Switzerland as a wealth management and financial center

Switzerland is one of the leading and most competitive financial centers by global standards. About 25 percent of global cross-border assets are managed in Switzerland. In addition, the Swiss financial center is one of the leading providers of trade finance and one of the most important locations for insurance and reinsurance worldwide. Due to this, the number of banks and insurance companies is also high. Two cities in Switzerland have a particularly high international profile, namely Zurich and Geneva, followed by Lugano as the third most important financial center in Switzerland. As a result, the Swiss economy depends heavily on the financial center, which accounts for about 10% of GDP.

Switzerland is committed to meeting international standards on tax issues, money laundering and terrorist financing, and financial market stability. At the same time, it creates the regulatory and legal framework that enables the financial sector to offer innovative products and services. For example, market barriers are reduced for companies in financial technology.

Insurance companies and banks also play a significant role in the Swiss economy, accounting for almost 50% of Switzerland’s GDP. In 2020, the value added of the financial sector amounted to about 68 billion Swiss francs and the number of employees in full-time equivalents was about 208,800. In 2019, the financial center, which is a strong exporter, accounted for 24% of service exports. Switzerland is among the most important financial markets in the world. At the end of 2019, the Swiss banking sector led global cross-border asset management with a 25% share. Swiss banks managed assets worth CHF 7,893 billion in 2019, about half of which originated abroad. About 246 banks existed in Switzerland in 2019, representing half of the Swiss market. UBS and Credit Suisse, two major international banks, own about 50% of the market. The remaining percent is primarily owned by the 24 cantonal banks, foreign banks, Raiffeisen banks, stock exchange banks, regional banks and savings banks, and private banks. In addition to direct value creation, the Swiss banking center effectively supports the domestic economy and population with loans and other financial services through its diverse and regional ties. Three-quarters of premiums are generated by Swiss insurance companies abroad.

In 2019, insurance companies, generated more than 240 billion Swiss francs in premiums, with about 78% of premiums coming from abroad. Both as a taxpayer and as an investor, the capital-intensive industry makes a significant contribution to the economic cycle: In 2019, its investment volume in Switzerland amounted to almost CHF 570 billion. The country is also well positioned in the insurance sector, with around 200 insurance companies. Zurich Insurance Group is undoubtedly the most important private insurer in Switzerland, followed by Chubb, SwissRe and Swiss Life. Switzerland’s economy and international reputation therefore depend heavily on a stable financial center. With a strong and dynamic financial market policy, the Federal Council is also helping the sector. In this way, it creates conditions in the financial market so that clients can obtain a comprehensive range of services at the national and international level. Therefore, the Swiss financial market policy is also based on the well-known advantages such as high productivity, stability, security and trust. It is planned that the financial center will remain internationally competitive in the future and at the same time meet the demands of the population. For this reason, it is important to be open to new technological developments and international developments in order to improve international competitiveness.

The current financial market strategy

In its financial market strategy, the Federal Council has defined three priorities: “innovative”, “networked” and “sustainable”, each of which includes three fields of action. The plan is for financial players to make efficient use of new technologies and data-based business models by focusing on “innovative.” The Federal Council is committed to making the regulatory conditions for digital access technology-neutral, digitizing connections to the authorities, and promoting innovation in the financial and wealth sectors. For cooperation, the Federal Council represents Switzerland’s interests in international financial market bodies, ensures attractive, internationally comparable conditions and promotes active communication of the Swiss financial center. In addition to the stability of the system, integrity and the fight against financial crime are also components of the “sustainable” strategy. Against the backdrop of Agenda 2030 and climate change, the Federal Council primarily promotes instruments for the measurability and transparency of the quality of services and the effective prices of products.

The Federal Council’s strategy aims to ensure that the Swiss financial center remains one of the world’s leading, modern and globally active financial centers. Switzerland has become a major hub for international investors, the crypto industry, internet billionaires, wealthy families and family offices. Families that are internationally oriented and mobile like to source their services outside their home country or country of residence.

How does Switzerland achieve such success?

Switzerland has been a neutral nation for 200 years. Direct democracy is the foundation of the country’s government. With direct democracy, the population has a direct influence on new federal laws and political decisions. Direct democracy in Switzerland has a long history dating back to 1291. No other country allows its citizens to have direct democracy. The Swiss economy is extremely robust and stable. The government has had an annual budget surplus for decades. One of the few countries with a AAA rating is Switzerland.

