A strong trend towards portfolio diversification was already observed in family offices last year. Given changes in inflation, interest rates, and overall economic growth, the largest change in strategic asset allocation in recent years is currently being implemented. Allocations to hedge funds have increased from 4% to 7%, and allocations to direct private equity have decreased from 13% to 9%. Allocations to real estate are gradually decreasing. More than a third of family offices are directing their investments into high-quality bonds with short maturities. They do so primarily for asset protection, yield, and capital appreciation.

Fixed income has become the most popular way to diversify wealth. Geographically, family offices want to increase investment in previously less favourable regions. Although nearly half of family office assets are located in North America, more than one-quarter want to increase investment in Western Europe over the next five years. Almost a third plan to increase and expand investment in the wider Asia-Pacific region.

Compared to global players, family offices have their own regional specificities. In the US, the main purpose of their existence is to support the generational transfer of wealth. The biggest problem is the recession, and therefore their allocations have been the least conservative.

In Latin America, they allocate the largest resources to fixed income (30%) and the smallest to real estate (5%). Hedge funds are the most popular investment in the Asia-Pacific region. This is followed by technology, especially medical devices and equipment. Up to 51% of investments are in the region, including Greater China.

In Europe, digital transformation (79%) and automation and robotics (75%) are the main themes. Only 11% of investments are in real estate. The Swiss family offices are primarily focused on supporting the generational transfer of wealth. Compared to the global market, Switzerland leads in investments in real estate (18%), cash (13%), and arts and antiques (4%). Hedge funds have the lowest allocation here.

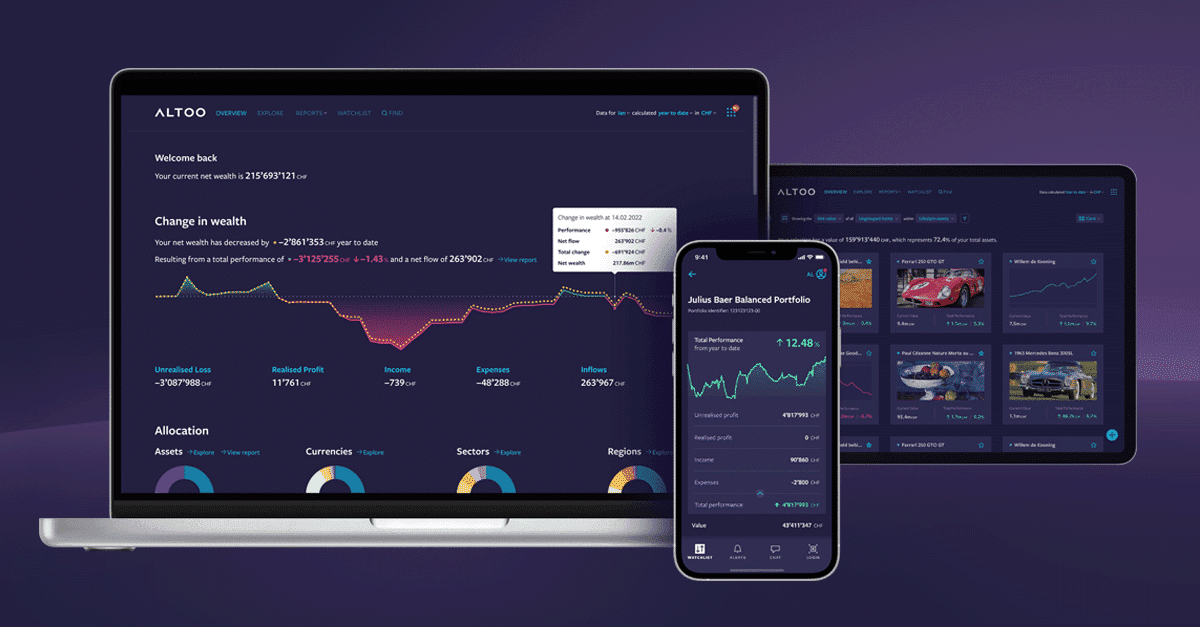

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.