China’s Growing Investment in Africa

China’s commitment to Africa is reflected in its robust investment growth. In the first half of 2023, Chinese direct investment in Africa exceeded $1.8 billion, an increase of 4.4 percent year-on-year. This substantial investment demonstrates China’s commitment to fostering long-term partnerships and promoting sustainable development in the region. Chinese companies have played a pivotal role in supporting Africa’s infrastructure projects, with investments exceeding $400 billion. These projects cover a wide range of sectors, from traditional industries such as construction, mining, and manufacturing to emerging sectors such as logistics, the digital economy, clean energy, health, green development, and finance.

A Catalyst for Africa’s Industrialization

China’s investment in Africa has been instrumental in driving the continent’s industrialization efforts. By partnering with African countries on investment projects, China has enabled them to enhance their capacity for independent development. This partnership has not only created jobs and economic opportunities but has also facilitated the transfer of knowledge and technology. African countries have been able to use Chinese investment to harness the potential of the technological revolution and adopt smart and green development practices.

Trade Partnership between China and Africa

China has been Africa’s largest trading partner for 14 consecutive years, underscoring the depth and importance of the economic relationship. In 2022, bilateral trade between China and Africa reached $282 billion, an increase of 11 percent from the previous year. This robust trade partnership has facilitated economic growth on both sides, opening up opportunities for greater market access and trade diversification. African countries have benefited from China’s demand for raw materials and manufactured goods, while China has gained access to Africa’s abundant natural resources.

The Belt and Road Initiative: A Game Changer

At the heart of China’s investment in Africa is the Belt and Road Initiative (BRI), a comprehensive framework aimed at promoting connectivity and economic integration across the continent. The BRI has been a driving force behind China’s infrastructure investments in Africa, which include projects such as railways, highways, ports, and telecommunications. These investments have not only improved transportation networks but have also promoted regional integration, enabling the movement of goods, services, and people across borders.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

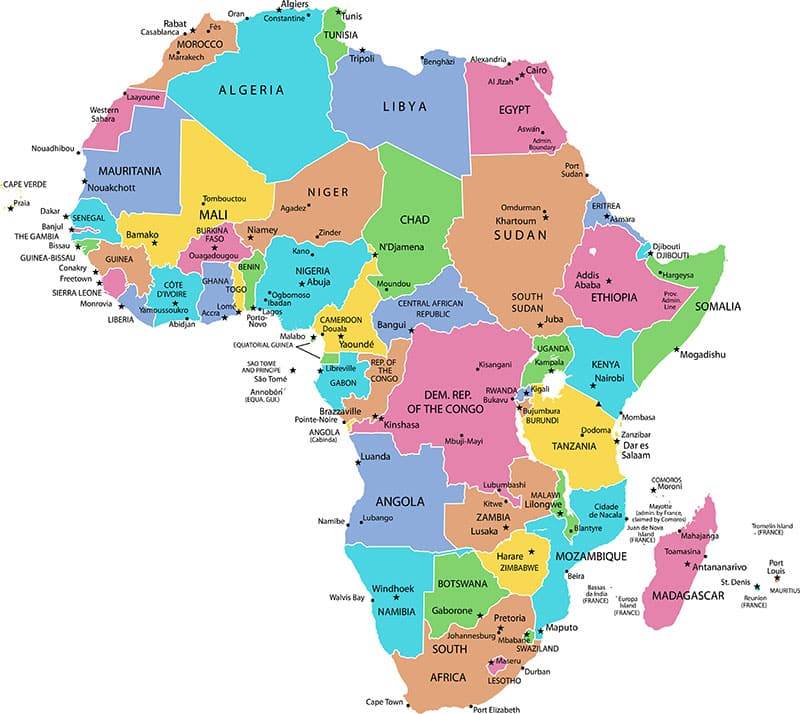

Geographical and Sectoral Distribution of Chinese Investment in Africa

Chinese investment in Africa is geographically concentrated, with a significant share going to Nigeria and Angola. These two countries account for a quarter of all Chinese investment in Africa. Nigeria in particular is a major investment partner for China on the continent, receiving substantial funds for infrastructure development, particularly in the rail sector. China is supporting two major standard-gauge rail projects in Nigeria, one from Lagos to Kano and the other from Lagos to Calabar.

The main areas of Chinese investment in Africa are transportation and energy. In transportation, China has made significant investments in railway projects across the continent. Nigeria, Kenya, Ethiopia, and Zambia are among the countries benefiting from Chinese-backed rail projects. For example, China’s Export-Import Bank provided a significant portion of the funding for the Addis Ababa Light Rail in Ethiopia, which serves millions of residents in the city.

In the energy sector, Chinese investment in Africa is mainly focused on oil and gas but also includes investments in renewable energy sources such as hydropower. China has become one of the world’s leading investors in renewable energy, surpassing the United States in terms of investment. This underscores China’s commitment to clean energy development and its contribution to Africa’s energy sector.

The Process of Chinese Investment in Africa

Contrary to popular belief, Chinese investment decisions in Africa are not made in a centralised manner. Chinese state-owned enterprises and their subsidiaries compete for projects rather than dividing them up in a centralised manner. Chinese companies actively scout infrastructure projects in Africa and attend high-level meetings with government officials to pitch their ideas.

Compared to their Western counterparts, Chinese companies are known for their efficiency and speed in implementing projects. Feasibility studies can be completed in a short period of time, allowing projects to be implemented more quickly than with companies from other regions. This quick turnaround time has been a key factor in the success of many Chinese-backed infrastructure projects in Africa.

Assessing the benefits and challenges

The China-Africa relationship has both benefits and challenges. Proponents argue that Chinese investment has been instrumental in developing infrastructure, boosting manufacturing, and freeing up domestic resources for critical sectors such as health and education. Chinese investment has also contributed to job creation and economic growth in African countries.

However, critics have raised concerns about the potential exploitation of Africa’s natural resources and the debt burden of Chinese loans. Some contend that China’s interest in Africa is more motivated by its own economic needs than by the long-term development of the continent. The potential environmental impact of Chinese-backed projects and the lack of transparency in some deals have also been criticised.