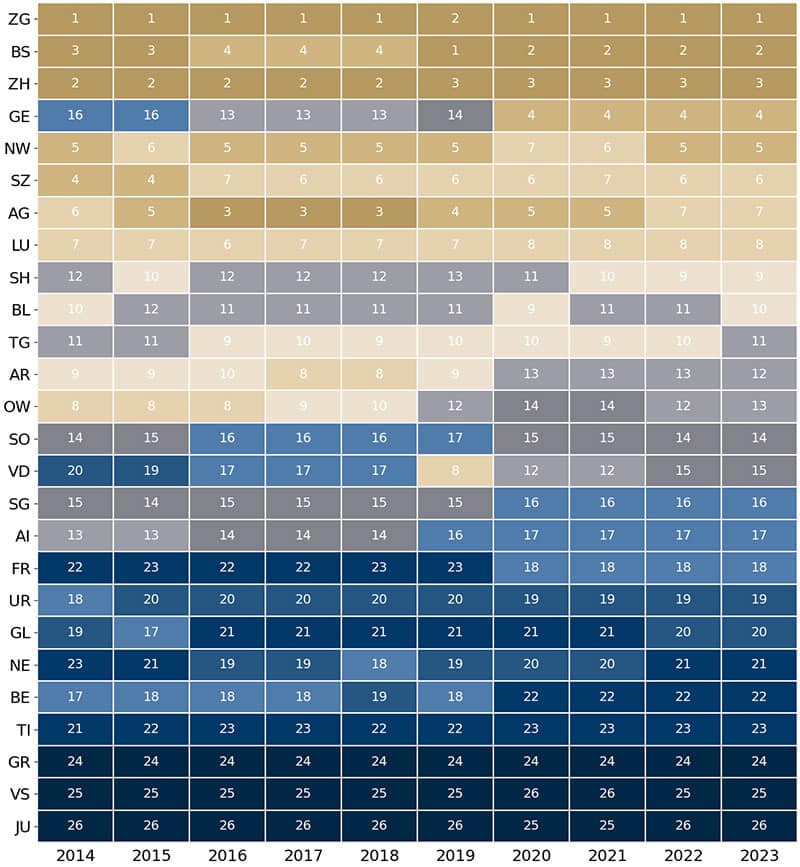

Since 2014, Credit Suisse (CS) has evaluated the competitiveness of the cantons. The ranking shows which cantons are economically most successful. As of 2020, the top of the ranking remained unchanged, with the cantons of Zug, Basel-Stadt, and Zurich. The following regions are highly competitive: Nidwalden, Schwyz, Aargau, and the canton of Lucerne. There, too, it remains attractive to start a company.

The cantons in northwestern Switzerland would benefit each other. Argau, Basel, Zug, and Zurich could be described as the growth engines of Switzerland. At the other end of the ranking are the mountain cantons of Graubünden, Wallis, and Jura, which are rarely described as business-friendly. Among them are Schaffhausen, Basel-Landschaft, and Thurgau, with solid growth prospects.

Tax Policy as the Key to Success

Those who choose Switzerland as a place of establishment have 26 cantons to choose from. Among the criteria preferred by investors are existing infrastructure (e.g., short distances for employees or the availability of the nearest airport). Furthermore, it is the availability of suitable specialists and, of course, the tax burden incurred.

The reasons for changes in the ranking (see figure) can mostly be found in the tax policies of the cantons. After all, this can be adapted faster than, for example, the availability of an adequate workforce or the reachability of the site, as the CS explains. For example, the cantons of Schaffhausen and Schwyz have significantly reduced taxes for natural persons. Individual cantons, such as Wallis and Jura, reduced corporate taxes as part of the corporate tax reform.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

The traditionally strong position of the canton of Zug is attributable to the above-average reduction in all the criteria examined, especially in terms of taxes and the availability of skilled labour. The canton of Zurich is also well accessible, has a highly qualified workforce, and has relatively good results in the taxation of natural persons. In 2020, the canton of Geneva was able to move from the middle of the ranking to 4th place thanks to a strong reduction in ordinary income tax rates.

However, as the CS observes, the inter-canton tax differences have decreased in recent years. This reduces the relative advantage of low corporate taxes. Some cantons are gradually reducing their corporate taxes over several years, which is why further changes in the ranking are likely to be expected in the coming years. In order to stand out from the competition, it will therefore become more important for the cantons to invest in the availability of specialists and in the infrastructure.

(1 = highest location quality, 26 = lowest site quality), 2014–2023

Source: Credit Suisse

OECD Minimum Tax adopted

The tax policy of the cantons not only provides good positions in the ranking but has for a long time also caused unrest in the country. According to the Organisation for Economic Cooperation and Development (OECD) and the Group of the Twenty Major Industrialised and Emerging Countries (G20), the taxation of large, internationally active corporate groups is no longer relevant. Around 140 countries, including Switzerland, have agreed that these companies should pay at least 15% tax on their profits. In Switzerland, these 15% are partly not achieved. This was the reason why the Federal Council and Parliament decided to introduce the minimum tax. In June 2023, the people decided to anchor it in the constitution.

These are companies with annual revenues of at least EUR 750 million. A few hundred domestic and a few thousand foreign corporate groups in Switzerland make the decision. Many of them settle in the highly taxed cantons, which are thus losing their attractiveness. Companies move away or do not settle in the country at all.