Despite the decrease, 2021 recorded the highest number of cyber incidents since 2013. Such statistics should serve as a wake-up call, particularly for financial businesses that manage the assets and transactions of Ultra High Net Worth Individuals (UHNWIs) and High Net Worth Individuals (HNWIs).

As reported by Bloomberg Businessweek, even the most fortified financial institutions have shown vulnerabilities. The Financial Times highlights that cyberattacks can disrupt markets, taint reputations, and severely dent investor confidence, with ramifications echoing the global financial system.

Therefore, this article aims to equip financial businesses with an in-depth understanding of the cybersecurity essentials crucial for safeguarding the interests of their UHNWIs and HNWIs clients. From decoding the current cybersecurity landscape specific to the financial sector to offering actionable insights on data protection, this article will potentially serve as a comprehensive guide for those responsible for the financial well-being of high-net-worth individuals.

Understanding the Cybersecurity Landscape in Financial Services

The cybersecurity landscape continuously evolves, posing increasingly complex challenges for businesses, especially those in the financial sector. For the financial industry, it is crucial for companies dealing with UHNWIs and HNWIs to be acutely aware of the latest developments and guidelines in this arena.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

In the realm of information systems, it’s crucial to align your cybersecurity strategies with the National Cybersecurity Strategy whenever possible.

Overview of the Current Cybersecurity Environment

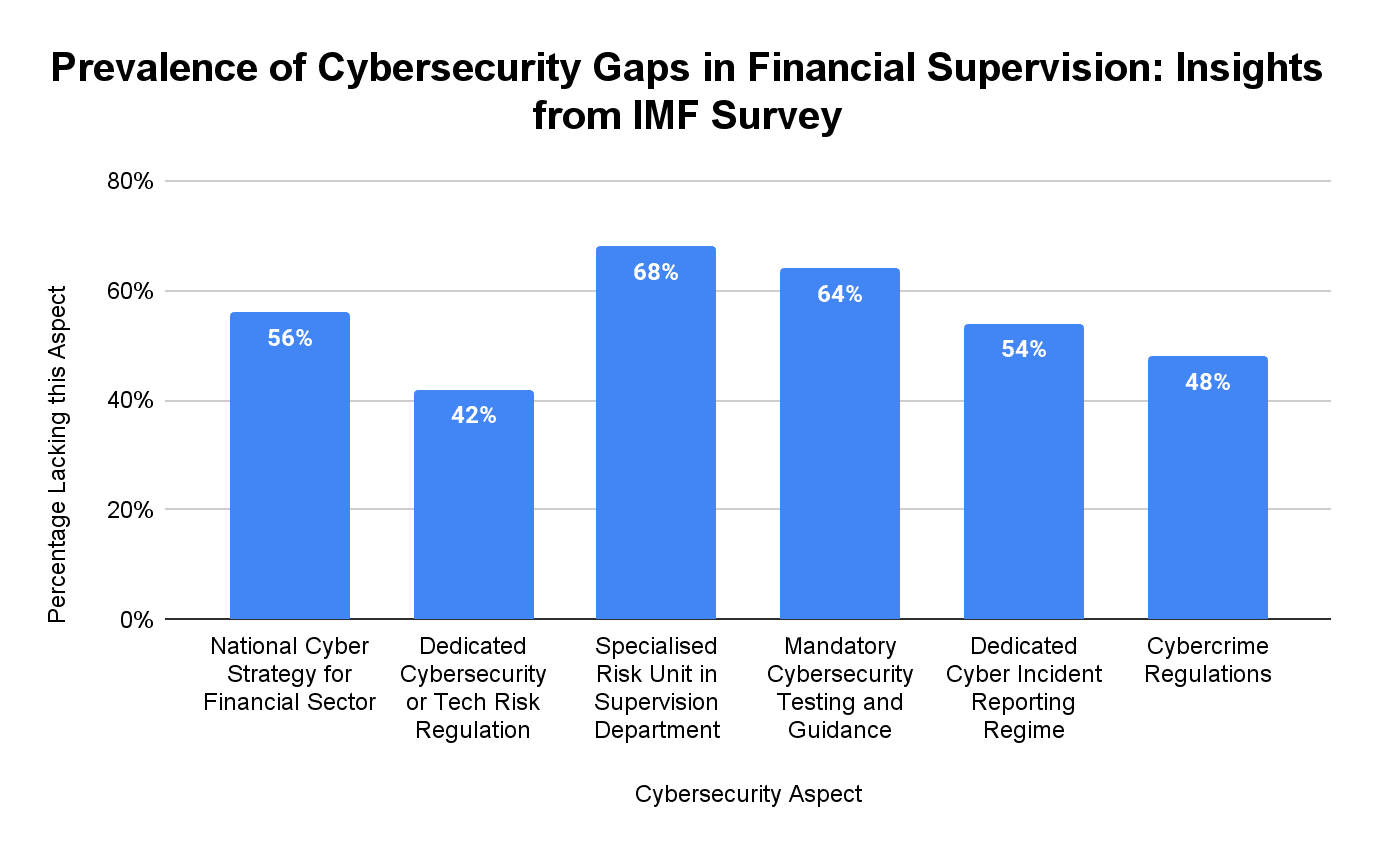

The recent International Monetary Fund (IMF) survey provides significant insights into the lack of comprehensive cybersecurity regulations among emerging markets and developing economies. Here we see a sharp contrast in the ordinal data of priority placed on cybersecurity across different countries.