The Swiss Franc (CHF) is considered a safe currency. In recent years, it has appreciated significantly. In Switzerland, the government operates on the principle of collegiality. The principle of collegiality requires that the seven federal councilors constantly work to find a compromise. The skepticism of the Swiss government and population towards the European Union and the Eurozone is justified. The Swiss government has always refused to enter the European Union and the Eurozone. The decision has paid off. In addition, Switzerland should have taken over the financing of the bankrupt EU countries. According to recent polls, the Swiss population has no interest in being a member of the European Union or the Eurozone. Stable Swiss private banks manage over 30% of the world’s privately controlled assets. It is unlikely that the owners of thirty percent of total cross-border assets are wrong.

Switzerland receives $2.6 trillion from international private clients last year, something no other country in the world has. According to a study by accounting firm Deloitte, Switzerland has maintained its leading position in the international wealth management market.

According to the analysis, Switzerland remains at the top in terms of competitiveness, closely followed by Singapore and Hong Kong. However, the report also emphasizes that Switzerland is still evolving in the wealth management sector and has long since reached its limits. While the international market in 2020 recorded the strongest growth of the last ten years at 10.6 percent, Switzerland achieved growth of 7.3 percent.

According to Deloitte, Switzerland did not receive any significant net new money last year. The pandemic had a significant impact on the appreciation of the Swiss franc against the U.S. dollar, resulting in a significant increase in market volume. According to Deloitte analysts, Swiss wealth managers need to develop new digital communication models with clients and expand their product offerings to fall behind their competitors.

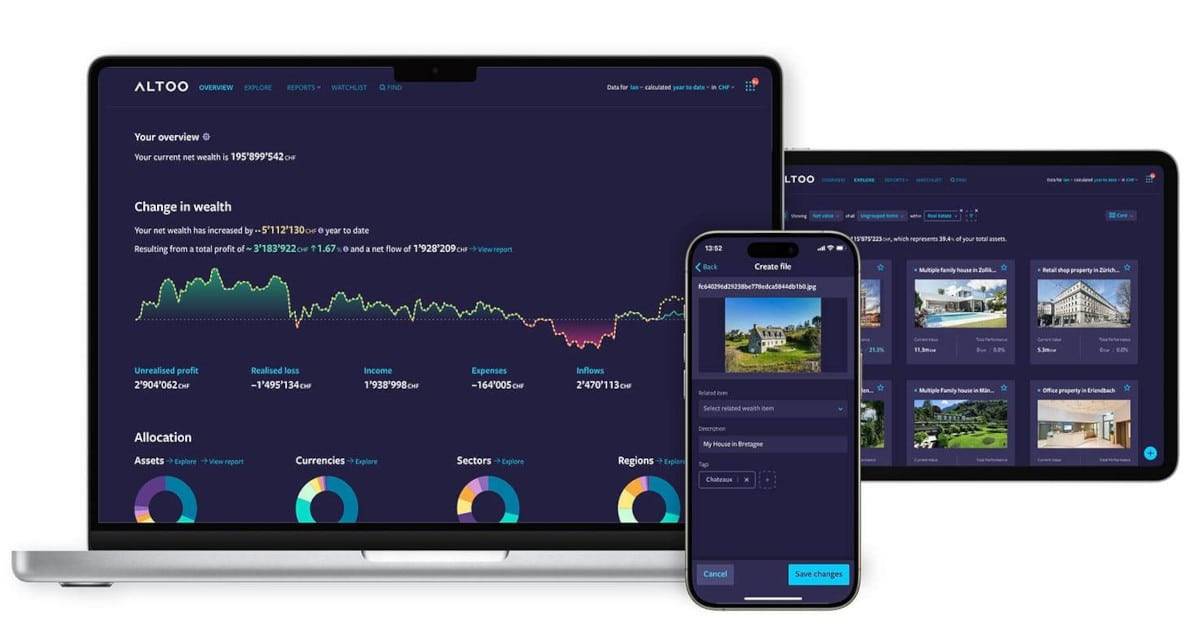

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Wealth management in Switzerland

If you look at it from the outside, it’s a simple game. But if you look closely, financial managers could get a lot wrong in 2021. Many invested cautiously again after the impressive recovery rally in 2020, but there were missteps: more than one in three stocks in the Swiss Performance Index (SPI), which includes 213 stocks, lost money in the previous year. Meanwhile, one in six securities in the price barometer, including dividends, returned more than 50 percent. It took a lot of finesse to pick stocks.

