Getting Your Game Face On: The Power of Strategy

Imagine: it’s the finals, the crowd is on the edge of its seat, and the athletes are clashing on the field. Amidst this adrenaline rush, one element remains crucial: strategy. From meticulously analysing opponents’ tactics to planning every play, sports strategy is all about the big picture. In the world of wealth management, it’s just as important to be strategic. Investors and financial advisors must read market trends, assess investment risks, and align actions with financial goals. Much like game planning in sports, wealth management is about piecing together multiple elements such as economic indicators, risk tolerance, and life goals in order to create a personalised game plan for financial success.

Assemble Your Dream Team: Portfolio Diversification

What is the secret sauce of a winning sports team? A balanced mix of skills. You need strength and speed, offence and defence. In the world of wealth management, diversifying your portfolio is akin to assembling a dream team. In finance, diversification means spreading your investments across stocks, bonds, real estate, and other asset classes. Like a star-studded sports lineup, diversification reduces reliance on any one investment and optimises the opportunity for growth; it’s about making sure each player (or asset class) contributes to your victory.

Playing Safe vs. Scoring Big: The Art of Risk Management

Both sports and investing require the skillful navigation of risk and reward. Athletes constantly push their limits, balancing the fear of injury with the sweet taste of triumph. Similarly, in the world of finance, successful investors walk a fine line, weighing potential returns against the potential for losses. This high-stakes game involves a mix of daring leaps and strategic pauses. It’s about understanding market fluctuations, gauging investment horizons, and aligning decisions with personal risk tolerance—all to effectively manage the balance. It’s as critical as an athlete making a daring play at a crucial moment or an investor taking a leap of faith on a promising, albeit risky, venture.

Eye on the Prize: Long-term Planning is Key

Professional athletes don’t just plan for the next game; they plan for their entire career. Similarly, effective wealth management requires a long-term perspective. It’s about looking beyond immediate gains or losses and focusing on lifetime goals. This may mean considering estate planning, philanthropic desires, or transferring wealth to the next generation. Amid the day-to-day ups and downs, keeping a long-term strategy in mind ensures that you’re making progress towards your ultimate financial goals.

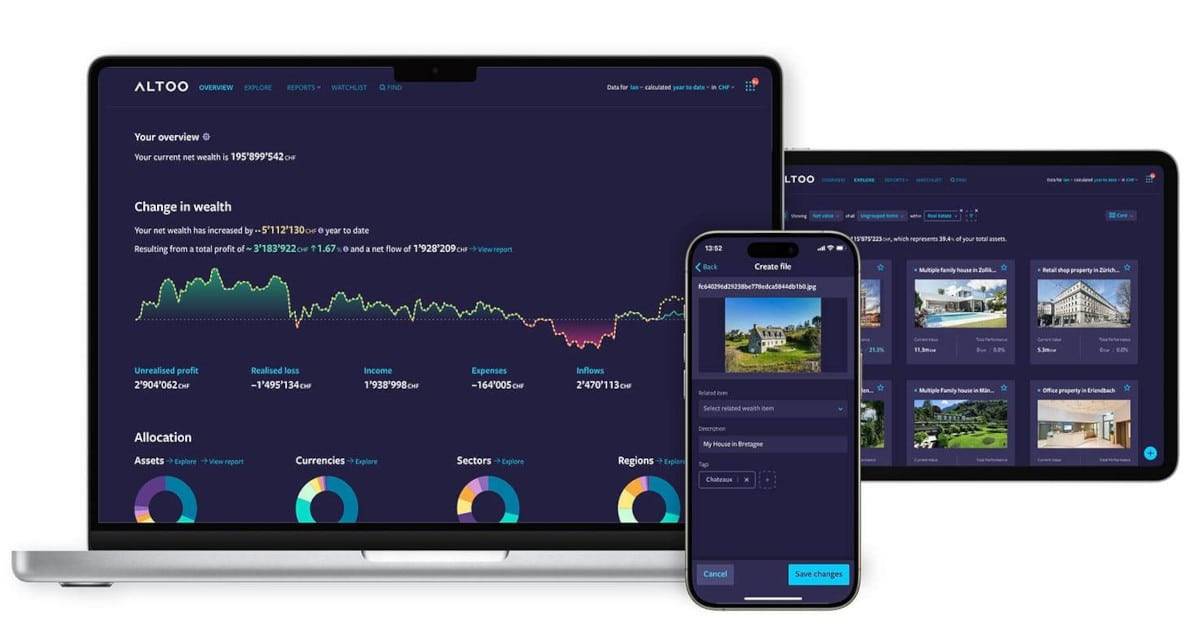

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Put a Professional in Your Corner: The Value of Expert Advice

A talented coach can make a world of difference in an athlete’s performance, just as an experienced financial advisor can guide an investor towards financial growth. These experts bring valuable experience, insights, and unique perspectives to the table. In wealth management, an advisor can navigate complex tax strategies, optimise portfolio diversification, and adjust investment strategies based on market conditions. Just as a coach guides an athlete to a higher level of performance, a financial advisor can light the way to your financial victory.