The majority of High Net Worth Individuals understand that it is important to diversify your portfolio. Rather than keeping all your money in one bank account, it is best to spread it amongst different investments – from traditional stocks and shares to art, fine wine and real estate. Cryptocurrency and NFTs are also becoming popular.

While having various assets helps cushion wealth owners against market volatility, it can also be complicated to track how much money is stored in each asset. That is where wealth management reporting software comes in.

There are lots of reasons to upgrade your wealth management reporting platform. Let’s take a look at some of them here.

The benefits of wealth management reporting software for HNWIs

01 – With a wealth management reporting system, all of your assets are visible on one dashboard

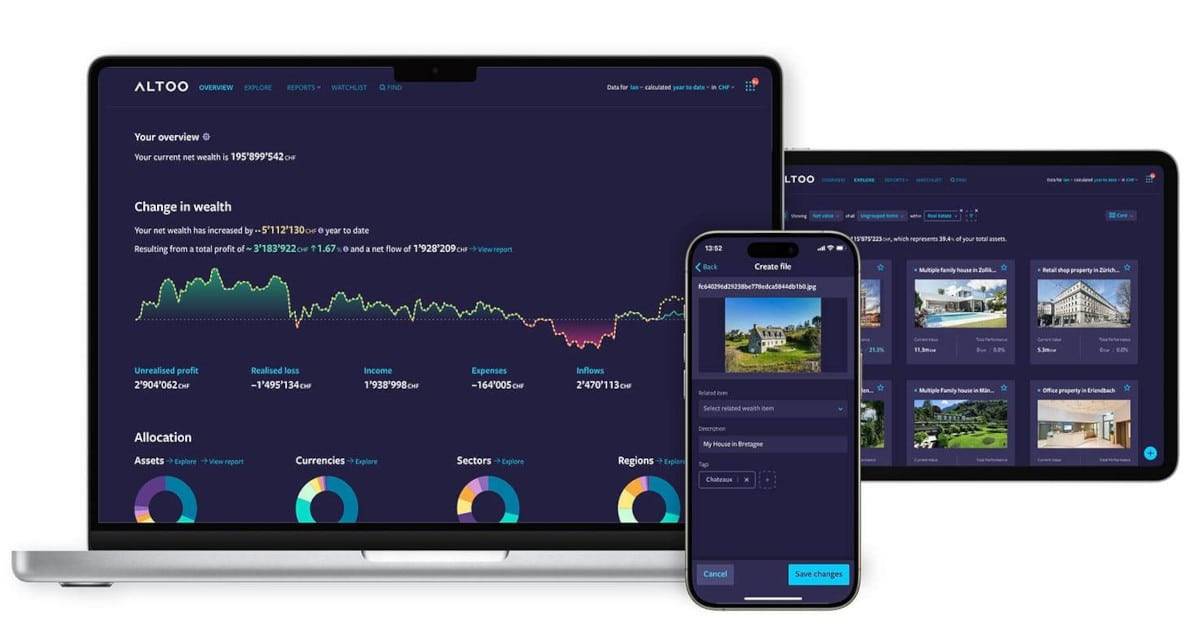

When a portion of your portfolio comprises non-bankable assets, keeping track of your total net worth can be challenging. With a wealth management technology solution like Altoo, everything is listed together in one place, making financial reporting effortless. While it is possible to do this manually with Excel spreadsheets, this becomes time-consuming. It is also prone to inaccuracy as it needs to be updated regularly and is less secure.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

Single files stored offline can get lost or damaged; if they are sent over email, they could be susceptible to interception. Wealth management reporting software is secure, cloud-based, and able to use technology to pull up-to-the-minute data from a variety of sources. As well as getting the current value of each asset, you can rest assured that the information is safe.

02 – Automated wealth management reporting solutions make it easy to collaborate with your network

Wealth management reporting software like Altoo is based on the cloud, so anyone who needs access – such as financial advisers and business partners – can access your encrypted data if you provide them with a login. Because this technology is designed to be a digital home for your wealth, you can conduct a wide range of actions within the dashboard, such as uploading supporting documents. You can also choose who has access to which information.

So, for example, your property adviser can see your portfolio of real estate and mortgage documents but will be blocked from seeing any of your other investments. This makes collaboration easy without compromising confidentiality.

03 – Reporting solutions for wealth management make data-driven decisions faster and easier

Having all your assets together on one intuitive dashboard lets you and your wealth managers see, at a glance, which areas are performing well – and which ones need more attention. Because technology can pull in historical data and market patterns, it is also easier to make a plan for the future.

And, because there is space for all supporting documents on the platform, it is possible to move quickly during turbulent market situations – for example, during a stock market crash. Having 24/7 access to investment data lets your team move quickly to protect your private wealth.

Are you ready to discover the benefits of automated wealth management reporting software?

Using wealth management reporting software to manage complex wealth has a wide range of benefits. The main one is that it is far easier, more intuitive and less time-consuming as there is no need to compile documents or translate industry jargon.

If you feel you could benefit from wealth management reporting software or simply want to learn more, apply for an Altoo demo account.