Many companies often approach it the wrong way, prioritising capabilities while overlooking their importance and role within the larger context. They seem to overlook the reality that a universal solution simply doesn’t exist.

We consistently evaluate our best practices and leverage case studies to focus our efforts and accomplish objectives for both our current and prospective clients. These case studies provide an in-depth exploration of our business processes and explain how our clients leverage the Altoo Wealth Platform.

Here are three brand new case studies from Altoo that showcase our successful implementation of the Altoo Wealth Platform with a profitable client experience.

See for yourself how ultra-high-net-worth individuals and family offices like yours are leveraging our platform to enhance productivity and boost efficiency!

Swiss Business Leader Gains 360° View of Total Wealth Beyond Tax Season

When management consultancy owner Toni Köhli reviewed the Altoo Wealth Platform as an award jury member at the 2020 Swiss Economic Forum, he saw a potential solution to his headaches with spreadsheets for handling financial data on his personal and corporate investments and cash flows. He soon began using the platform and has been pleased with how it: – Automates nearly all the tedious processes of translating raw transaction and asset performance data into actionable, understandable insights for himself and his family. – Provides secure, one-stop capabilities for storing important digital documentation, such as insurance policies, mortgage contracts, and more. Read more about Toni’s journey with Altoo in the case study (PDF).

Business Value Creation Expert Says Goodbye to Spreadsheets and Hello to On-Demand Visibility of Total Wealth

As an operating partner at a leading Swiss private equity firm, Thomas D. Meyer has a keen eye for spotting inefficient workflows and processes in portfolio companies. When it came to managing his own wealth, he knew there had to be a more efficient alternative to spreadsheets for handling his financial data from multiple banks and custodians. He found that alternative in the Altoo Wealth Platform, which automates tedious tasks related to consolidating, analysing, and visualising this data. Now, Thomas can get a clear, accurate picture of his total wealth whenever he likes, instead of only once a year.

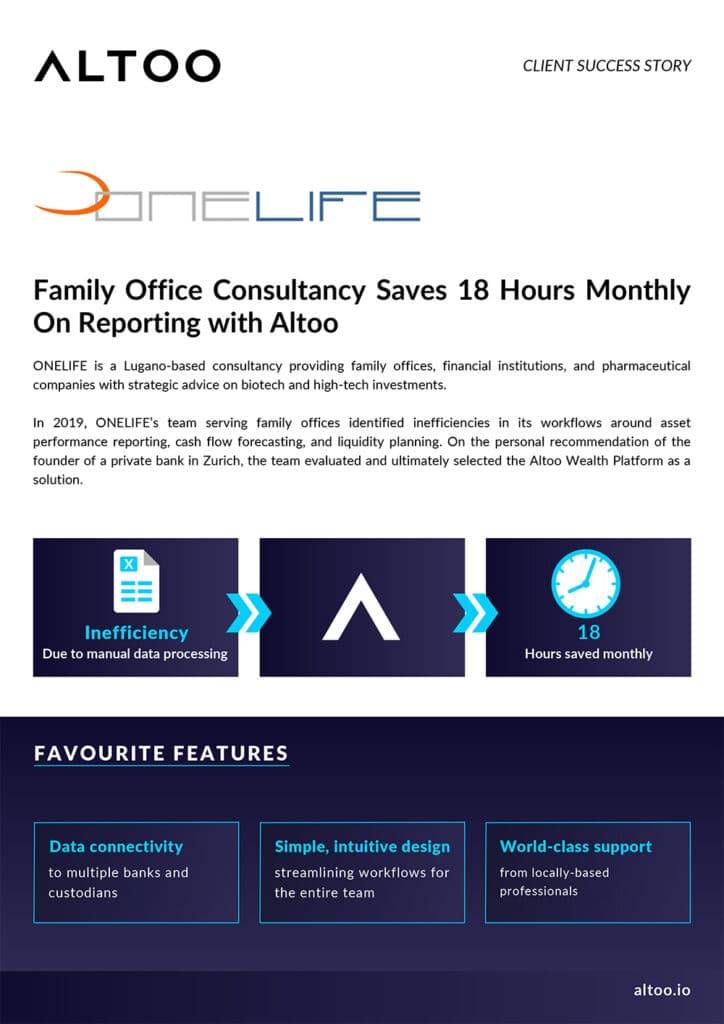

Family Office Consultancy Saves 18 Hours Monthly On Reporting with Altoo

Everyone in the family office space knows that high-quality reporting needs to get done. The only question is whether it gets done the easy way or the hard way. Family office Onelife SA was spending 20 hours a month doing it the hard way, manually processing transaction data from multiple institutions. Now, the Altoo Wealth Platform automates many of these processes. The results include:

1) 18 hours saved every month thanks to streamlined workflows,

2) 83% fewer data audits thanks to greater confidence in data quality.

Need help planning your tech investment? Contact us to design your unique client journey at hello@altoo.io.