What is a Trust?

The legal institution has its origins in the 12th or 13th century. English knights who took part in crusades appointed administrators for their estates at that time. A trust has no legal personality of its own, but establishes a legal relationship between several parties.

The founder of the trust transfers his assets to a trustee during his lifetime or in the event of his death. The trustee thus becomes the administrator and owner of the assets. However, these are not personal assets, but separate assets.

What is a Foundation?

In accordance with the guidelines given by a founder, foundations are distinct legal entities. Any property that is handed to a foundation by its founder becomes the foundation’s property, and it is governed in accordance with a charter and a set of regulations. A foundation, just like a trust, is required to have clearly stated goals, and these goals might be related to charitable giving or to something entirely different. The creator of a foundation may opt to retain some capabilities, such as the ability to manage investments or issue distributions, despite the fact that there are no beneficial owners associated with the foundation. Trust deeds can also contain reserved powers, but the nature of these powers and the extent to which they are exercised can vary greatly.

Legal aspects

Trusts have proven to be a more suitable option for families residing in common law jurisdictions, such as the UK. These jurisdictions have tax regulations that are typically more accommodating towards trusts, allowing families to benefit from their advantages. Furthermore, the presence of a well-established body of case law provides a reliable foundation for families to rely upon when utilising trusts.

A foundation is commonly characterised as a fusion between a trust and a company. In a parallel role to that of a council overseeing a foundation, directors of a company assume the crucial responsibility of overseeing and managing the various activities of the organisation. In a striking parallel, both companies and foundations share a crucial commonality in the form of separate legal personalities. This entails that both entities are required to have a physical registered office, further solidifying their resemblance. In civil law jurisdictions, opting for a foundation rather than a trust is often favoured due to the greater clarity and understanding surrounding the corporate structure. This serves as an additional rationale for such a choice.

When determining the most suitable structure for succession, wealth planning, and philanthropy, it is crucial to carefully evaluate each family’s unique circumstances. This evaluation should encompass various factors, including legal and taxation regulations, cultural practises and practical implications associated with residing in a specific country.

By considering these elements, one can make an informed decision regarding the optimal approach for their family’s situation.

