Wealthy Women Prefer Female Advisors

Wealthy Women Prefer Female Advisors

Women controlled 32% of the world’s wealth in 2020, according to Boston Consulting Group, who predicted that their share of it would grow by compound annual growth rate of 5.7% to USD 97 trillion in 2024.2

About 25% of ultra-wealthy women have gained their wealth purely as heirs, around 45% have created their own fortunes, and the rest have achieved UHNW-status via a combination of inheritance and entrepreneurship. Ultra-wealthy women often allocate a significant share of their assets differently than men. They tend to have strong interests in philanthropy, sports, art, and education.3

Female wealth management clients have also shown a particular affinity for:

Digital wealth management technology, especially as a result of the Covid-19 crisis. A UBS report found that women particularly appreciate being able to use digital tools to strike an efficient balance between their personal and professional lives.4 Moreover, research from EY found that wealthy women expect to make greater use of digital channels in the future and are just as enthusiastic as men about fintechs, robo-advisors, and other digital investing solutions.5

Female advisors, and wealth management firms with few women on their teams should take note of this preference. While women play an increasing role in managing wealth, according to a report from Carson Group6 the general underrepresentation of female advisors is not good for the wealth management industry as whole.

“The findings of our 2023 Women in Wealth Management study reinforce the crucial role that female financial advisors play in today’s industry. Beyond the qualitative insights, the statistical data underscores the need for continued efforts to enhance gender diversity, promote sponsorship, and create inclusive cultures,” said Julie Ragatz, Vice-President of NextGen and Advisor Development Programs at Carson Group.

HENRYs Value Smooth, Hassle-Free Digital Experiences

HENRYs Value Smooth, Hassle-Free Digital Experiences

High earners, not rich yet (HENRYs) make between US $250k and $500k a year. Many of them find it challenging to accumulate wealth, often allocating a majority of their income to consumer spending, educational costs, and housing expenses instead of investments. Those who do set aside money for the future – usually after paying off their student and car loans, according to Equifax7 – are likely to enter the ranks of high net worth individuals (HNWIs).

HENRYs are among luxury marketers’ favourite segments to target, and they deserve your attention too. Especially affluent young women: EY found that those hovering at the HNWI threshold with a household wealth of around US $1.5 million are the most likely high-income earners to seek advice on managing their wealth.5 By establishing trust with a HENRY during his or her first steps towards building significant wealth, you can cultivate a lifelong client.

Typical HENRYs have long working hours. Many have grown up surrounded by social media and value user-friendly digital experiences that do not involve too much effort when it comes to their finances. Considering that a significant portion of their financial lives revolve around spending money as opposed to saving it, it is noteworthy that the same Equifax report found that HENRYs prefer to pay bills online and via mobile devices and automatically charge recurring bills to debit or credit cards.

To build strong relationships with soon-to-be HNWIs, aim to help them navigate the challenges of balancing their lifestyles with their financial assets, reducing debt, and increasing savings. Keep your advice short, simple, and data-driven. Statistically, they are likely familiar with the power of data – the highest paid professions in Europe are in data-intensive industries like IT and energy 8 – but lack the time to sift through reports and make sense of them.

Great Wealth Transfer Recipients Look for Digitally Enhanced, Holistic Advice

Great Wealth Transfer Recipients Look for Digitally Enhanced, Holistic Advice

In the so-called Great Wealth Transfer, US $84 trillion in assets is set to leave primarily Baby Boomers’ hands over the next 20 years, with 85% of it going to recipients born after 1965, i.e. Gen Xers, Millennials, and Gen Zers.

The younger the heir, the more likely he or she is to seek new financial advisors. According to Unblu’s 2023 Digital Wealth Management Outlook,9 a remarkable 80% of Millennials look for wealth guidance from a fresh source after inheriting their parents’ money.

Many Millennial and Gen Z heirs – similar to their HENRY peers – are digital natives. Having grown up with technology at their fingertips, they are comfortable with online banking and investment platforms and expect instant self-service options, hyper-personalised communication, and superior digital experiences from their financial service providers.

