Digitalisation: Hype or Old News?

Digitalisation: Hype or Old News?

Both in Switzerland and globally, digitalisation is not a new phenomenon. In many ways, it embodies the zeitgeist of the 21st century, serving as our single most significant indicator that predictions of a technology-centric financial future will come true.

The widespread use of mobile devices is an obvious example. In 2023 an estimated 85 % of Swiss residents used Whatsapp at least once in a month to communicate digitally, as reported by Statista.1 Popular desire for digital connectivity will likely rise in the future with wearables, smart clothing, and more sophisticated versions of the Apple Watch making augmented reality accessible to the mass market.

Nor is digitalisation a new to Swiss private banking and wealth management. The results of a 2019 Swiss National Bank survey indicated that the country’s banks expected a strong level of digitalisation and saw it as a source of opportunities for cutting costs and improving service quality. 40% of the surveyed banks named collaboration with fintechs among their top two strategic digitalisation strategies.2

Swiss banks are going digital not just to stay connected but also to stay competitive – and perhaps even to stay relevant. Today, Microsoft founder Bill Gates’ now 20-year-old observation that “Banking is necessary; banks are not” seems more accurate than ever.

Such digital investments typically involve a wide range of technical concepts like cloud computing (the storage and processing of data on external servers), self-service processes (automated systems allowing users perform tasks or get information without the help of other people), and command & control structures (centralised systems for issuing decisions or orders).

Three such concepts have emerged as priorities for Swiss private bankers and asset managers as they seek to deploy digital capabilities proven to drive value for more successful competitors:

Artificial Intelligence and machine learning

To support, for example, predictive portfolio management approaches.

Institution-to-institution relationships

To access and leverage more comprehensive sets of financial information.

Big data

To open up entirely new possibilities for better understanding and predicting customer behaviour.

Artificial Intelligence and machine learning

To support, for example, predictive portfolio management approaches.

Institution-to-institution relationships

To access and leverage more comprehensive sets of financial information.

Big data

To open up entirely new possibilities for better understanding and predicting customer behaviour.

Over the past decade, Swiss financial institutions have increased their utilisation of digital channels by 55%, a significant improvement. As competitors with decentralised and digital-centric business models continue to enter the market, the imperative to evolve, innovate, and reassess strategies is more pressing than ever. The Swiss Bankers Association has named digitalisation a core strategic topic.3

The Great Wealth Transfer Is the Great Reason to Digitalise

The Great Wealth Transfer Is the Great Reason to Digitalise

The Great Wealth Transfer is set to be the largest intergenerational flow of capital ever witnessed in human history.4 An estimated $84 trillion will move into younger hands in the United States, and £5.5 trillion in the United Kingdom. In Switzerland, the revisions to inheritance law introduced in 2023 have given estate planners more room to manoeuvre.

For wealth managers, this massive transfer of wealth represents enormous strategic and operational challenges for two reasons:

- First, there is no guarantee that heirs will continue working with their parents’ wealth management providers. While the wealth may be familiar, in many ways advisors will need to “re-win” its new owners as clients.

- Second, there is a significant risk that traditional financial providers will not be able to adequately address and serve the new generation of their clients, who grew up surrounded by technological innovation and have different institution-specific demand and expectation patterns. Compared to their less digitally-savvy predecessors, they have radically different expectations for transparency and on-demand visibility with respect to managing their assets.

It should be clear by now that the main reason wealth managers need to address the issue of digitalisation is to meet the needs of their clients, who expect to be able to process and analyse their financial transactions (or at least certain types of them) using digital solutions.

The philosophy of client empowerment should therefore become the guiding principle of the innovation process for wealth managers. The new types of their clients want to increase their degree of autonomy and self-determination. They expect their wealth managers to enable them to pursue their interests independently. They want more investment choices and new ways to monitor the ones they have made across multiple asset types, from cryptocurrencies to collectibles and fine art – or simply that bottle of their favourite vintage wine.

Furthermore, digitalisation enables financial institutions not only to better engage and network with their clients but also to streamline the workflows of their internal organisational units. Improved all-round connectivity ultimately leads to more loyal clients with more revenue potential.