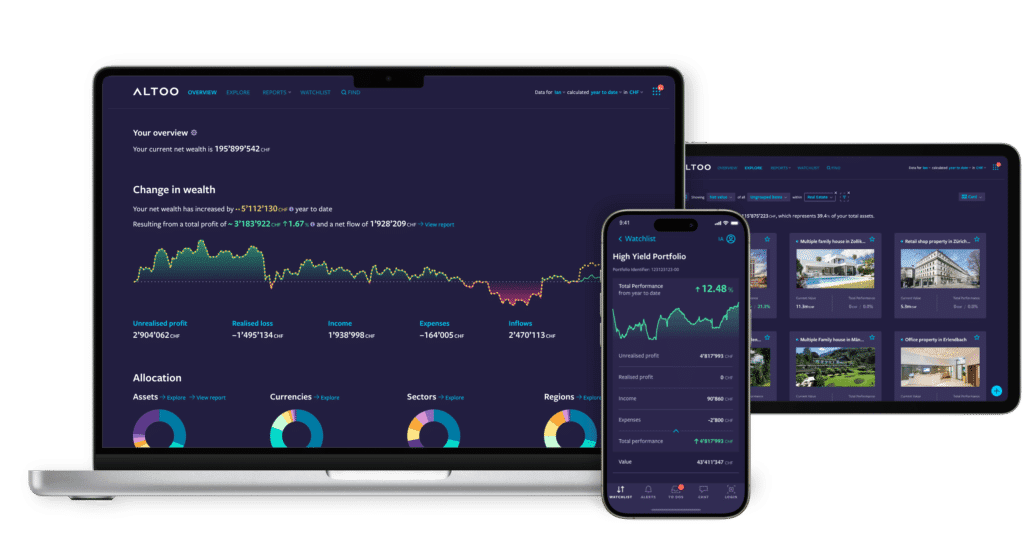

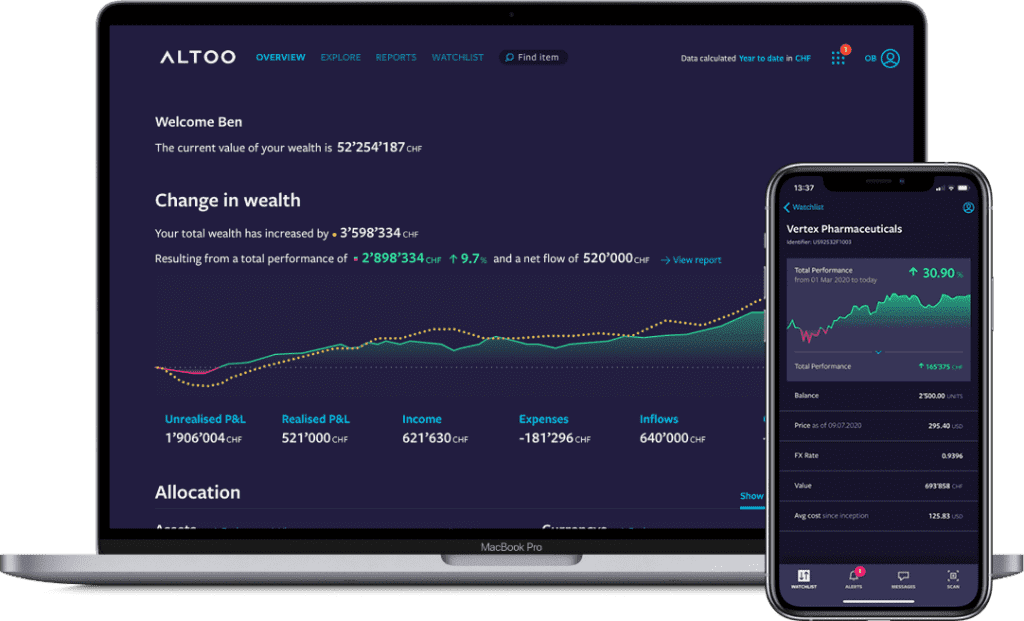

Wealth management

Many foundations and trusts opt for professional wealth management as it improves the efficiency and effectiveness of their day-to-day operations.

There are three main reasons for this decision: (1) time relief through outsourcing of processes with high workloads, (2) reduction of liability risk by agreeing on binding and transparent investment guidelines; and (3) the expertise of professional asset managers and their experience with the management of numerous foundation assets

Experts conclude that the assets of these entities need to be managed in a way that allows them to fulfil their mission in the most effective manner possible. What appears straightforward on the surface is sometimes rather challenging to put into practise.

Because of the profound shifts that have taken place in the financial markets, many of the presumptions that were made when a foundation or a trust were established are no longer valid. The distributions that foundations and trusts make, on the other hand, are a significant part of the contribution that they give to society.

Consistent return maintenance is the duty of competent entity managers. Not just for paying their regular payouts, but also for funding charity initiatives that primarily benefit foundations.

The majority of individuals who have charity ambitions also want to keep their assets, so they require somewhere around three percent of their existing income per year to reach those goals. During this stormy year for stocks and in the face of increasing interest rates, this is going to present a challenge that is particularly tough for managers to overcome.

The majority of wealth managers are not sufficiently sensitive to the needs of their endowment customers and instead provide ideas that are “off the shelf.” However, given the present climate of rising inflation and fears about a recession, foundation managers would need to change portfolios in close cooperation with clients in order to guarantee that essential distributions were not put in jeopardy. There is an increased requirement for sound financial management, and in many instances, there is pressure being put on returns.

Regardless of the reasons they were established, foundations and trusts in today’s world have challenging obligations in the areas of wealth management and governance.

The ever-increasing complexity and regulation of the financial markets have an impact on foundations and trusts, just like other types of investors, so these entities must also deal with constantly changing regulations. This requires maintaining a continual equilibrium between expenses, potential returns, and responsible governance.