For some years now, it has been becoming increasingly clear that younger investors are likely to factor considerations that are not purely financial into their wealth decision-making. As far back as 2018, MSCI identified that 90% of Millennials wanted to tailor their investments to their values,10 and Morningstar identified that many Gen Xers were sharing this priority in 2019. 11

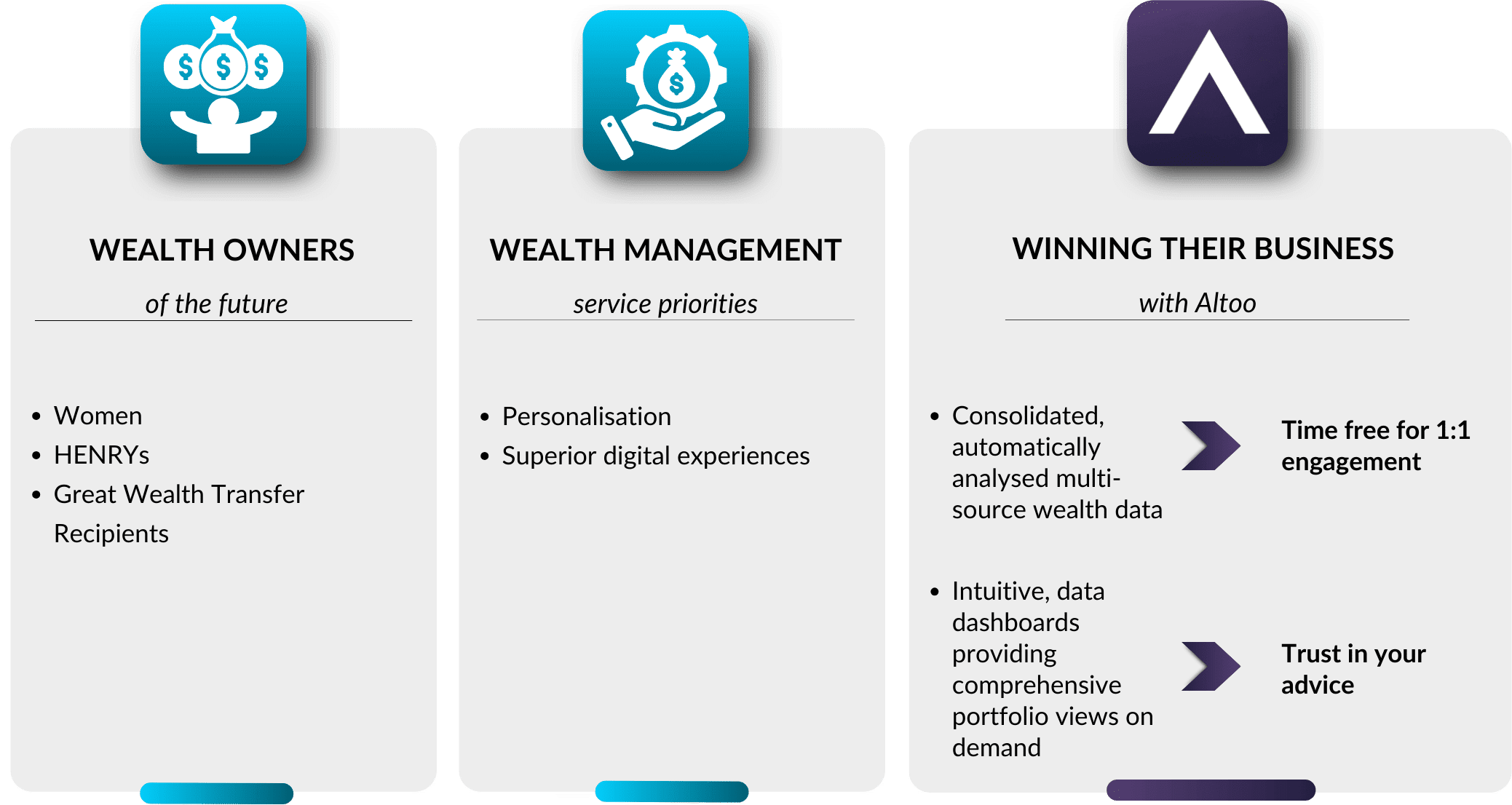

Service Priorities for Wealthy Women, HENRYs, and Great Wealth Transfer Recipients

Service Priorities for Wealthy Women, HENRYs, and Great Wealth Transfer Recipients

According to another piece of research from EY,12 all of tomorrow’s most promising wealth management clients expect you to provide:

01 Personalised services tailored to their increasingly complex financial lives

Personal attention matters, especially to women. Simon-Kucher, a global consultancy, found that women are 30% more likely than men to prefer in-person financial advice and 25% more likely than men to recognise the benefit of one-on-one meetings.13 Also, young wealth owners of any gender will expect you to take the time to form a holistic understanding of their values and how their finances can best reflect them.

