“It’s a great opportunity. If they don’t plan for it, they don’t have to worry about it; the government will do it for them,” said Mark Mirsberger from the US company Dana Investment Advisors to CNBC. He is referring to how intestacy laws will govern how assets are distributed without a will in place.

Talking about Wealth

The first hurdle is often bringing generations together to discuss their family legacy, advisors say. A lot of wealthy parents don’t show their kids what’s there. “One of the most important things is to make sure the next generation is comfortable handling the wealth they are about to inherit,” said Rick Keller from banking and wealth management consulting First Foundation Advisors in Irvine, California, to CNBC. “Parents have gotten used to managing their wealth over 20, 30, or 40 years; kids have less than a year.”

Financial literacy is a huge part of this wealth transfer. Sometimes a lifetime of education is necessary. That may mean finding various ways to work with the heirs and get them to cooperate.

Respecting Priorities

Children and grandchildren operate differently than their parents, and their priorities may be different. Once the descendants become well versed in wealth management and investing, they bring new viewpoints, ideas, and energy that families are advised to embrace. The younger generations are more focused on issues like climate change, social justice, and companies that are environmentally and socially conscious. They often have a broader view of the world of investments. They’re looking at impact investing and other investment classes that their parents might not have considered, and they may have strong opinions about the types of investments they want to prohibit.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

Ideas versus Reality

It’s also important to realise that the relative’s wealth could change due to circumstances. The idea of what one inherits does not always correspond to reality. For example, market movement could increase or decrease asset values. Or they may have an unexpected need to draw down funds, such as new or rising long-term care costs.

According to the New York Life portal, while inherited wealth may provide a financial lift for some, overall, Americans’ financial progress is impacted by inflation, growing credit card debt, and unexpected expenses. In fact, lack of emergency savings (29%), health care costs (27%), and credit card debt (26%) are the biggest risks adults perceive to their financial security and wellbeing. Having a general idea, however, will help with the most critical step, which is being proactive and educated on what it means to have wealth.

Finding help

A financial professional can help make the Great Wealth Transfer process easier. By working with an advisory team, a plan for multiple purposes can be developed. The important considerations are, for example, how to facilitate the wealth transfer, the amount of control to be maintained, the cash flow required to sustain the contemporary lifestyle, other goals concerning the wealth, including philanthropic activities, the involvement of the next generation in planning for the wealth transfer, etc. There’s no one right approach; instead, strategies vary based on the complexity of the assets, the family’s needs, and the ultimate goals concerning the wealth and relevant beneficiaries.

The Great Wealth Transfer presents a chance for families to consider how they can preserve their wealth across generations. By examining the estate plan with an eye towards what each generation needs, one can ensure everyone involved is engaged and prepared for success.

We think you might like

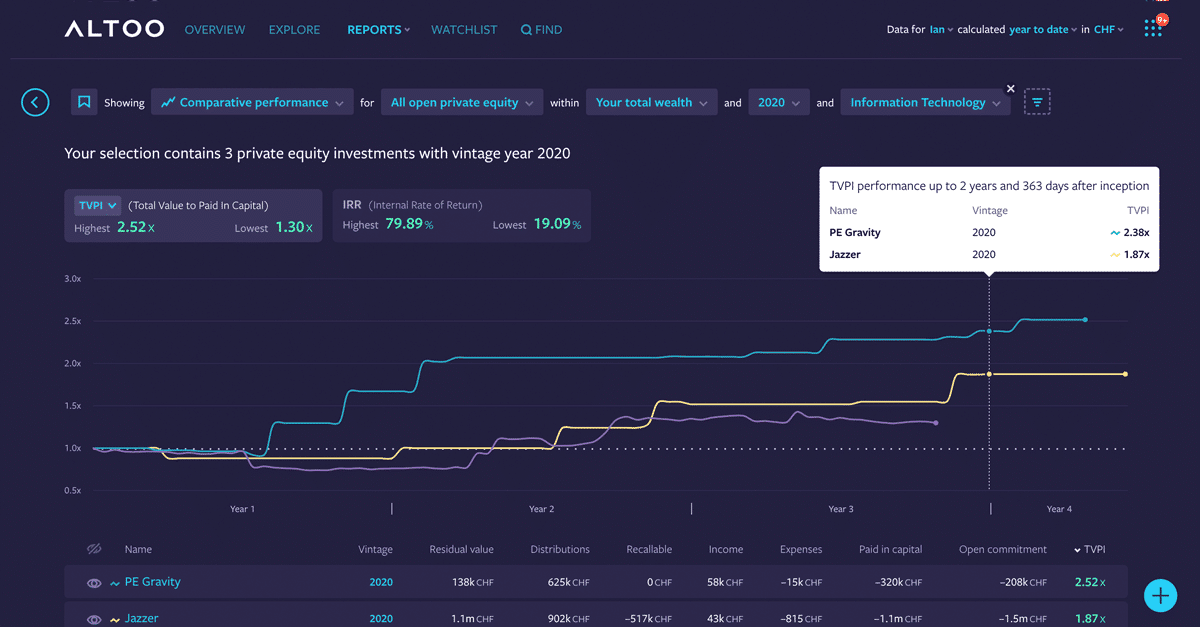

We are delighted to announce the launch of our latest feature: Private Equity reporting. Designed to equip you with a comprehensive set of tools and metrics to help you gain deeper insights into your investments and make better financial decisions. All your Private Equity investments at a glance Our new report provides you with a […]