- Lack of National Cyber Strategy: Over half (56%) of surveyed central banks or supervisory authorities do not have a formulated national cyber strategy for the financial sector.

- Absence of Dedicated Regulation: 42% of the authorities lack a specific cybersecurity or technology risk management regulation. Moreover, a substantial 68% do not have a specialized risk unit in their supervision department.

- No Mandatory Testing: A majority (64%) of the surveyed economies do not require financial institutions to undergo cybersecurity testing or provide them with guidance for the same.

- No Incident Reporting Regime: Over half (54%) of countries lack a dedicated regime for reporting cyber incidents.

- No Cybercrime Regulations: Nearly half (48%) of the surveyed economies do not have specific regulations to combat cybercrime.

Source: IMF

The report also emphasises that cyber threats targeting financial institutions have become more sophisticated. They leverage advanced techniques such as spear-phishing and ransomware attacks. Financial businesses must invest in robust cybersecurity measures to protect the organisational data and the highly sensitive financial information of their UHNWIS and HNWIS clients.

As we navigate this intricate landscape, remember that ‘knowledge is the first line of defense.’ The Altoo expert team is readily available for consultations for those interested in a more comprehensive outlook.

Why UHNWIs and HNWIs are targets

Wealthy individuals are particularly tempting targets for cyber attackers, given the scale of their investments and the complexity of their financial activities.

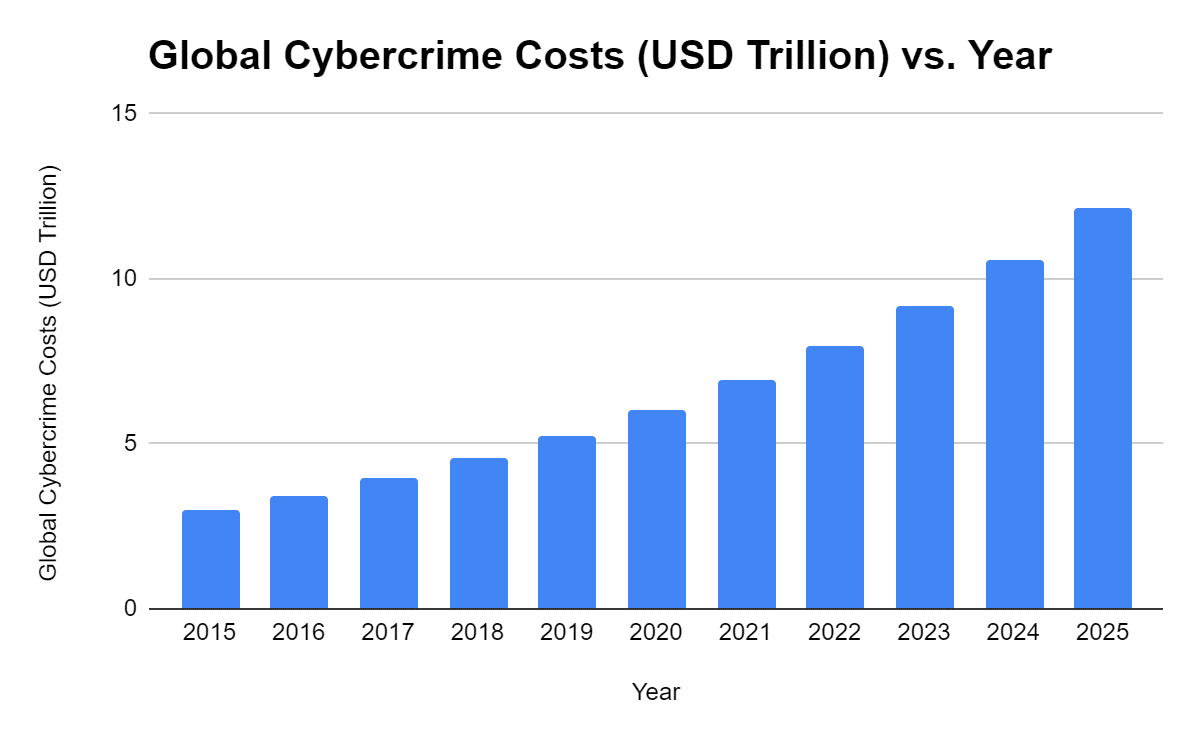

Experts believe that cybercrimes are financially motivated and explicitly targeted towards high-net-worth individuals. As per the Cybersecurity Ventures, the global costs associated with cybercrime are predicted to surge at an annual growth rate of 15% over the forthcoming five years.

