The younger scions of extremely affluent families frequently have a strong affinity for digitization and seek improved digital experiences as intergenerational wealth transfers begin to take place. Furthermore, rather than their parents’ bankers, they could want to engage with bankers that are similar to them in age and background, observes EPAM, the US digital strategy and business consulting firm. For example, they have access to video calls, chat apps, and social media, but their forebears may not have been as tech-savvy.

Reasons for Digitalization

Services such as main accounting and partnership accounting, investment performance management and tracking, as well as tax reporting and capital commitment tracking,are often managed in unconnected systems. Once you digitise, you no longer have to process the data manually. The data overview is clear and efficient.

Still, before being digitised, Family Offices should first check the family’s goals. From there, you can find the most suitable digital partners. It is practical to offer a simple, intuitive digital reporting solution to family members. Neither UHNWI nor the staff in an FO are financial experts. Furthermore, the FO is to get an internal look at everything that has to be digitized. That’s the biggest problem with most FOs—they don’t have a clear overview.

Virtual Family Office

Virtual FO is a phenomenon that many may not know about. Instead of all employees working in one office in one place, the FO can work remotely and take care of different customers. It is also possible for a coordinator to organise the various specialists. Virtual FO is suitable for families whose members are not all residents of the same place. For example, it is a family with family members on different continents. Thus, in most cases, it is cheaper to start a virtual FO than a personal office.

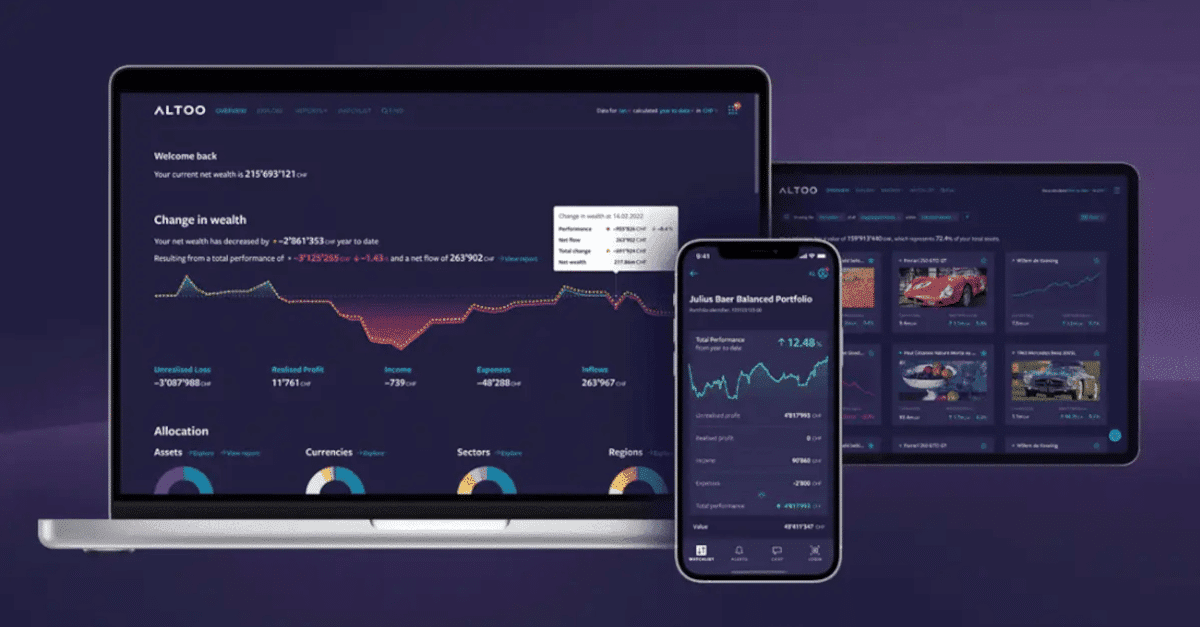

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Digital FO and Open Banking

An integral part of digitalization in FinTech is Open Banking. Here belong, for example, platforms that aggregate financial data from different banking relationships, enabling a complete asset overview, also called multibanking. The data exchange is very secure here. Open Banking contributes to a positive customer experience. The simplification and networking of different service providers—banks, FinTechs, etc.—are in the interests of both the customer and the service provider.

The FOs typically have little time and cannot accurately track and control the total assets managed because there is a lot of data and people they have to keep an eye on. “The management of large assets is often very complex for individuals and their carers. But it must be easy to understand. UHNWIs are not necessarily financial experts and are looking for a simple and intuitive reporting solution,” says Philip Hediger, Head of Wealth Servicing at the Swiss WealthTech ALTOO. “The technology enables modern access and makes interactions more convenient for all stakeholders. Digital solutions can also make customer conversations more efficient and targeted.”

Future of digital Wealth Management

A survey by The Economist Intelligence Unit has shown that customers have a lot in common. Regardless of continent and age, every generation defines prosperity by security, quality of life, freedom, and health.

This is also where the main benefits from digital solutions come from. These include secure and intuitive storage and sharing of documents, including secure collaboration with external stakeholders, as well as more precise financial decisions based on real-time insights. Finally, the digital solution reduces the risk of losing important documents and sensitive data.

In Asia, high importance is placed on digitization and digital wealth management. Women and Generation Z make up a large proportion of Asian and Middle Eastern societies (in the United Arab Emirates, almost 50% of people are between the ages of 15 and 35). Given this development, we can assume that wealth management will be highly digital and networked within the next ten years. Digital services are attractive to women and the so-called HENRY (High Earners Not Rich Yet), who have a great chance of becoming wealthy in the future.