Data-Driven Decision Making

Technology has opened up a vast realm of data analytics and artificial intelligence (AI) capabilities, enabling asset managers to make more informed decisions. Advanced algorithms can process massive amounts of data and identify patterns and trends that human analysts may miss. These insights help optimize portfolios, manage risk, and allocate assets, leading to more tailored investment strategies and improved returns.

Robo-Advisors

Robo-advisors have gained popularity as automated investment platforms that use algorithms to provide financial advice and manage portfolios. These digital platforms offer convenience, accessibility and cost-effectiveness, making them attractive options for individuals with significant financial resources. Robo-advisors use questionnaires and risk assessments to create personalized investment plans and provide diversification and rebalancing services without the need for extensive human intervention.

Blockchain and Cryptocurrencies

The emergence of blockchain technology and cryptocurrencies has revolutionized asset management by introducing new investment opportunities and transforming transaction processes. Blockchain offers enhanced security, transparency and efficiency, facilitating the creation of digital assets and decentralized finance (DeFi) ecosystems. Many high-net-worth individuals are increasingly exploring cryptocurrency investments as part of their diversified portfolios, while blockchain technology streamlines settlement processes, reduces intermediaries, and lowers transaction costs.

Enhanced Client Engagement

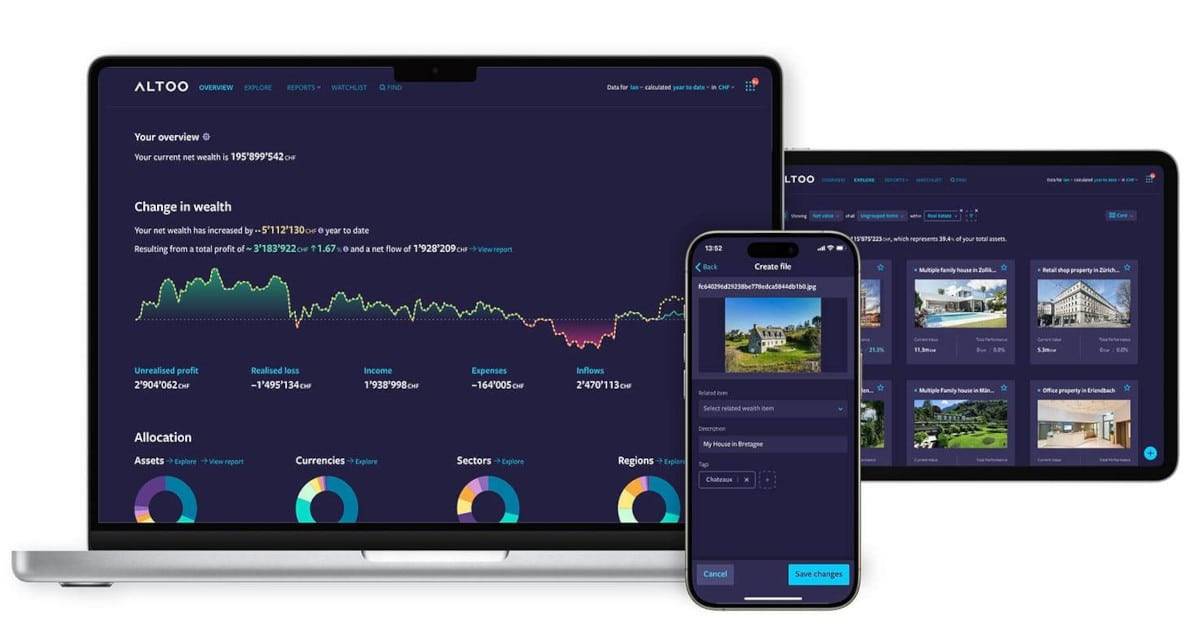

Technology has enhanced the client experience by providing real-time access to investment information and interactive tools. Wealth management apps and online portals allow individuals with significant financial resources to monitor their portfolios, track performance, and receive personalized recommendations. In addition, chatbots and virtual assistants powered by natural language processing (NLP) provide instant customer support and efficiently address questions and concerns.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Machine Learning and Predictive Analytics

Machine learning algorithms and predictive analytics enable asset managers to identify behavioral patterns and more accurately predict market movements. By analyzing historical data and market trends, these technologies help make proactive investment decisions, optimize portfolios and manage risk. Individuals with significant financial resources benefit from timely insights and customized strategies, ensuring that their assets are aligned with their financial goals.