Fintech, the burgeoning sector born from the marriage of finance and technology, has emerged as a formidable force challenging the dominance of traditional banking institutions. It is becoming increasingly clear that the rise of fintech represents a transformative shift that is reshaping the very foundations of how we manage our finances.

Technological Advancement: Fintech’s Superior Edge

Fintech has consistently thrived due to its ability to leverage the latest technologies, such as cloud computing, machine learning, artificial intelligence, and big data analytics. Traditional banks, on the other hand, often rely on legacy infrastructure, which limits their ability to integrate with other financial platforms and perform complex financial processes. Fintech’s reliance on cutting-edge technology enables these companies to deliver a superior customer experience compared to traditional banking institutions.

Personalized Client Experience: Fintech’s Specialization

While traditional banks cater to a broad audience and offer a range of financial services, fintech startups often take a more specialised approach. Fintech companies focus on addressing specific consumer and business needs, offering personalised solutions tailored to each customer. This specialisation allows fintech companies to offer a higher level of customisation and meet the unique needs of their target audience.

Regulatory Framework: Fintech’s Flexibility

National governments or central banks are in charge of regulating traditional banks. This framework ensures a level of transparency between financial institutions and their customers. In contrast, the fintech ecosystem operates with fewer regulations. While this lack of regulation allows fintech providers to innovate quickly and adapt to emerging financial trends, it also raises concerns about the potential risks associated with the industry.

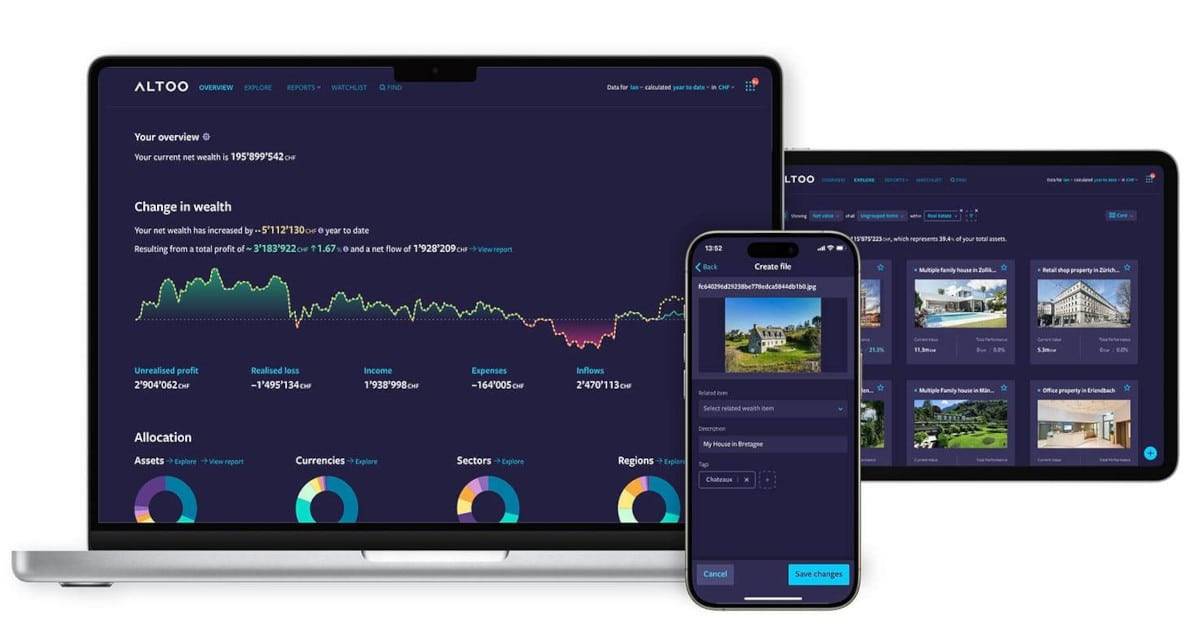

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

Growth Potential: Fintech’s Promising Future

The 2020 pandemic has highlighted the need for digital financial services that meet the needs of consumers. As a result, the fintech sector is poised for continued growth in the future, with more businesses and individuals relying on fintech solutions for their financial needs. Traditional banks are likely to respond to the challenges posed by fintech disruption by offering greater levels of personalisation, enhanced mobile banking capabilities, and improved digital security.

Market Penetration: Fintech’s Mobile Advantage

While traditional banks often rely on physical, brick-and-mortar locations to serve their customer base, fintech capabilities can be accessed through mobile devices. Fintech’s distributed technologies allow for greater mobile penetration, giving users convenient access to financial services at their fingertips. This mobile advantage sets fintech apart from traditional banks, which may require customers to visit physical branches for their banking needs.

Wide Range of Customers: Fintech’s Inclusive Approach

Traditional banks tend to focus on risk management, favouring customers with strong credit ratings and a proven track record of financial success. Fintech solutions, however, cater to a broader range of customers. Individuals with lower credit scores or poor financial histories often find fintech platforms more accessible, providing them with investment advice and other financial services that may not be available through traditional institutions.

Collateral Requirements: Fintech’s Flexibility

Traditional banks often have strict collateral requirements for customers applying for loans. In contrast, fintech platforms typically have more flexible criteria, making it easier for customers to obtain financing and financial services through these web-based platforms. Fintech’s less stringent collateral requirements allow a broader range of individuals and businesses to access the financial resources they need.

Technological Advancements: Shaping the Future of Finance

The banking sector has undergone a digital transformation in recent years, but many traditional banks continue to struggle with legacy system issues that hinder their performance and ability to adapt to new technologies. Fintech startups have a competitive advantage in this regard, as their business models are built from the ground up around advanced technology and data science. Fintech’s reliance on technology allows for rapid innovation and adaptation to evolving customer needs.

Impact of Banking Regulations: Fintech’s Agility and Flexibility

The banking industry is subject to increased regulation by national and central banks, which comes at a significant cost. Fintech companies, on the other hand, operate with greater flexibility and agility. Their lean operating models allow them to allocate resources to areas such as new technology and customer support, enabling them to adapt quickly to changes in the financial industry.