Digital Innovation Thanks to Open Banking and Data

Digital Innovation Thanks to Open Banking and Data

Digital service providers like Altoo have emerged to assist independent asset managers and financial institutions in outsourcing significant portions of their value chains, thereby revitalising outdated processes and products. According to 2022 analysis from McKinsey, investment advisory is a key arena in which banks can drive value through digitalisation.5

High and ultra-high-net-worth individuals, especially younger ones, are increasingly embracing the idea:

- As far back as 2017, Capgemini found that 56% of HNWIs were open to using digital tools as value-added complements to their wealth management services.6

- In 2021, EY identified that one in four high net worth clients and one in five very-high net worth ones saw digital tools as their first choice for engagement. EY also found 78% of Millennial wealth clients planning to make greater use of digital tools in the future.7

- In 2023, EY suggested that digital tools to construct an aggregate family-wide view of assets and liabilities were good solutions for the 84% of clients saying that wealth transfer planning was equally or more complex than it was in 2021.8

European regulators are also on board. Through the second Payment Services Directive (PSD2), they have sought to provide financial institutions with a framework for integrating third-party services into their offerings through application programming interfaces (APIs). Such data connections open up opportunities for rapid and collaborative innovation towards new revenue streams and better client outcomes. In 2023, McKinsey found European private banks having tripled their technology spend versus 2019, with catching up on data utilisation among their key goals.9

Simply having data is not enough. Maximising the value of available data will likely require ramping up currently low levels of investment in analytics and innovation. For example, Capgemini has emphasised the importance of being able not only to extract insights from data but also incorporate them into content, high-frequency digital touch points, and tools for continuous portfolio tracking that provide clients with relevant information.

Wealth Managers Look to FinTech

Wealth Managers Look to FinTech

In finance, monolithic digital solutions have had their day. Forward-thinking wealth management providers are seeking to enhance – while maintaining control of – their existing models with modular fintech solutions designed to solve particular digitalisation challenges.

As mentioned earlier, the most crucial of these challenges is to meet the digital needs of their increasingly technology-savvy clientele.

