Transition from Resilience to Innovation Today’s

Wealth Management sector is filled with ambiguity, and so are the high-net-worth individuals who have changing financial needs. Just a decade ago, customers conducted most of their banking business through a single financial institution. Nowadays, it has become common to have multiple banking relationships. As a result, personal wealth is dispersed among many different custodians and legal systems, with several stakeholders offering specialized services. This makes it clear that wealth management has gotten more difficult.

Accenture notes that wealth management will probably transition from resilience and reshaping to establishing the groundwork for innovation by 2025 as players are increasingly adopting a new plan for 2023 and beyond in North America, APAC, and Europe. Furthermore, in order to serve emerging wealth creators like entrepreneurs and women, or to access ESG and non-investable assets that might further fuel the industry’s sustainable development outlook up to 2025, companies would need to innovate to become next generation wealth managers.

Complex Wealth Management in one single solution

Once a niche segment, outsourced wealth management services became critical components within the wealth management ecosystem. In particular, technology has made the secure management of complicated wealth simpler than before.

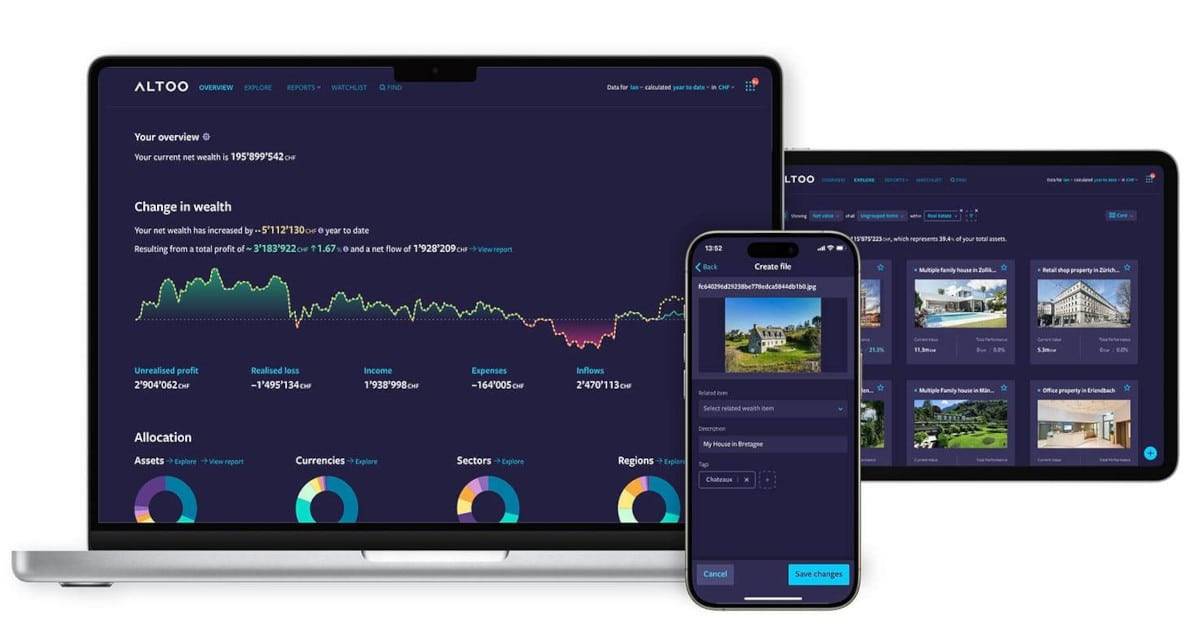

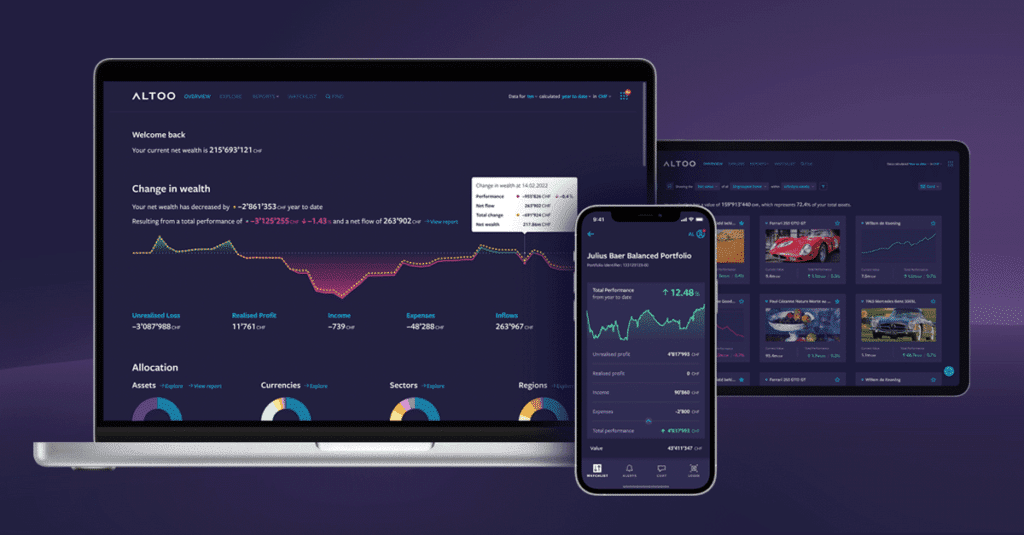

Take Altoo, for example, where complex wealth is discussed, positioned, and measured in state-of-the-art ways on one single platform. This Swiss company provides wealthy individuals with a simple and intuitive solution, as well as wise transparency and control.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Altoo stands for “alltogether” and as a white-label technology wealth platform, it has been developed with the aim to consolidate entire asset structures such as money at several banks, real estate, private equity, art, etc. It enables automated controls and communicates with the consultant network on a daily basis, making it the perfect solution for family offices, trusts, foundations, and private wealth owners. Accordingly, the company has invested heavily in the encryption technology of its own private cloud, as client safety is a top priority.

