Redefining the Wealth Management

By integrating long term investment management, tax planning, philanthropy, and lifestyle support, family offices provide a centralized approach to wealth management. We explore their changing landscape, highlighting their expanded role and the implications for wealth management strategies.

A family office is a privately held limited liability company that handles investment and wealth management for wealthy individuals and families. Generally with at least $50-$100 million in investable assets. The company’s financial capital is the family’s own wealth.

The Shift Towards Comprehensive Services

In the past, family offices focused primarily on managing investment portfolios (stocks, hedge funds…) and financial affairs for wealthy families. However, the complexity of wealth management and the unique needs of wealthy individuals have led family offices to broaden their scope.

They offer a range of services including investment management, tax and succession planning, philanthropy, estate planning, wealth plans and personal lifestyle support.

Integrated Wealth Management

Single family offices have become central hubs that coordinate various aspects of a person’s or family’s financial life. By integrating investment management with tax and estate planning, family offices provide a holistic approach to wealth management. This perspective ensures a better coordination of financial strategies. It enables families to align their investment goals with their overall wealth preservation objectives.

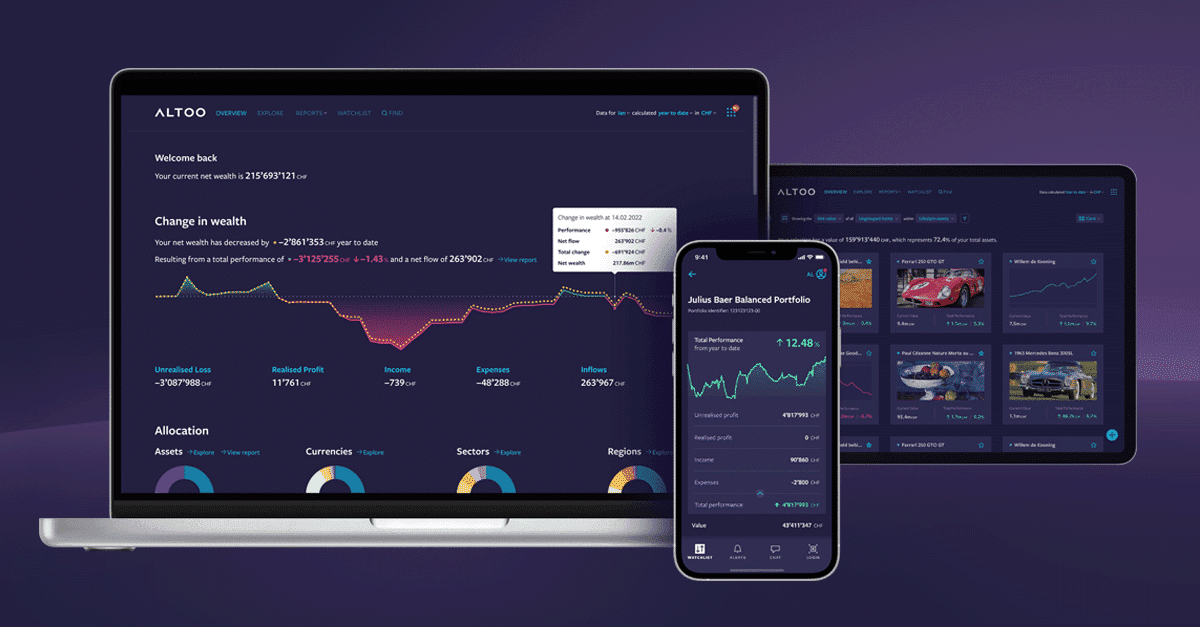

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Tailored Solutions for Complex Needs

Wealthy individuals often have complicated financial situations, complex structures and specific needs. Family offices specialize in understanding these complexities and providing customized solutions. They work closely with clients to develop personalized investment strategies. Taking into account risk tolerance, venture capital, private equity, real estate, capital investments, time horizons and specific financial goals. They manage the transfer of wealth between generations, helping a smooth transition and preserving the family’s net worth.

Concierge Services and Lifestyle Support

Beyond capital investments, family offices offer concierge and lifestyle services to their clients. These services can include travel planning, property management, education coordination and even personal security.

By taking care of non-financial needs, family offices reduce the administrative burden on high net worth families, allowing them to focus on their personal and professional aspirations.

Collaboration and Expertise

Both types of family offices, single and multi family offices often work with external professionals such as lawyers, accountants, investment advisors and philanthropic advisors to manage the family’s assets.

By leveraging the expertise of these professionals, family offices tap into a wealth of knowledge and resources, ensuring that members of the family receive the best advice and guidance in a variety of areas.