Monaco is a small, wealthy country on the French Riviera that is known for its tax breaks, high-class living, and beautiful views of the Mediterranean. As a world financial center, Ultra-High-Net-Worth and High-Net-Worth Individuals are drawn to it. Even though Monaco is small, its economy is strong because it is based on tourism, real estate, and banking.

Understanding Monaco’s special tax system could be good for the finances of Ultra-High-Net-Worth Individuals (UHNWIs) and High-Net-Worth Individuals (HNWIs). The goal of this article is to give UHNWIs and HNWIs in-depth analysis, insights, and ideas about their finances.

Different Types of Taxes in Monaco

Here is a list of additional taxes that you should know about:

- Personal Income Tax: Monaco does not impose a personal income tax on its residents, making it highly attractive for wealthy individuals.

- Corporate Tax: Companies that generate more than 25% of their revenue outside Monaco are subject to a 33.33% corporate tax rate.

- Social Contributions: While there’s no personal income tax, residents are required to make social contributions to fund public services.

- Value-Added Tax (VAT): Monaco follows the French VAT system, with the standard rate being 20%.

- Property Tax: Monaco does not have an annual property tax, but property transactions are subject to a registration duty.

- Inheritance and Gift Tax: These taxes are levied but vary depending on the relationship between the donor and the recipient.

- Capital Gains Tax: Monaco does not impose a capital gains tax, potentially benefiting investors.

- Wealth Tax: There is no wealth tax in Monaco, which can be advantageous for individuals with substantial assets.

- Business Profits Tax: Businesses that earn less than 25% of their turnover outside of Monaco are generally exempt from this tax.

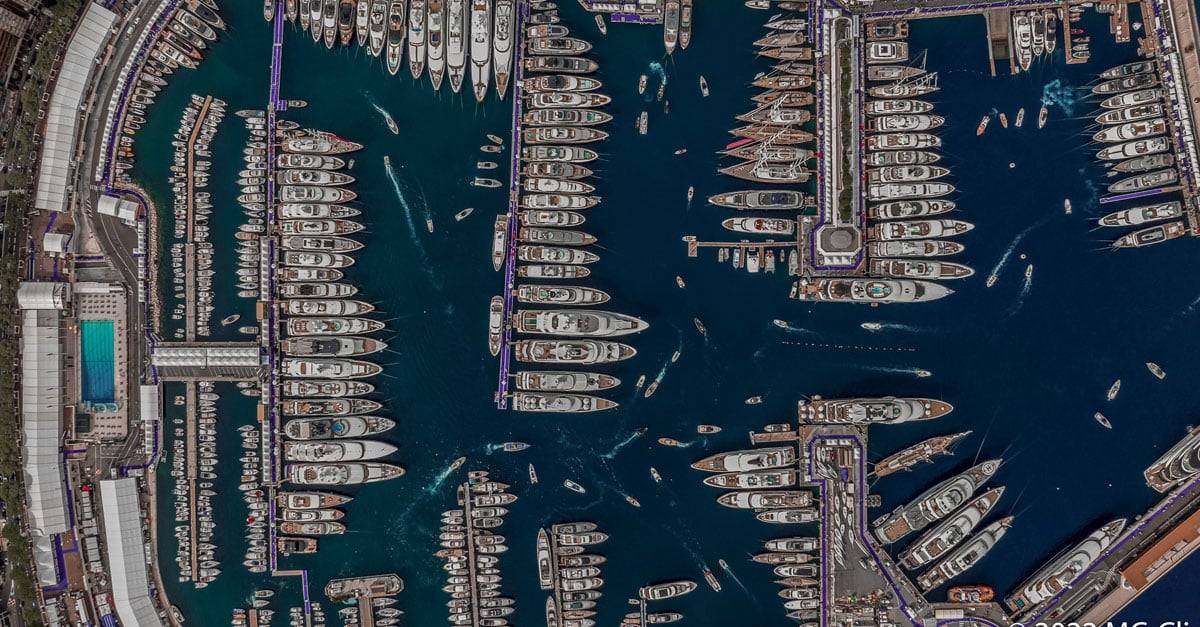

- Shipping and Yacht Tax: Monaco levies specific taxes on shipping companies and yachts registered under its flag.

- Tourist Tax: Hotels and other tourist accommodations may charge a small tourist tax.

- Stamp Duty: Certain legal and official documents require a stamp duty to be paid.

The Allure of Monaco for UHNWIs and HNWIs

Monaco, whose name is synonymous with luxury, has long been a haven for the world’s richest. But why are Ultra-High-Net-Worth Individuals (UHNWIs) and High-Net-Worth Individuals (HNWIs) so drawn to this Mediterranean haven? Is its allure based solely on its glitz and glamour, or does it also offer tangible financial benefits?

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Tax Benefits: The Financial Incentive

- Zero Income Tax: One of the most compelling reasons is the absence of personal income tax. This could potentially result in significant savings, especially for those in high tax brackets in their home countries.

- No Wealth Tax: Monaco also does not impose a wealth tax, which might be particularly advantageous for individuals with substantial assets.

