Mitigating Risk through Asset Diversification: Protection against Volatility

Concentrating wealth in a single asset or industry exposes individuals to significant risk. Diversification acts as a protective shield by spreading investments across different asset classes. Allocating funds to stocks, bonds, real estate, commodities and other assets reduces the impact of market downturns and protects portfolios from excessive volatility.

Balancing the Portfolio: The Power of Asset Allocation

Effective diversification requires careful asset allocation. By dividing investments among different asset classes based on risk tolerance, financial goals and time horizon, individuals can achieve a well-balanced portfolio. A combination of growth-oriented investments such as stocks, income-producing investments such as bonds, and alternative investments such as real estate can help individuals achieve an optimal risk-return balance that is aligned with their specific objectives.

Exploring Geographical Diversification: Capitalizing on Global Opportunities

Limiting investments to a single market or region can expose individuals to regional economic downturns. Geographic diversification provides exposure to different economies, regulatory environments and currencies. Investing internationally allows individuals to participate in global growth and potentially access markets with different risk-return profiles, reducing the impact of regional market fluctuations.

Uncovering Sector Diversification: Navigating Industry Dynamics

Sector diversification helps individuals balance their exposure to industry-specific risks. Industries perform differently over time due to various factors such as technological advances, market trends, or regulatory changes. By investing in a variety of sectors, such as technology, health care, energy, and consumer discretionary, individuals can reduce their exposure to any one industry and take advantage of growth opportunities that may arise in different sectors.

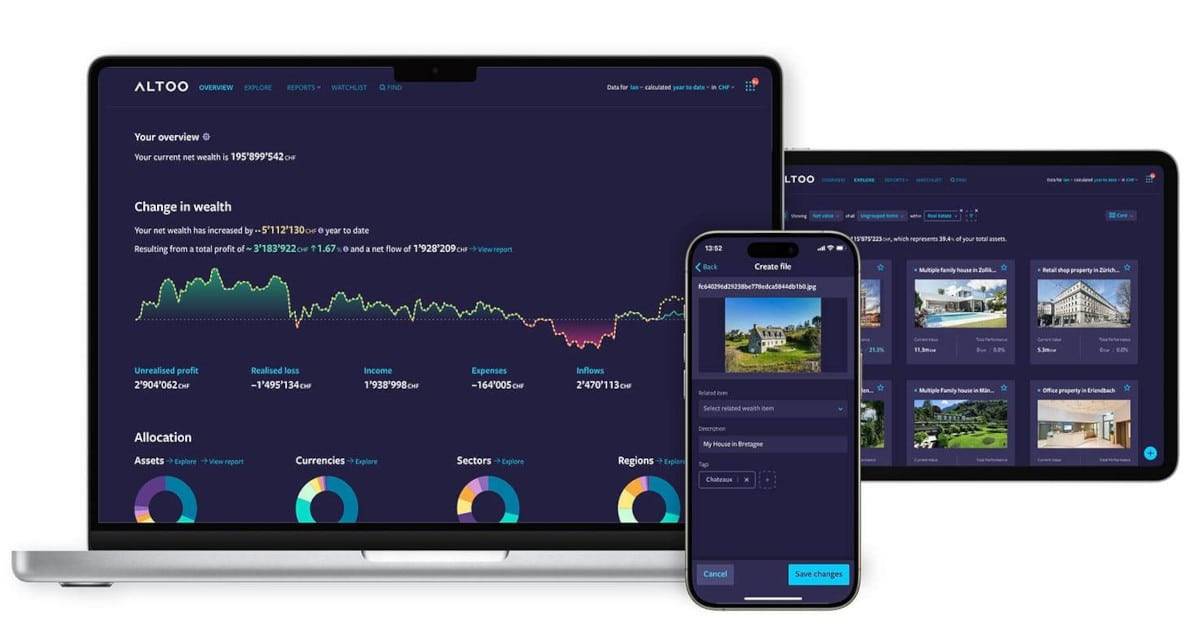

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

The Role of Professional Guidance: Partnering with Experts

Developing a sound diversification strategy requires expertise and ongoing monitoring. Many individuals choose to work with a financial advisor, wealth manager or portfolio manager who specializes in wealth management. These professionals provide personalized advice, conduct risk assessments, and identify appropriate investment opportunities based on an individual’s financial goals and risk tolerance.