According to Knight Frank, an average of 32% of European ultra-high-net-worth individuals’ total wealth is allocated to primary and secondary homes. Austrian UHNWIs are particularly fond of such assets, putting 59% of their total wealth into them. Commercial property is even more popular among UHNWIs around the world, whom Statista found allocating an average of 21% of their total wealth towards directly holding it and 12% towards indirectly holding it through funds or real estate investment trusts. In Switzerland, the Swiss Asset Management Institute identified real estate as asset managers’ favourite alternative asset class to include in their mixes in 2022.

Clearly, investors like real estate. They have many good reasons to do so, including that it often serves as a secure, effective hedge against inflation and – especially for the wealthiest of investors – a key component of an affluent lifestyle and a family legacy. In general, real estate has a reputation as a “safe” investment asset class where prices tend to rise more than they fall, as exemplified by the recent case in Switzerland.

There are, however, a couple of particularly challenging aspects of owning real estate directly:

01 Properties Have Unique Types of Expenses

01 Properties Have Unique Types of Expenses

To effectively manage an investment portfolio, it is necessary to have a clear understanding of the value of every asset in it, each asset’s associated expenses, and how each one fits into the overall portfolio. A primary purpose of a digital wealth platform is to help investors and their advisors gain such an understanding by bringing together and presenting financial data from multiple sources.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

In the case of traditional assets like equities or funds, there are relatively few forms of expense data to track. Transaction costs or management fees are the most common examples.

Directly owned real estate, on the other hand, comes with a variety of expenses – like utilities, property taxes, refurbishment costs, and insurance premiums – that are practically never encountered with traditional financial assets. Using spreadsheets to track expenses for any asset is tedious and risky, but for real estate assets they are particularly cumbersome.

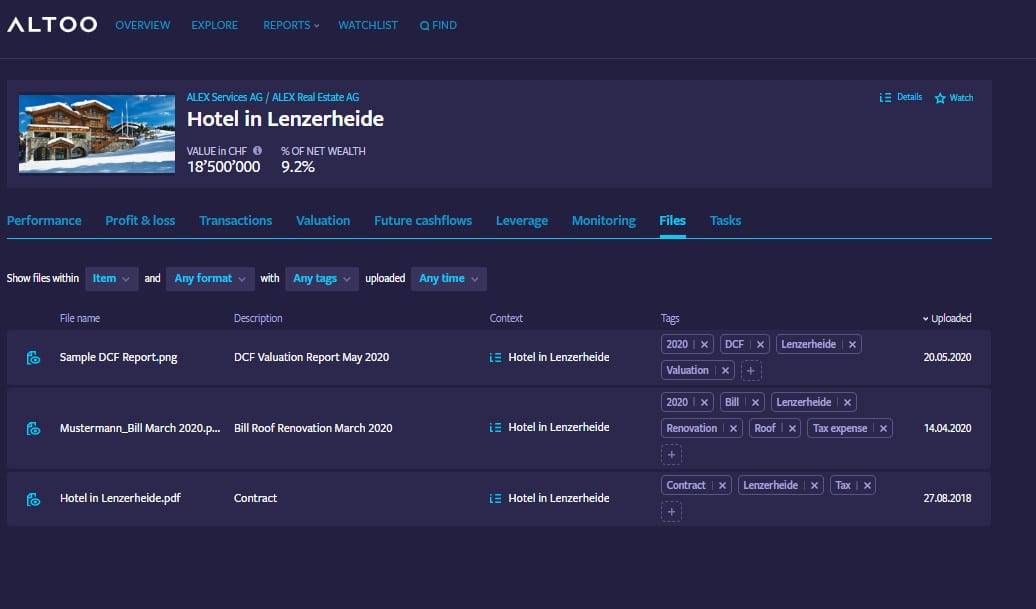

Here, a sophisticated digital wealth platform incorporating features to support real estate investing can help streamline the process of weighing up the financial costs and benefits of keeping particular properties in a portfolio. The Altoo Wealth Platform, for example, allows property owners and their advisors to:

- track properties’ current and historical valuations, particularly beneficial considering that real estate holdings, especially high-end residential properties, tend to be relatively illiquid, with market data often limited and/or slower to obtain,

- place these valuations within the context of macro and micro property price trends,

- track all expenses,

- upload and attach contracts, insurance policies, renovation bills,

- tag relevant transactions for various reasons like tax relevance or valuation updates,

- observe the status of mortgages and other liabilities, and

- project cash flows.