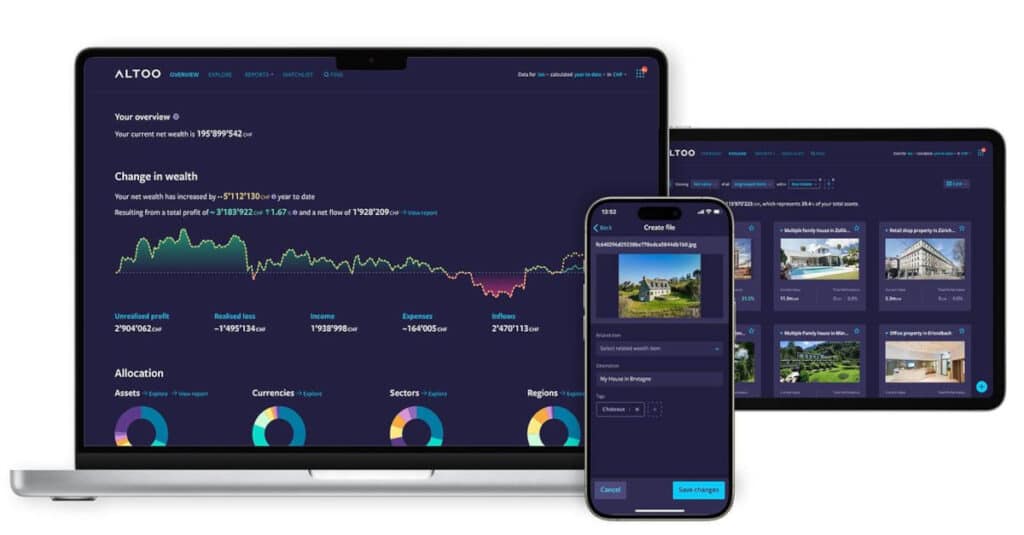

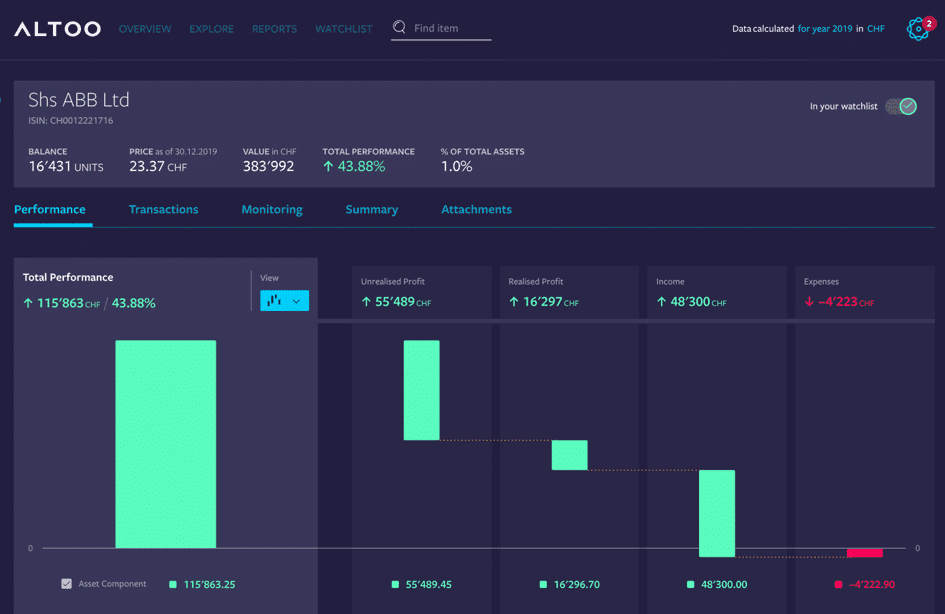

Wealth technology that is open, flexible, and customisable has thus entered the spotlight. For example, Altoo’s platform allows clients to view every aspect of their total wealth through one portal, with automated analysis and visualisation of data flowing in from multiple sources across their portfolios.

Technologically, the building blocks of the platform can be connected to a financial institution’s backend architecture. On the frontend, the user interface can be tailored to align with the institution’s brand identity, with clients able to quickly start taking advantage of integrated digital communication channels and clear dashboards displaying analytical insights.

This platform supports a wide range of applications which can be launched as a wealth firm evolves to meet clients’ emerging demands, sharpen its digital profile, and deliver new, unique value-added services.

Altoo Brings a Multi-Banking View and More to Wealthy Individuals

In Switzerland, multi-banking services have traditionally been available only to corporate clients. But now, with the help of Altoo, it is possible to map and monitor the complex asset structures of high- and ultra-high-net-worth individuals.

Baar-based Altoo has been offering the Altoo Wealth Platform, a cockpit for overseeing often complex wealth situations, since 2017. Clients do not need to login to visit multiple websites to check on their balances and portfolios; Altoo presents them in clear, easy-to-understand visualisations that bring everything together in one place.

These visualisations are based on data that the platform consolidates from multiple sources across clients’ entire financial portfolios of bankable assets in traditional classes like equities, bonds, and cash, as well as non-bankable assets such as property, cars, and art. Clients can dive deeper into analysis of each asset to see gains realised from share sales, private equity gains not yet realised, past and future dividends, custodian fees, transaction costs, property rental revenue and expenses, and more.

Altoo also provides a “document safe” for keeping contracts, insurance policies, and other paperwork as well as a secure messaging channel for wealthy clients and all their advisors – including tax consultants or property managers, for example – to share information. A mobile app is available to give clients access to their most important data when they are on the go.

Private banks can white label the Altoo Wealth Platform, and several currently do. Private bankers at various institutions have recommended us to their clients whom we are now proud to serve directly.

Takeaway: Integration of Business and Technology Is Now a Must

Digitalisation is bringing a breath of fresh – and competitive – air to wealth management. Clients expect user-friendly digital services and convenient access to information in virtually every aspect of their lives, and their finances are no exception. Wealth managers unable to provide clients with highly tailored recommendations and delightful digital experiences are at a clear risk of losing relevance, trust, and most importantly business.

To keep up, wealth managers should seek to join open, data-driven ecosystems centred around client benefits. Fintechs with innovative strength and speed – in particular wealth technology platform providers like Altoo – are set to be their greatest allies.

ACTIONABLE INSIGHTS

It's time to invest in digitalisation.

For financial firms in Switzerland and around the world, digital tools are crucial for staying relevant to increasingly digitally-savvy investors.

Focus innovation on empowering clients.

Great Wealth Transfer recipients seek more personalized advice and greater control over their portfolios.

Leverage fintech solutions.

Specialised technology service providers open doors to data-driven ecosystems centred around client benefits.

[Endnotes]

[1] Statista, Most Used Messenger by Brand in Switzerland

[2] Swiss National Bank, Survey on Digitalisation and Fintech at Swiss Banks

[3] Swiss Banking: Digital Finance and Cybersecurity

[4] Altoo, How the Great Wealth Transfer Might Shape the Future of Society

[5] McKinsey, The Future of Banking: A 20 Trillion Dollar Breakup Opportunity

[6] Capemini, 2017 World Wealth Report Press Release

[7] EY, Where Will Wealth Take Clients Next?

[8] EY, 2023 Global Wealth Management Research Report

[9] McKinsey, European Private Banking: Resilient Models for Uncertain Times