- Limited Corporate Tax: Companies that earn less than 25% of their revenue outside Monaco are generally exempt from corporate tax, offering a potentially favorable environment for business owners.

Monaco has one of the highest numbers of millionaires per capita, which could be partially attributed to its tax benefits.

Income Tax: The Zero-Rate Advantage

When it comes to income tax, Monaco stands out as a unique jurisdiction, offering a zero-rate policy that has become a cornerstone of its appeal to UHNWIs and HNWIs. But what does this absence of personal income tax actually entail, and are there any restrictions that financial advisors and managers should be aware of?

The Implications of Zero Income Tax

The absence of personal income tax in Monaco can be a game-changer for many. For UHNWIs and HNWIs, this could potentially translate into significant financial gains, especially when compared to the high tax rates in other countries.

Among the OECD countries, in 2022, the countries of Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) had the highest top statutory personal income tax rates in Europe, making Monaco an attractive alternative.

Social Contributions: The Other Side of the Coin

While the zero-rate income tax is a significant advantage, it’s crucial to note that residents are still subject to social contributions. These contributions fund Monaco’s social security system and other public services. Although these rates are generally lower than in many European countries, they should not be overlooked.

Corporate Tax: Exceptions to the Rule

While Monaco’s tax landscape is often lauded for its personal income tax exemptions, the corporate tax structure is different. It is critical for UHNWI and HNWI to understand that not all businesses are exempt from taxation in Monaco.

The 33.33% Corporate Tax: Whom It Affects

Monaco imposes a corporate tax rate of 33.33% on companies that don’t meet specific criteria. Primarily, businesses that generate more than 25% of their turnover outside of Monaco fall into this tax bracket. This is a crucial factor that differentiates Monaco from other tax havens where corporate tax benefits are more universally applied.

Business Structure: The Key to Tax Liability

The structure of your business plays a pivotal role in determining your tax liability in Monaco. Companies designed to earn revenue primarily within Monaco could potentially benefit from tax exemptions, while those with significant international operations might not.

Wealth and Capital Gains Tax: What You Need to Know

Monaco’s tax landscape offers another compelling advantage for UHNWIs and HNWIs: the absence of wealth and capital gains taxes. However, this does not necessarily imply complete freedom with regard to all assets and investments. Here’s what financial advisors, managers, and support teams need to know.

The Absence of Wealth Tax: A Closer Look

Monaco does not impose a wealth tax, which could be a significant benefit for individuals with substantial assets. This is one of the key factors that sets Monaco apart from other European countries, where wealth taxes can be a considerable financial burden.

No Capital Gains Tax: What It Means

Similarly, Monaco does not levy a capital gains tax, which might offer a potentially favourable environment for investors. The absence of capital gains tax has made Monaco a hotspot for international investors looking to maximise their returns.

01 Not All Assets Are Equal

While the absence of wealth and capital gains tax is undeniably attractive, it’s crucial to understand that this does not mean all assets and investments are free from taxation. For example, property transactions are subject to a registration duty, and certain types of income generated within Monaco might still be subject to taxes.

02 Property Transactions

One typical instance where taxation occurs is property transactions. For example, when a property is bought or sold in Monaco, a registration duty is typically levied. The specifics of this duty can vary, but it’s generally a percentage of the property’s selling price.

03 Taxable Income

In addition to property transactions, certain types of income generated within Monaco might still be taxable. Here are a few types of income that may be taxed:

- Income from commercial and industrial profits

- Income from non-commercial professions

- Salary, wages, annuities, and pensions

Tax Laws for French Nationals

Monaco has a bilateral agreement with France that determines the tax status of French nationals living in Monaco. According to this agreement, French nationals who have not resided in Monaco for at least five years prior to October 31, 1962, are subject to French income tax laws.

The information provided should serve as a general overview of Monaco’s tax system. Specific circumstances can significantly impact how taxation applies, so it’s always recommended to consult with a tax advisor or legal expert when dealing with assets or investments in Monaco.

The Caveats: What to Watch Out For

While Monaco is often seen as a paradise for the wealthy, it’s essential to consider the potential downsides. Here are some key points to watch out for:

- High Cost of Living: Monaco is one of the most expensive places to live, affecting everything from groceries to entertainment. Financial advisors should factor this into any cost-benefit analysis.

- Limited Real Estate: With limited land area, property in Monaco is both scarce and expensive. This could potentially limit options for those looking to invest in or move to Monaco.

- Competitive Business Environment: For businesses that generate significant revenue outside Monaco, the 33.33% corporate tax rate could offset other financial benefits.

A Balanced View is Crucial

Monaco offers a range of effective tax rates, but it’s not a one-size-fits-all solution. Financial advisors and managers should weigh these caveats carefully to provide a balanced perspective for their clients.

By understanding both the advantages and challenges, UHNWIs and HNWIs – or their financial teams – can make more informed decisions about whether Monaco is the right fit for their financial goals.

You can read more articles about Monaco in Altoo’s special section.