02 Outstanding digital experiences

How you deliver personalised advice – and how clients know it is personalised – will to a large extent determine the degree of trust you can build. Refreshed hybrid models leveraging clients’ own wealth data, reinforced with digital collaboration capabilities, will improve your accessibility, engagement, and credibility. Technology consultancy Broadridge’s recommendations for wealth management firms include incorporating digital tools into every aspect of their operations, especially with respect to equipping advisors with foundational analytics tools that synthesise data from across clients’ financial holdings – and proper training on how to use them.14

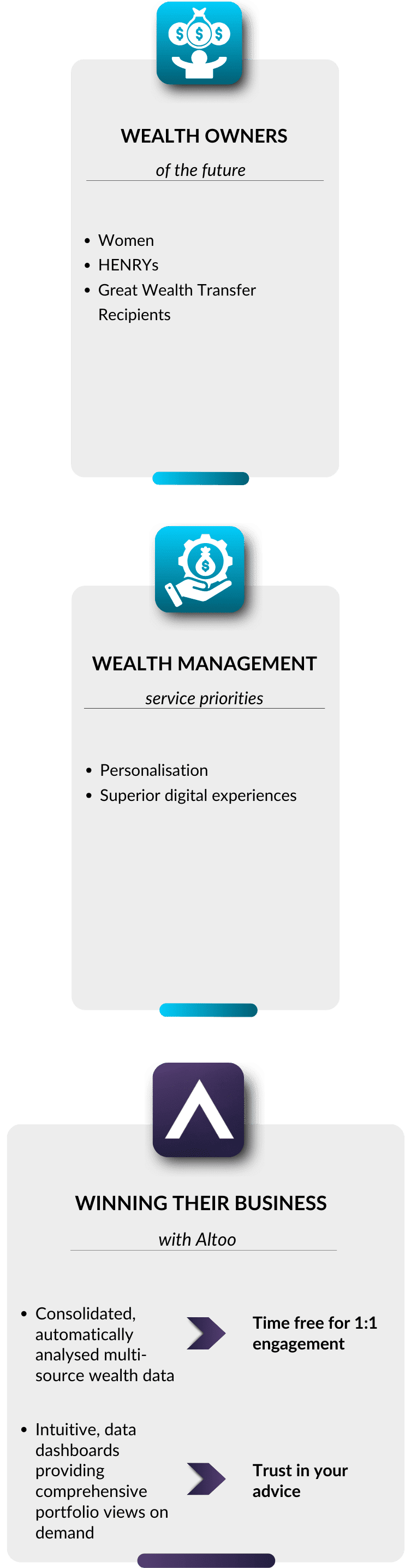

Altoo: Presenting Portfolios According to Tomorrow’s Tastes

A preference for clear, simple answers is universally shared by all high and ultra-high-net-worth individuals, regardless of their gender or generation. This preference has, however, come into the spotlight due to shifting demographics.

The Altoo Wealth Platform has thus been designed to help you satisfy your client base of today and tomorrow. It aggregates data on what wealthy individuals own and owe, automatically analyses this data, and presents the results in clear visualisations that take just a few seconds to explain and understand. Also, in addition to enabling assets to be grouped according to customisable criteria reflecting younger investors’ personal convictions, it automates away many manual tasks to give you more time for one-on-one conversations particularly prized by wealthy women of all ages. Onboarding is fast and easy, with most wealth management firms and their asset-rich but time-poor clients up and running in just a few days with the help of Altoo specialists.

[Endnotes]

[1] World Ultra Wealth Report, Altrata

[2] Managing the Next Decade of Women’s Wealth, BCG

[3] The Defining Characteristics of Ultra Wealthy Women, Altrata

[4] Women-Wealth-2030, UBS

[5] Women and wealth: The case for a customized approach, EY

[6] State of Women in Wealth Management Report 2023, Carson Group

[7] Meet Henry - High earners, not rich yet, Equifax

[8] What are the best paying sectors in the EU?, Eurostat

[9] Тhe Digital Wealth Management Outlook 2023, Unblu

[10] Swipe to invest, MSCI

[11] Swipe to invest, MSCI

[12] When volatility causes complexity, how can wealth managers create opportunity?, EY

[13] Women in Wealth Management, Simon-Kucher

[14] Targeting the Digital Generation, Broadridge