There is a great deal of buzz around data-driven recommendations in today’s wealth management world. And rightly so: letting the numbers speak for themselves is among the most powerful ways to make a strong case for practically any advice you give.

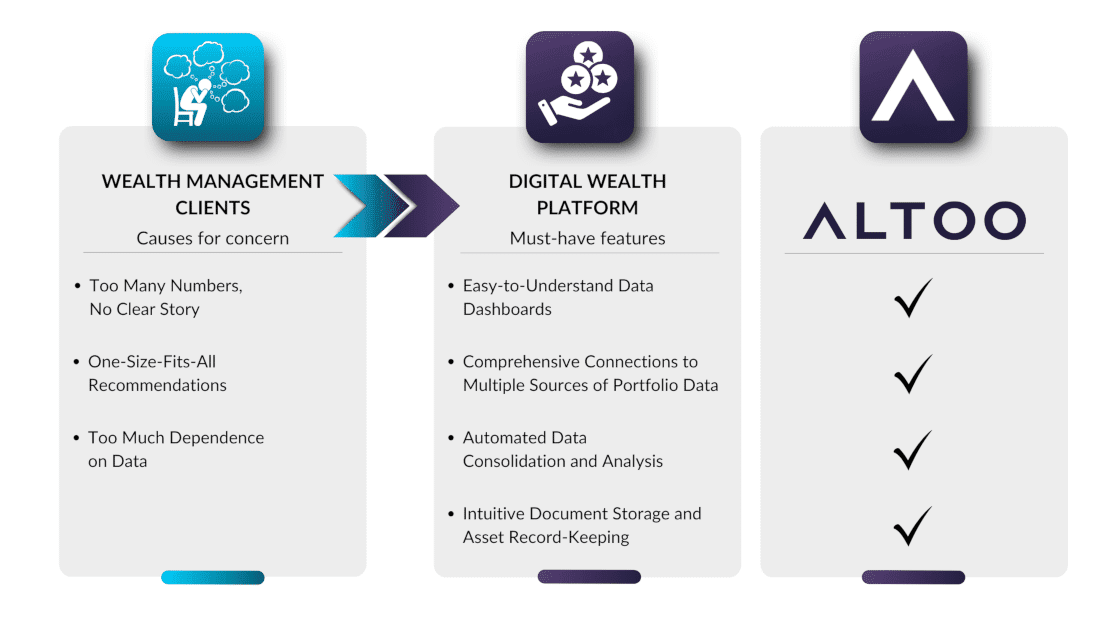

But what if your advice does not “click” with a client? Here are the three most likely reasons – and how a good digital wealth platform can help you turn their concerns to your advantage.

01 Too Many Numbers, No Clear Story

01 Too Many Numbers, No Clear Story

By automatically consolidating and analysing data on clients’ assets, advanced wealth technology can help you formulate guidance that you know aligns with their goals and risk tolerance.

This alignment, however, is not always obvious to them. A 2021 Boston Consulting Group report1 highlighted that many clients fear that their lack of specialised financial knowledge is putting their wealth at risk. They don’t just expect you to understand their asset data – they also expect you to help them understand it.

If you face an objection about your advice not making sense, treat it as an opportunity to improve your storytelling – not necessarily your story. You may have a strong conclusion, but it will likely fail to resonate with a client unless you set the scene for it.

That means you should avoid overwhelming clients with complex technical explanations. Instead, give them the big picture, outline your data-driven decision-making process, and then show how your recommendations fit in with that big picture.

Here, a digital wealth platform with advanced visualisation capabilities can make it easy for you to tell winning data stories that give your clients greater confidence in your advice. It will clearly display the results of its number crunching in intuitive dashboards that are perfect storytelling aids. According to research published by the American Management Association, written information is 70% more memorable when it is combined with visuals and actions.2

73% of technology companies featured in the 2023 Forbes Family Office Software Roundup3 – including Altoo AG – mentioned such dashboards among their clients’ top most requested functionalities. Designed to give wealth owners a sense of total control over their assets, our platform provides a comprehensive yet simple view of all their holdings.

