNWIs) is 89% male, with an average age of 65. In the near future, however, the population of wealth owners will include more women, Great Wealth Transfer recipients, and affluent earners having just crossed the high net worth threshold. This article outlines what you should know to best position yourself to serve tomorrow’s digital-native investors.

As a wealth manager, do your clients take your advice entirely at face value? If not, they probably have good reasons. After all, they most likely became wealthy by thinking analytically. You should not expect them to stop that analysis just because you are providing the answers. Fortunately, their difficult questions can hold immense value for both you and them. A sophisticated digital wealth platform can help you extract and unlock that value.

In today’s increasingly digitalised financial landscape, all forward-thinking wealth professionals face a shared set of challenges in consolidating, analysing, and visualising data as they monitor investments. For family officers in particular, these challenges involve three specific challenges. Here we suggest how you can successfully address them.

To keep up with constantly shifting traditional markets like real estate and equities as well as emerging asset classes like NFTs and cryptocurrencies, many family offices have recognised the importance of investing in their people’s targeted education. In this article, we list some of the best business school offerings designed to help family office executives skill up.

Most modern wealth managers have plenty of financial data of multiple types from multiple sources. The key question is: what are they going to do with it? Properly visualising the data is one of the most valuable steps for distilling meaningful insights from it – and ultimately driving superior returns for their clients. Here is why.

Modern wealth managers seek to leverage the latest digital solutions as they continuously refine their strategies. An effective portfolio management system can provide them with a technological foundation for analysing investment performance in real-time and making better, more-informed decisions regarding asset allocation, risk management, and rebalancing. Below we outline what wealth managers can expect from such a solution.

Automated, algorithm-driven investment platforms, commonly known as robo-advisors, have emerged as a convenient solution for portfolio management. While able to serve as an alternative to human financial advisors for fee-sensitive clients preferring a do-it-yourself approach, robo-advisors can also provide a valuable tool for traditional, relationship-driven wealth management firms to provide superior services. This article describes how.

Projections of the value of the personal assets set to change hands during the so-called Great Wealth Transfer have risen from US $129 trillion from $72 trillion. More significantly, or perhaps alarmingly, are expectations that up to 88% of heirs to this wealth will fire or replace their parents’ financial advisors. How can you position yourself to keep serving the next generation of their clients? Read on for our top three recommendations.

Wealthy families and their advisors face the challenge of handling complex information from diverse sources, including investment managers, lawyers, and accountants. Artificial intelligence (AI) is emerging as a powerful ally, aiding in extracting valuable insights from this information overload and facilitating clear communication within family offices. Below we outline the top four family office use cases for AI and what to remember when embracing them.

As we settle into 2024, an upward trend in many cryptocurrencies’ prices is putting the relatively new asset class in headlines and under many investors’ consideration. Below we break down the ten most important cryptocurrency-related vocabulary terms to know as what many analysts consider to be the next crypto bull market takes off.

As the new year unfolds, the business landscape is poised for significant transformation. The upcoming megatrends of 2024 promise to redefine industries, reshape strategies, and create both challenges and opportunities for companies worldwide. Let's delve into the five most important ones to watch this year.

As digitalisation reshapes the global economy, a trend of so-called crypto philanthropy has emerged. Involving cryptocurrencies such as Bitcoin and Ethereum, this innovative concept provides a borderless and bureaucracy-free alternative to traditional philanthropy and is poised to take on a powerful role in charitable giving.

For family offices, going paperless not only streamlines operations but also supports a more sustainable and efficient business model. Read on for our top tips on how your family office can digitalise to improve the way you manage finances and boost overall productivity.

Asian business founders and wealth owners are ageing, and more of them than ever are transferring their assets to younger family members in what has been dubbed the Great Asian Wealth Transfer. This trend is setting the stage for private wealth management advisers and banks to shine through comprehensive estate and legacy planning.

The ability to extract actionable, real-time insights from multi-source data is an increasingly important success factor for wealth management businesses. Here we introduce data virtualisation as a way for them to build this ability and why they should consider adding it to their digital tool belt.

As we enter 2024, a new wave of ESG trends will shape the business world and drive positive change. Here we present the top trends for 2024, providing valuable insights for companies looking to make a meaningful impact. From mandatory reporting requirements to supply chain transparency, these trends will pave the way for a more sustainable future.

International real estate investments represent one of the most popular avenues for diversifying, preserving, growing wealth. This article explores six countries outside the European Union whose property markets are expected to draw significant interest from high-net-worth individuals seeking outsized returns.

Single and multi family offices are contending with more complexity than ever. For family officers and the families they assist, this article lays out the three main causes of this complexity and how the Altoo Wealth Platform simplifies them.

Wealth management firm leaders are always on the lookout for ways to save time, reduce costs, and make their processes more effective with new technologies. Their colleagues, however, are often reluctant to alter their familiar workflows. Read about the best ways to achieve firm-wide adoption of new digital solutions that can lead to success for the entire team.

Whether you are overseeing a private foundation or a public charity, it is essential to have effective practices in place to ensure the responsible stewardship of your organisation's resources. By implementing best practices in foundation asset management, you can maximise the impact of your philanthropic efforts and safeguard the long-term sustainability of your foundation.

We think you might like

According to the latest Global Family Offices Market Report by UBS, the global family office market was set to reach a value of USD 87.18 billion by 2022. Owing to the growing number of affluent families, it is projected to grow further at a CAGR of 7.5% between 2023 and 2028 to reach a value of USD 133.60 billion by 2028.

In October, Forbes Magazine featured Altoo in its ‘2019 Family Office Software Roundup’. The overwhelming response by Forbes’ global audience demonstrated that our commitment to Switzerland and the Swissness of our technology delivers a strong value proposition to international clients.

Bill Gates stands as a paragon of not only immense financial success, but also as an example of profound societal impact. With a net worth estimated at $116.1 billion in 2023, Gates has reinvented the notion of wealth for our time, transforming it from a mere accumulation of currency to a force for global change.

In case you missed it

In today's fast-paced world, wealth and asset management has become increasingly complex and time-consuming for private individuals. The more bank relationships you have and the more diverse your individual portfolio, the harder everything becomes to manage — especially if you’re trying to do it manually. Advanced wealth management platforms like Altoo are helping people like you manage their financial portfolios across banks in near real time through the power of bank connectivity.