The Rise of Hyper-Personalization

Hyper-personalisation has become a crucial element in wealth management as clients increasingly demand tailored experiences and personalised services. With the advent of innovative technologies and the influence of personalised experiences in other industries, investors now expect wealth management firms to deliver the same level of customization and personalisation.

Comprehensive Data Collection

To provide truly personalised advice, financial professionals need access to comprehensive client data. This includes information on income, expenses, assets, liabilities, investment history, risk tolerance, and other relevant factors. By collecting and analysing this data, wealth managers can gain deep insight into their clients’ financial situations and goals, enabling them to provide customised recommendations and strategies.

Leveraging Data Analytics and Machine Learning

Advanced analytics and machine learning algorithms play a critical role in hyperpersonalization. By analysing vast amounts of data, wealth management firms can uncover patterns, trends, and personalised insights that lead to better investment decisions. These technologies enable financial professionals to create personalised investment strategies, optimise portfolios, and make real-time recommendations based on individual client preferences and goals.

Communication and Collaboration

Effective communication and collaboration are essential components of hyperpersonalization. Wealth managers need to engage with their clients through multiple channels and provide seamless experiences across touchpoints. By leveraging digital platforms and digital communication tools, financial professionals can stay connected with their clients, provide timely updates, and address their specific needs and concerns.

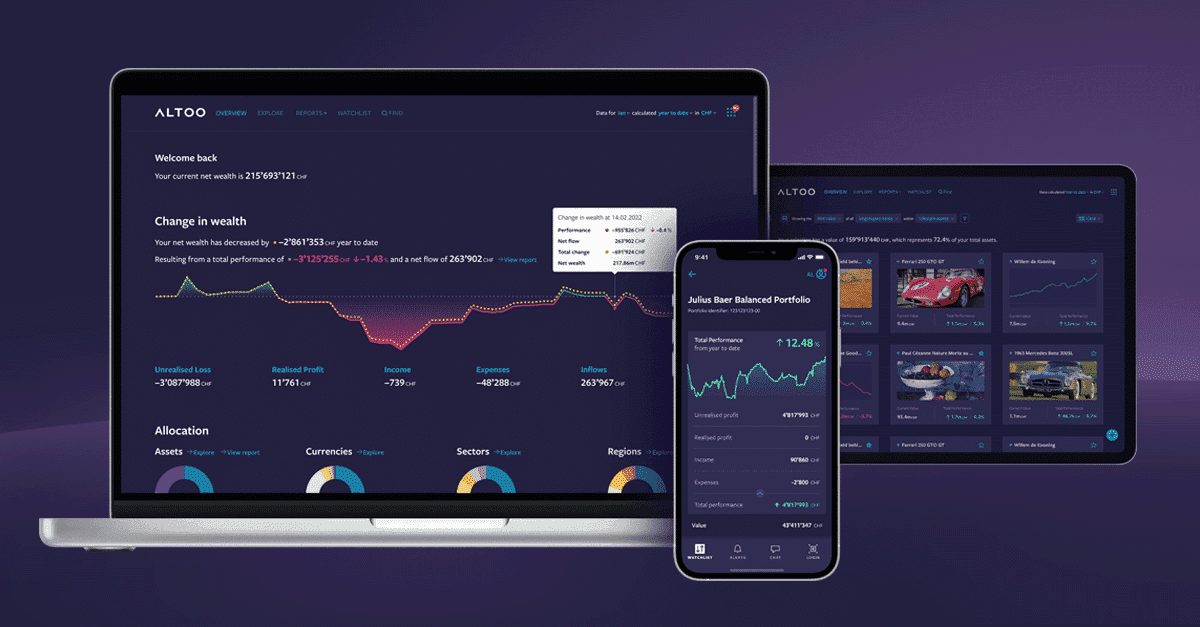

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Customized Client Reporting

Client reporting is a critical touchpoint in the client-advisor relationship. By providing personalised and insightful reports, wealth managers can demonstrate the value they bring to their clients. Traditional reporting methods are often cumbersome and lack customization. With hyper-personalisation, however, financial professionals can leverage technology to deliver visually appealing and interactive reports that present complex financial information in a clear and understandable manner.