It is also worth noting that Altoo consolidates and visualises data from across an investor’s entire portfolio – with respect to properties as well as all other forms of bankable and non-bankable assets including, for example, private equity – to give a comprehensive, easy-to-understand view of his or her total holdings. This visibility allows investors and their advisors to:

- make data-driven decisions about whether to keep or divest specific property holdings and

- understand exactly how much of their overall wealth is parked in real estate, particularly helpful in liquidity planning given the generally slow-moving nature of most real estate markets. Among all the assets a UHNWI is likely to hold, properties are among those requiring the longest time to sell at asking price.

02 Real Estate Is Immovable, but It Has Many “Moving Parts” To Manage

02 Real Estate Is Immovable, but It Has Many “Moving Parts” To Manage

Each property – and therefore the experience of owning it – is unique. Generally, no two pieces of real estate share exactly the same location; similar properties only a few hundred metres apart may be valued differently. Also, every building is likely to have one-of-a-kind physical characteristics and perhaps even historical significance. A property owner will thus often need to oversee on a case-by-case basis:

- Operational workflows related to interacting with tenants, construction companies, banks, insurers, and other third parties.

- Compliance with local regulations concerning the property itself. Locations can be subject to specific zoning laws, for example. Also, many European countries including Switzerland, Austria, and Germany have strict energy efficiency rules in place.

- Compliance with local laws concerning property ownership and transfers. Regulations around owning and inheriting real estate can vary considerably between countries. Swiss rules often make gifts of owner-occupied properties challenging to navigate for households. This sort of location-specific complexity typically prompts real estate investors to pay special attention to how they legally structure their ownership of individual properties.

In the face of such organisational and regulatory hurdles – which can be particularly perplexing for a spouse or other heirs in case of an UHNWI’s untimely passing – many wealthy property owners rely on the advice of trusted local advisors like real estate professionals, tax consultants, and lawyers.

Here, the key benefit of a digital wealth management platform lies in securely facilitating workflows and information sharing among multiple stakeholders. The Altoo Wealth Platform, for example, gives property owners a secure, one-stop digital environment for:

- Interacting with property managers, family members, or anyone else involved in the ongoing management of properties. The level of each user’s privileges can be customised on a “need-to-know” basis to ensure confidentiality.

- Getting an overview of the legal ownership structure used for each property.

Storing lease agreements, titles, mortgage contracts, and any other type of records associated with individual properties. All documentation is far more accessible and easier to categorise compared to hunting through email chains and checking who is in CC. Also, access to information can be easily limited to defined users as required.

The platform is hosted in Altoo’s Swiss private cloud, allowing users to connect from anywhere via the web or the Altoo mobile app with full confidence in our exceptional data security.

Make Real Estate Investing Simpler with Altoo

Make Real Estate Investing Simpler with Altoo

While real estate is often considered a passive investment, directly holding it is far from entirely “hands off.” The Altoo Wealth Platform makes it as simple as possible by automating the most tedious aspects of tracking the values of properties, determining the total costs of owning them, streamlining workflows around them, and visually contextualising them as elements of entire portfolios.

Direct Real Estate Investing Complexities

Altoo Features

Altoo Benefits

Unique types of expenses

Consolidation and visualisation of all data on:

- All expenses

- Current and historical valuations

- Overall portfolio value

Complete understanding of each property’s true value and overall real estate allocation within entire portfolio

Many “moving parts"

- Secure, one-stop communications

- Legal structure verviews

- Document storage

Total control over information flows among stakeholders

| Direct Real Estate Investing Complexities | Unique types of expenses |

| Many “moving parts” | |

| Altoo Features | Consolidation and visualisation of all data on:

|

| Altoo Benefits | Complete understanding of each property’s true value and overall real estate allocation within entire portfolio |

| Total control over information flows among stakeholders |

Want to learn more? We look forward to hearing from you!