Wealth planning is the art of organizing and arranging your assets in the best possible way. It is a continuous process, the stages of which are documented in writing in the form of a plan. The goal of the plan is to protect the owner’s wealth and transfer it to the next generation in the most tax-efficient manner possible.

The basis of wealth planning is:

- succession planning for real estate and businesses

- global asset protection

- international tax planning

- international residence transfer planning using Citizenship by Investment program.

HNWIs (or high-net-worth individuals) are becoming increasingly mobile and interconnected around the world. Wealth planning is more complex than ever due to international interconnectedness and the impact of multiple legal and tax systems with ever-changing laws. To achieve successful results, you need professionals with years of practical experience who can quickly present solutions in the areas of private wealth management, wealth planning and asset protection. Especially in recent years, it has become a science that encompasses many disciplines.

More and more family offices are moving into Switzerland. Since Brexit, more family offices are being drawn from London to Zurich, Zug and Geneva. Switzerland is a paradise for family offices for wealthy and internationally connected families. This means that Switzerland is not only the best country for professional wealth management with the best family offices but also has the best jurisdiction in the world for international private wealth management.

What is Private Wealth Management?

Private wealth management, also known as private wealth management, is the art of providing wealth and financial advice and asset management to continuously build, protect and transfer wealth. A HNWI’s global wealth is overseen by a single family office. Offices for multiple families oversee multiple families simultaneously. HNWI private wealth is managed by independent wealth managers, fintech firms, law firms, asset management firms, financial advisors, tax advisors, relocation agencies, and multi-family offices. Custodians do not manage the assets. They are merely a custodian. Asset managers have special asset management mandates.

Uncertainty in the Swiss asset management industry is currently reaching new heights and managers are facing difficult times. Platform companies, for example, seem to be preparing to enter the market. Swiss private banks are severely affected by these difficulties and uncertainties. In an expanding market, potential growth opportunities in the traditional offshore business are limited and profitability levels are falling short of expectations. Thus, the industry continues to compound.

There will be no solution to the fundamental problems in the near future; instead, new factors of change will add to the mix that will shape the future of the wealth management industry. To gain a better understanding of the key uncertainties facing the wealth management industry in Switzerland, a comprehensive study of relevant trends was conducted with 25 executives from leading private banks in Switzerland, collectively responsible for over CHF 2 billion in assets under management.

The research identified five key uncertainties: the client interaction model, differentiated value creation through wealth management, control of the value chain, ownership of client relationships, and the ability to monetize and leverage data.

To keep these uncertainties under control, five steps are taken in asset management: develop a common long-term view; decide on the future position; test the strategic decisions under stress; select focus initiatives for the near future.

On the other hand, executives should also heed five recommendations now to prepare for the future, regardless of their long-term perspective and future position:

- develop strategic discipline

- learn to partner in ecosystems

- focus relentlessly on the customer experience

- empower customer service representatives

- and increase organizational adaptability.

These actions will create firms that are much more agile and capable of dealing with the new world of the future and proactively shaping the new look of the wealth management space in Switzerland.

The future of Swiss wealth management

In this scenario, only those who master the ecosystem, be it trusted advisor, orchestrator, niche producer or infrastructure provider, will be successful. Those who best understand client needs beyond investment management will dominate the client interface. Collaboration among experts providing appropriate solutions creates value. Seamless digital and “offline” integration of a variety of services will be a key feature that differentiates it from others. Compared to traditional asset managers, the average annual flat fee for a CHF 1 million equity portfolio is 1.37%, while digital providers are only 0.62%. The price of traditional asset management is thus almost twice as high.

In addition, there are product fees that some traditional banks do not disclose and are therefore not visible, unlike online wealth managers. However, according to research, product fees in traditional wealth management are also significantly higher on average than digital providers, as traditional banks increasingly use active products. As a result, there is a strong likelihood that wealth management will become heavily fintech in the future, with online providers gaining in popularity.

It is undisputed that, according to market experts, Switzerland will remain competitive for a long time, often in the leading position, and will continue to be one of the most important hubs for global wealth managers in the future.