Experts suggest that the added value of wealth management platforms goes beyond pure data aggregation. The idea is to give customers access to a digital space where they may manage their money as well as observe it. In order to promote safe collaboration and document management, a comprehensive strategy also takes into account non-bankable assets, offers a user-friendly design, and allows regulated stakeholder access.

For illustration, a user can allow his real estate advisor restricted access to just the platform’s mortgages and real estate holdings. The advisor is able to submit all documents relevant to the various real estate assets and frequently update them as well. Secure communication is possible with the use of an internal communication network. Moreover, such a digital system simplifies legacy planning. In the worst-case scenario, inheritors will have all the information they need to protect their family’s wealth.

Five Wealth Management Trends

Wealth management is a booming industry and its global wealth is expected to touch USD 3.43 trillion by 2030. There are both recent trends and ones that have dominated the industry for a while. Yet, both will quicken the pace of change in the industry through 2023 and beyond.

01 The financial experience reimagined

A broad array of investors now expect to receive “intelligent” advice, delivered live or via automated finance algorithms. One of the evolving trends is especially the growing use of artificial intelligence, which can be extremely cost-efficient as well. In its podcast, Deloitte advises, specifically, to implement: (1) new client digital solutions, (2) broker-dealers’ new digital application launches, (3) state-of-the-art CRM capabilities, (4) modern data management capabilities, and (5) streamlined on-boarding as well.

As the competition for high-net-worth individuals has grown fiercer than ever, PwC proposes that the winning model is a hybrid model. Not only does this improve human connection, but it also revamps the customer experience. Lost are the times when wealth management firms met their clients twice a year. Nowadays, what counts are bespoke concierge-like services. With that, it is of course estimated that new tasks will fall on relationship managers. Those managers who effectively manage their time have higher levels of client engagement and satisfaction. Those who can automate where necessary may be able to focus more on client-facing operations. With that regard, it is recommended that businesses continue to shift toward a team-based approach to promote continuity of relationships even as lead advisors retire. New technologies and robo advice capabilities have the potential to somewhat ease the shortage of advisors by allowing existing advisors to spread themselves over a greater number of client relationships.

02 The “Great Wealth Transfer”

The big wealth transfer is about to happen! Every day, over 10,000 baby boomers reach 65, and over the following 20 to 30 years, their offspring will inherit trillions of dollars’ worth of money. The Baby Boomer generation, roughly defined as those born between the mid-1940s and mid-1960s, holds the overwhelming majority of wealth in the western world. Exact estimates vary widely. Some sources, for example, estimate that the boomers hold roughly $15 trillion in assets in the United States.

For that, attorneys and other sorts of wealth managers will need to get ready for the asset transfers that their customers will be making. This will require a lot of preparation. Baby boomers will need to make decisions about how to transfer their assets, including cash and real estate, as well as who they want to donate them to and how to safeguard treasured heirlooms.

03 Refocus on the mass – affluent segment

This market is expanding as more members of the upper-middle class look to increase their wealth through investments. Mass-affluents, who include investors with assets between $250,000 and $1 million, make up about 11% of the world’s population, with a significant number of young, digitally active professionals looking for tailored services. The Global Data Wealth Markets Analytics report claims mass-affluents in the United States are on track to control over USD47 trillion by 2025. It is also predicted that this group will explore and opt for alternatives such as structured products, digital assets, art, non-bankable assets, and other traditional high-net-worth individual assets. As mass-affluent wealth grows organically and through inheritance, it will require more sophisticated financial advice.

Today’s mass-affluent clients are looking for solutions that consider the rising cost of living, their growing interest in sustainability, and their retirement requirements. In addition, they expect assistance in accumulating and safeguarding their wealth, together with cost-effective financial counselling and advice. With that, wealth management firms realize the need to capture leads through alternate data sources such as online channels.

04 Cryptocurrency regulation

Crypto-assets management is coming, and it is likely bound for significant growth in a future that is not far from now. It is expected that the wealth management firms and institutions will actively advocate for enhanced transparency and regulation even more to protect investors, advisors, and individual consumers. Nevertheless, the global crypto market reached more than $3 trillion last year. In 2022, the White House already made a concerted effort to regulate the digital asset industry with the Executive Order on Ensuring Responsible Development of Digital Assets, a high-profile acknowledgement of the potential of the #cryptocurrency industry.

That Executive Order commits the White House to taking part in research on cryptocurrencies and engaging departments across the government to collaborate in the creation of a regulatory framework for digital assets. It also outlines a “whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology.” As the World Economic Forum suggests, this means “more privacy, security, financial inclusion, and global competitiveness for the United States”. While many countries such as the United States and Switzerland have already started regulating this emerging asset class, most of the initiatives in other parts of the world are in the early stages of development.

05 Reducing compliance costs

Frequent regulatory changes across multiple jurisdictions drive these firms to leverage solutions that streamline their operations. Thus, partnerships with solution providers will become essential for allowing firms to respond quickly to changes. New regulations on data privacy include the Fiduciary Rule in the United States and the General Data Protection Regulation (GDPR) in Europe. The demand for data governance has grown as a result of these requirements, which also encourage businesses to look for technology to meet compliance standards, particularly in terms of how they manage liquidity risk.

It is expected that wealth management companies will spend less money on capital investments as a result of regulatory solutions. Also, many reporting duties that many businesses today carry out manually will be automated. Dashboards that offer improved liquidity monitoring visibility are among the additional alternatives.