The continuous data trends show an astonishing $10.5 trillion USD in yearly expenses by 2025, a significant leap from $3 trillion USD in 2015.

Source: Cybersecurity Ventures

Similarly, the issue of digital ad fraud is also gaining momentum. As per an estimate published in Bloomberg Law, the advertising industry is currently losing an estimated $51 million daily to ad fraud. This figure is expected to balloon to an annual loss of $100 billion by the year 2023.

The Allure for Cybercriminals

The attractiveness of UHNWIs and HNWIs as cybersecurity targets stems from the extensive and often complex financial data they hold. Their involvement in large-scale investments and cross-border transactions makes them vulnerable to supply chain attacks. The niche financial markets make them ideal targets for hackers interested in committing financial fraud, identity theft, or engaging in corporate espionage.

Regulatory Concerns

The extent of personal data stored, processed, and shared by financial businesses that deal with UHNWIs and HNWIs clients is subject to various regulations, like GDPR in Europe and CCPA in the U.S. These laws make it even more crucial for these financial businesses to pay attention to cybersecurity.

Non-compliance with regulations like GDPR in Europe and CCPA in the United States could result in hefty fines, not to mention the erosion of client trust and susceptibility to Distributed Denial of Service (DDoS) attacks that could cripple their information systems.

Types of Data Targeted

The most commonly targeted sensitive information includes investment portfolios, transaction histories, and personal information like Social Security numbers and tax identification numbers. These data types are often exchanged in high-value transactions, making them susceptible to cyber-attacks.

Prevention Measures

While regulatory compliance is essential, it is often not enough. Industry best practices and guidelines suggest implementing multi-layered cybersecurity measures. This includes advanced firewall systems, and robust authentication processes, which is critical. One effective strategy is to deploy malicious software detection tools and keep them updated.

By understanding the reasons why UHNWIs and HNWIs are prime targets for cyber-attacks, financial businesses can better prepare and protect themselves and their high-value clients from financial harm.

The Core Elements of Financial Cybersecurity

A well-rounded cybersecurity strategy encompasses multiple protection layers designed following Standards and Technology (NIST) guidelines to safeguard financial assets and sensitive information. Here, we delve into the core components crucial for robust financial cybersecurity.

Multi-Factor Authentication (MFA)

Multi-factor authentication is a staple in the financial cybersecurity arsenal. It requires multiple verification forms before granting access, significantly reducing the likelihood of unauthorized breaches.

Businesses should implement MFA and encourage their clients to use it for added protection. A study by Google states, MFA can block up to 100% of automated bots, 99% of bulk phishing attacks, and 66% of targeted attacks.

Secure Data Storage Solutions

As much as transactions need to be secure, so does financial and personal data storage. When it comes to secure data storage, it’s advisable for financial businesses to use encrypted storage solutions.

But don’t stop there—ensure these solutions comply with essential privacy regulations. For your clients in Europe, look for GDPR-compliant options; for those in the U.S., CCPA-compliant solutions are critical.

Doing so will potentially fortify your defence against cyber threats and earn your client’s trust by demonstrating that their data privacy is a top priority.

Insight: A report by Varonis found that 53% of companies had over 1,000 sensitive files open to every employee.

Regular Software Updates and Patch Management

Outdated software can become the weak link in your cybersecurity chain. Automating updates where possible and conducting regular checks is recommended to ensure all software is up to date.

Insight: Cybersecurity Ventures predicts that a new organization will fall victim to ransomware every 11 seconds by 2021, often due to outdated systems

Employee Training and Awareness

Cybersecurity isn’t just a tech issue; it’s a human issue. Acknowledging that human error or ignorance can undermine even the most advanced security infrastructure is crucial.

Implement regular training programs to educate employees about the latest threats and how to handle them. These should cover the latest cyber threats and equip your staff with practical guidelines on identifying and handling potential risks. By investing in human capital in this manner, financial businesses create a more holistic cybersecurity posture that includes technology and the human elements that interact with it.

Insight: According to ISACA, 58% of cyber incidents occur as a result of employee behaviour.

Robust Network Security

A secure network is the backbone of financial cybersecurity. Use firewalls, Intrusion Detection Systems (IDS), and Intrusion Prevention Systems (IPS) to monitor and control network traffic.

Insight: In a recent IMF survey, 42% of financial supervisors lacked dedicated cybersecurity or technology risk-management regulation, making network security even more crucial.

By focusing on these core elements, financial businesses can create a cybersecurity fortress capable of protecting the unique needs and high stakes associated with UHNWIs and HNWIs clients.

Wrap Up

Financial businesses catering to UHNWIs and HNWIs clients face unique cybersecurity challenges. Staying updated on the ever-evolving threat landscape, adhering to regulations, and implementing robust cybersecurity measures are critical. A comprehensive approach involving technology and human factors is essential for safeguarding sensitive financial data. For specialized software solutions that counteract cyber threats effectively, consider Altoo Software Solutions as your trusted partner.