What is the difference between Wealth Management and Asset Management?

Wealth Management extends beyond investments to include essential financial aspects such as estate planning, tax optimization and intergenerational wealth transfer. It takes a holistic approach to optimizing and securing an individual’s overall financial well-being over the long term. Working with professionals in a variety of fields, such as lawyers and accountants, wealth management teams offer expertise beyond traditional investing.

In contrast, the primary focus of asset management lies in making informed investment decisions and effectively managing portfolios. Asset management seeks to leverage an individual’s investments so that the overall returns are maximized. Asset management tends to focus on proprietary expertise to manage a clients’ investable assets.

The difference in a nutshell

Asset management tries to get the most out of a person’s investments so that they make the most profit in total. Wealth management looks at a person’s finances as a whole and tries to improve and protect their financial health over time. Asset management usually focuses on using a client’s unique skills to take care of their investable assets. There are many different kinds of experts on wealth management teams, such as lawyers and accountants, who work in areas other than traditional investing.

Understanding Wealth Management

Wealth management encompasses a holistic approach to managing an individual’s financial affairs, taking into account various factors beyond investments. It is a comprehensive and personalized strategy that addresses long-term financial goals, risk management, tax planning, estate planning, and intergenerational wealth transfer. Wealth managers work closely with clients to develop a deep understanding of their unique circumstances, values, and aspirations, allowing for tailored solutions that align with their objectives.

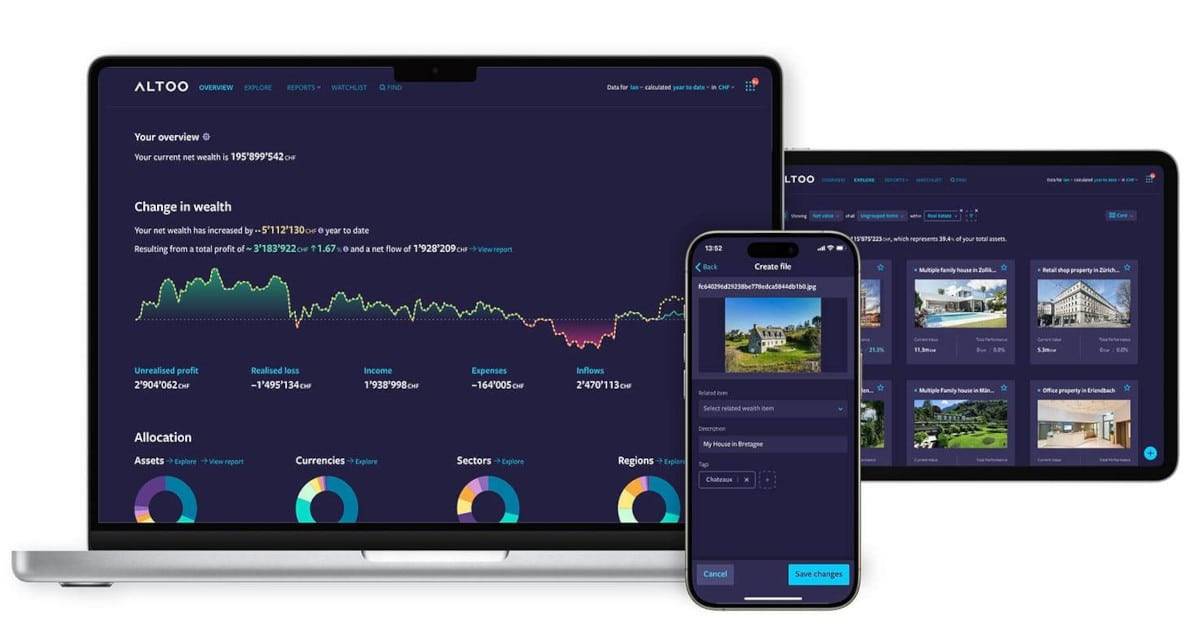

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Wealth management services often include financial planning, portfolio management, tax planning, philanthropic endeavors, retirement planning, and legacy planning. The overarching goal is to provide a high net worth individual with a comprehensive roadmap for financial success, while mitigating risks and preserving wealth across generations.

What does a Wealth Manager do?

Wealth managers combine the fields of managing assets and making plans for money. They should be trained, or be able to find people who are, to offer services like tax planning, estate planning, and retirement planning to their clients. Because wealth management covers so many areas, most teams have experts from fields other than standard trading. Lawyers might be needed to come up with a good plan for estate planning, and accountants could help with questions about taxes.

Wealth managers are usually listed as investment advisor representatives and get paid by a flat fee, a fee based on a portion of AUM, or a mix of the two.

The tasks of a Wealth Manager in a nutshell: Wealth managers act as trusted advisors, employing their expertise and leveraging a vast network of specialists to offer a wide range of services tailored to the client’s specific needs.

What is Asset Management

Asset management, on the other hand, is a more specialised field that primarily focuses on the investment aspect of wealth management. Asset managers are responsible for overseeing a client’s investment portfolio, making strategic decisions to optimise returns within a given risk tolerance. Their primary objective is to grow the client’s assets over time by carefully selecting investment vehicles and diversifying the portfolio to manage risk.

What does an asset manager do?

The asset manager is the person or group whose job it is to make sure that the client’s profits are as high as possible. Asset distribution is one of the most important ways they do this. As the name suggests, this means putting all of the client’s investable money into different asset groups. A simple allocation model divides these assets between stocks and bonds in a way that matches the client’s risk tolerance and financial goals.

For example, if a client says they don’t like taking risks, the asset manager might put more money into bonds, which are usually safer investments. On the other hand, if the investor wants to increase the value of their assets, the asset manager might put more money into stocks, which are often riskier but have the potential for higher returns. Most of the time, an asset manager will look at past data to predict the risk-return potential of the assets that would be best for an investment based on their risk profile.

Asset managers are often listed as broker-dealers and get paid based on commissions or fees that are a portion of the assets under management (AUM). Most of the time, clients with more AUM will pay less in fees.

The tasks of an asset manager in a nutshell: Asset managers analyse market trends, conduct in-depth research, and employ various investment strategies to identify opportunities and make informed decisions. They monitor the performance of investments, conduct regular reviews, and make adjustments as needed to align with the client’s financial objectives and market conditions. Asset management services typically include investment advisory services, portfolio construction, risk management, and performance reporting.

Frequently Asked Questions

What are financial assets?

A financial asset is a liquid asset whose value comes from a legal right or a claim of ownership. Financial assets include cash, stocks, bonds, mutual funds, and bank accounts. Their value is based on how much people want and need them in the market where they sell, as well as how much risk they carry.

Why is wealth management important?

Your wealth, as measured by both possessions and money, should be managed to either increase in value or avoid depreciation. Wealth management is the process of analysing and making decisions regarding one’s fortune in order to reach one’s financial objectives. Wealth management is an important activity in order to keep, consolidate, manage and grow your wealth.

Who is an HNWI (High-Net-Worth Individual)?

High-net-worth individual (HWNI) is a term used in the financial business to describe a person with cash assets worth more than a certain amount. People in this group usually have at least $1 million in cash or other flexible assets. By definition, liquid assets are either cash or money in stocks that can be easily turned into cash at any time. That doesn’t include the person’s main home or things like fine art and antiques that are hard to sell and have a fluctuating value.

Who is an UHNWI (Ultra-High-Net-Worth Individual)?

To be designated a UHNW individual, a person must have a minimum net worth of $30 million. The calculation of a person’s net worth involves subtracting the value of their assets from the value of their liabilities (credit score, mortgage or loans).