02 One-Size-Fits-All Recommendations

02 One-Size-Fits-All Recommendations

You probably serve multiple clients, and they know you do. They also know you have digital tools available to automate many aspects of your research and analysis. It is not hard for them to imagine, therefore, that a “black box” is steering your entire client base towards relatively similar assets and allocations.

Even if you can masterfully tell the data story behind your advice, they may wonder just how unique that story is. 2021 research from Accenture found that over half of wealth management clients felt the advice they were given was too generic.4

If clients express doubts about how personalised your approach to working with them is, treat their concerns as an opportunity to demonstrate that you know exactly what their portfolio looks like and how your advice is tailored to it.

A proper digital wealth platform will help you and each of your clients gain a full, detailed, and personalised picture of his or her own portfolio.

Built to do just that, the Altoo Wealth Platform allows clients to authorise you for secure data access on their specific assets custodied at multiple institutions through application programming interfaces (APIs). This way, each of your clients can rest assured that you and your analytical algorithms are working from their own wealth data to deliver personalised recommendations and alerts.

03 Too Much Dependence on Data

03 Too Much Dependence on Data

Emotional control is a constant challenge for even the most successful investors. Even if you make a perfect – and perfectly understandable – data-driven case for making a decision, your client may have emotional reasons for pushing back.

For example, he or she may have a sentimental attachment to a poorly performing stock or be tempted to chase gains from a new, trending cryptocurrency for which limited market data is available.

Emotionally-oriented pushback from a client may seem like a nuisance. In fact, it creates one of your most valuable opportunities to build trust with him or her. Like everyone, your clients have a deep-seated psychological need for others to understand and address – if not necessarily share – their feelings.

If you encounter this type of concern, therefore, it is your cue to help meet this need by:

- Listening

Vanguard has found that around 40% of the value wealth advisors provide clients is emotional, for example through coaching behaviour and building confidence.5 Do not simply, therefore, keep talking about how data – or lack thereof – points to your recommendations. Get to know your clients, how they think, and how they might think different. You’re not a psychologist, but you do need to understand why your client feels the way he or she does to the extent that it will be a strategic wealth-building factor. - Left Brain, Right Brain

Parse out the emotional and data-driven reasons you and your clients have for making decisions. While the formal study of so-called “emotional finance” is largely academic at this time,6 simply defining and noting clients’ emotional drivers for making a given decision can create a practical basis for finding correlations between feelings and performance as you continue to hone their wealth-building strategies.

No technology can handle these emotional sides of your role as well as you can. Altoo’s technology, therefore, is designed to streamline communications with your clients and free up as much time as possible for you to personally connect with them. In addition to providing a centralised, secure messaging platform for communications, it automates data entry, performance analysis, and other tedious aspects of your job. Also, secure and intuitive document storage makes keeping tasks and notes – including any about emotional drivers for investing or divesting – clearly organised.

A Foundation for Peace of Mind

Putting your clients’ minds at ease starts with anticipating and understanding their concerns. The Altoo Wealth Platform gives your clients peace of mind that every aspect of their wealth is transparently under your capable control. It automatically brings together data on whatever form their wealth takes, runs it through complex analyses so you don’t have to, and presents the results in simple, well-structured dashboards that are a pleasure to review. It also supports easy, one-stop document storage and messaging for individual assets to ensure you spend less time navigating through records and more time engaging in the one-to-one conversations that clients value most.

[Endnotes]

[1] https://web-assets.bcg.com/d4/47/64895c544486a7411b06ba4099f2/bcg-global-wealth-2021-jun-2021.pdf

[2] https://www.amanet.org/articles/using-visual-language-to-create-the-case-for-change/

[3] https://www.forbes.com/sites/francoisbotha/2023/10/31/the-2023-family-office-software-roundup/

[5] https://institutional.vanguard.com/iam/pdf/ISGAROE.pdf

[6] https://journals.sagepub.com/doi/10.1177/21582440231206900?icid=int.sj-full-text.citing-articles.29