Prof. Dr. Andreas Dietrich

Andreas Dietrich is Professor of Banking and Finance at Lucerne University of Applied Sciences and Arts. He is the Director of the Competence Center “Financial Services Management” and a member of the Board of Directors of the IFZ. (Institute of Financial Services Zug). In addition, he is a board member of the Lucerne Kantonalbank (LUKB), a renowned banking expert with frequent appearances on Swiss television and a regular author of the popular IFZ Retail Banking blog.

“Altoo, a technology buy-out of the FLYNT Bank, has been offering since 2017 to very wealthy clients the Altoo Wealth Platform, a cockpit for complex wealth situations. The platform consolidates not only the assets of traditional asset classes such as shares, bonds or liquidity (“bankable assets”), but also of illiquid asset classes (“non-bankable assets”) such as real estate, cars, or art”, states Prof. Andreas Dietrich.

Two Business Models

Furthermore, the Altoo Wealth Platform offers secure interaction between the client and his advisors (e.g. property managers or tax advisors) and a “document safe” for storing contracts, insurance policies and other documents. The product is a web solution. However, a mobile app is also available in order to access the most important data on the move. The Zug-based company is currently on the market with two different business models:

- In the customer segment of wealthy individuals and signle-family offices, Altoo provides a remedy for manual consolidation, which in most situations up to now is done via spreadsheets.

- In the second sales channel, Altoo is looking for cooperation with multi-family offices, asset managers and private banks that make the technology available to their end customers as a white labelled solution. However, some client advisors at Rahn + Bodmer Co. or Reichmuth & Co., for example, recommend Altoo technology to their clients. The clients of these banks use the platform directly via Altoo, and accordingly the revenues go to the Zug-based company.

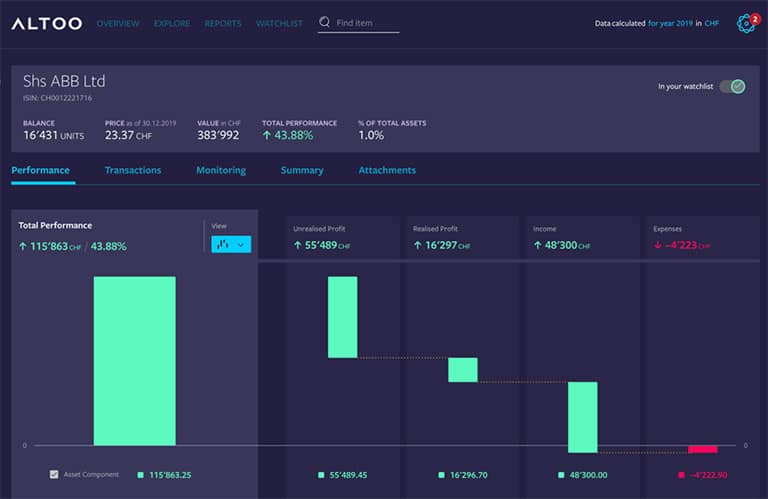

According to Prof. Andreas Dietrich the front-end is considered to be clear (see Figure 1). The presentation of the development of the various asset classes and values has been well done. In the “main cockpit,” you can quickly see the most relevant changes.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

However, clients can also dive deeper into the various asset classes. In general, the advantage of such a solution is that the information from the various banks is all prepared in the same way. Without Altoo, the customer would still have to find his way around various e-banking solutions at different banks.

A detailed Overview

Positively considered is also the fact that on the platform different options can be chosen for showing the performance. For example, evaluations can be defined and viewed according to different currencies and different time periods (since the beginning, since 2017, this year, …). “Also the performance representation of shares in this solution is interesting. On the one hand, realised gains or losses are shown. On the other hand, in addition to (as yet) unrealised gains, dividends and (subtracted from these values) custody account and transaction costs are shown separately (see Figure 2). For real estate, rental income is also shown”, explains Prof. Dietrich. The platform thus also offers a combination of bankable assets (income) and non-bankable assets (real estate)”

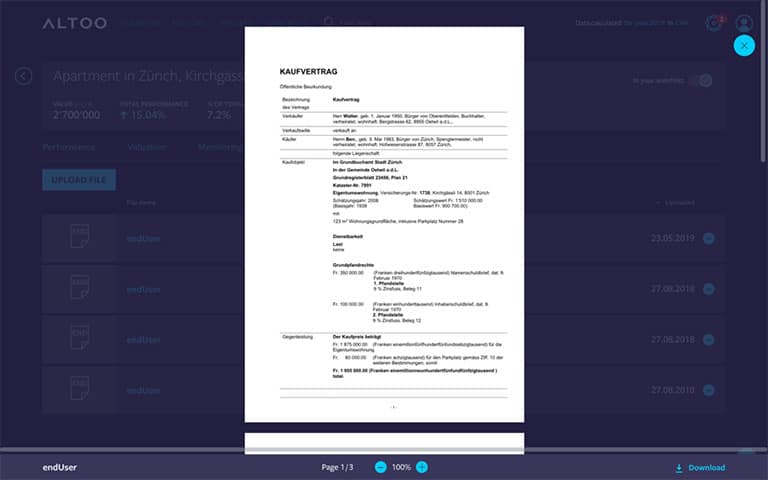

Positive is also the possibility of Altoo to deposit the individual documents and contracts similarly to a “safe” on the platform. The initial effort of uploading the corresponding documents itself is worth it and brings a lot of added value. Almost all customers take advantage of this offer: once a client has uploaded all the contracts and set up accordingly, he is strongly bound to the platform.

„An important function in Altoo’s offer is also the secure sharing of information. For example, the tax advisor can access all data, while the trustee or property manager can only be granted access to individual data. Access authorizations can be easily controlled in the cockpit” says Prof. Andreas Dietrich. This facilitates coordination and data exchange and increases transparency, which is particularly relevant for succession planning for families. Access permissions can be easily controlled in the cockpit. They also increase transparency, which is especially relevant when it comes to succession solutions for family members. Furthermore, different rules and associated multiple alerts can be created. For example, notifications can be triggered when a bank account has a certain amount is exceeded and therefore negative interest rates are due.

“Open banking is also becoming increasingly relevant in wealth management. Since practically all wealthy clients have complex wealth situations and usually divide the corresponding assets between different banks, an “extended” Multibanking solution like the one offered by Altoo seems to be an interesting solution“, says Prof. Dietrich. “A consolidated view of the total assets, both of classical assets and of illiquid investments, using a clear digital cockpit, according to my view, seems to generate a clear added value.”

Source: IFZ Retail Banking Blog