Digital Wealth Platforms in a Nutshell

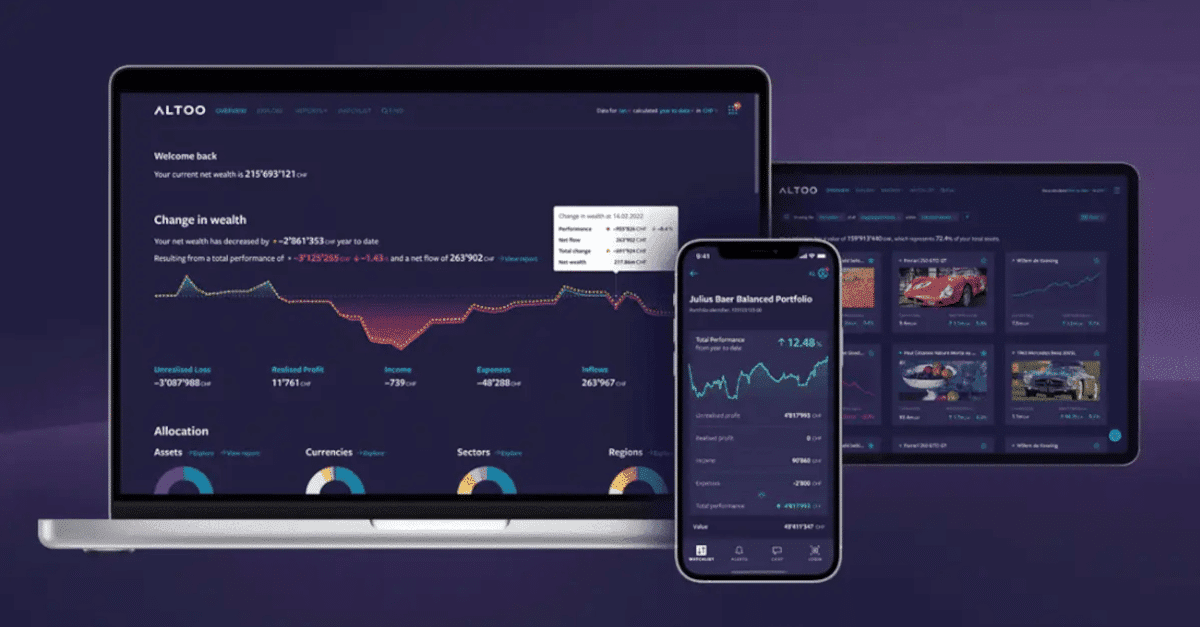

As the name suggests, a digital wealth platform is a technology platform for providing financial services through digital channels. The latest examples of such channels include dashboards providing consolidated views of holdings and mobile apps allowing users to stay connected and up-to-date while on the go.

Digital wealth platforms’ features and capabilities continue to grow, all with the fundamental purpose of improving how asset portfolios are managed.

Expectations Fueling the Rise of Digital Wealth Platforms

Investors have always expected – and will continue to expect – their portfolio values to grow. Today, however, investors expect a better experience overseeing and directing this growth.

Practically all investors are also consumers in their day-to-day lives, and large tech companies have poured enormous resources into making their online consumer decisions enjoyable, intuitive, and easy. It should not be a surprise, therefore, that investors now expect similar experiences when it comes to portfolio management, making data-driven decisions, and handling virtually every other aspect of their often complex financial lives. A good digital wealth platform puts such experiences at their fingertips.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

For financial service providers, a digital wealth platform can strengthen the client relationships that are at the heart of their businesses. Improved visibility of decision-making and the data behind it make for more transparent, trustworthy financial planning, and digitalised internal workflows around document storage and communications make collaboration among multiple stakeholders smoother and more efficient.

What to Look For in a Digital Wealth Platform

Data security should be among the top considerations when evaluating a digital wealth platform. Even the most leading-edge features will be of little benefit if using them means putting private information or even personal safety at risk. If a digital wealth platform offers communication and document management capabilities, for example, they should adhere to the highest standards of encryption.

Also, judge how well the platform distils clear, actionable insights from increasing volumes of financial data on increasingly complex asset portfolios. Diversification is the hallmark of good investment strategy but can often slow decision-making when information on specific holdings must be sourced individually.

And last but not least, pay attention to how well the platform integrates with existing technology architecture and workflows, especially related to compliance. Managing significant wealth typically involves addressing a wide variety of legal and regulatory requirements, and a good digital wealth platform will make handling them smooth and efficient.

These recommendations stem from our meticulous, ongoing analysis of the evolving expectations of high net worth and ultra-high net worth individuals. And we have not just observed these expectations – we have built the Altoo Wealth Platform to help meet them.

Hosted in Switzerland and compliant with industry-leading data security standards, our platform:

- provides wealth owners and managers with comprehensive yet easily understandable overviews of portfolios of a wide range of bankable and non-bankable assets, from private equity stakes to collectible cars,

- streamlines workflows related to document storage, communications, and more,

- and brings simplicity to complex wealth through an expanding set of innovative digital tools.