A successful startup exit, an inheritance, a life insurance payout: Sometimes people become wealthy “overnight.” But wealth is complex and it won’t take long until being wealthy starts losing its cosiness. The Altoo Wealth Platform provides solutions.

The dream of being a multi-millionaire having all the freedom in the world is just that – a pipedream. It may be contrary to common wisdom, but even wealthy people have to worry about money – because with wealth comes responsibility and complexity. It’s not without reason that there is an entire profession of wealth managers solely focusing on managing private investments.

The complexity of wealth management can be particularly tiring for people who have suddenly come into cash. Maybe you have built up a successful startup for the last ten years, and now an investor has bought your shares. Or maybe you’ve had a good hand for early-stage cryptocurrency investments, received an inheritance, or won the lottery. You can’t just park that liquidity in a bank account.

Wealth is complex

New wealth holders are often overwhelmed, as they’ve never been concerned with wealth management before. After all, having too much money is not a challenge most people have to think about in their lives.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

But it is indeed a challenge: You have to make decisions; you need to work with several banks, asset managers, and investment advisers. You may need a real estate consultant, and you surely need a tax advisor.

You can outsource some of the work, but not the responsibility and decision-making. The two things in life that you should always do yourself are managing your finances and choosing your spouse. You have to keep tabs on everything and understand what’s going on.

Here is the good news: It’s the 21st century, and we have a range of digital tools that can make your life easier.

Go digital!

For many years, Excel spreadsheets were the preferred solution. But Excel-based wealth management is inefficient, cumbersome and prone to errors. It’s also risky, and it will lead to bad decision-making.

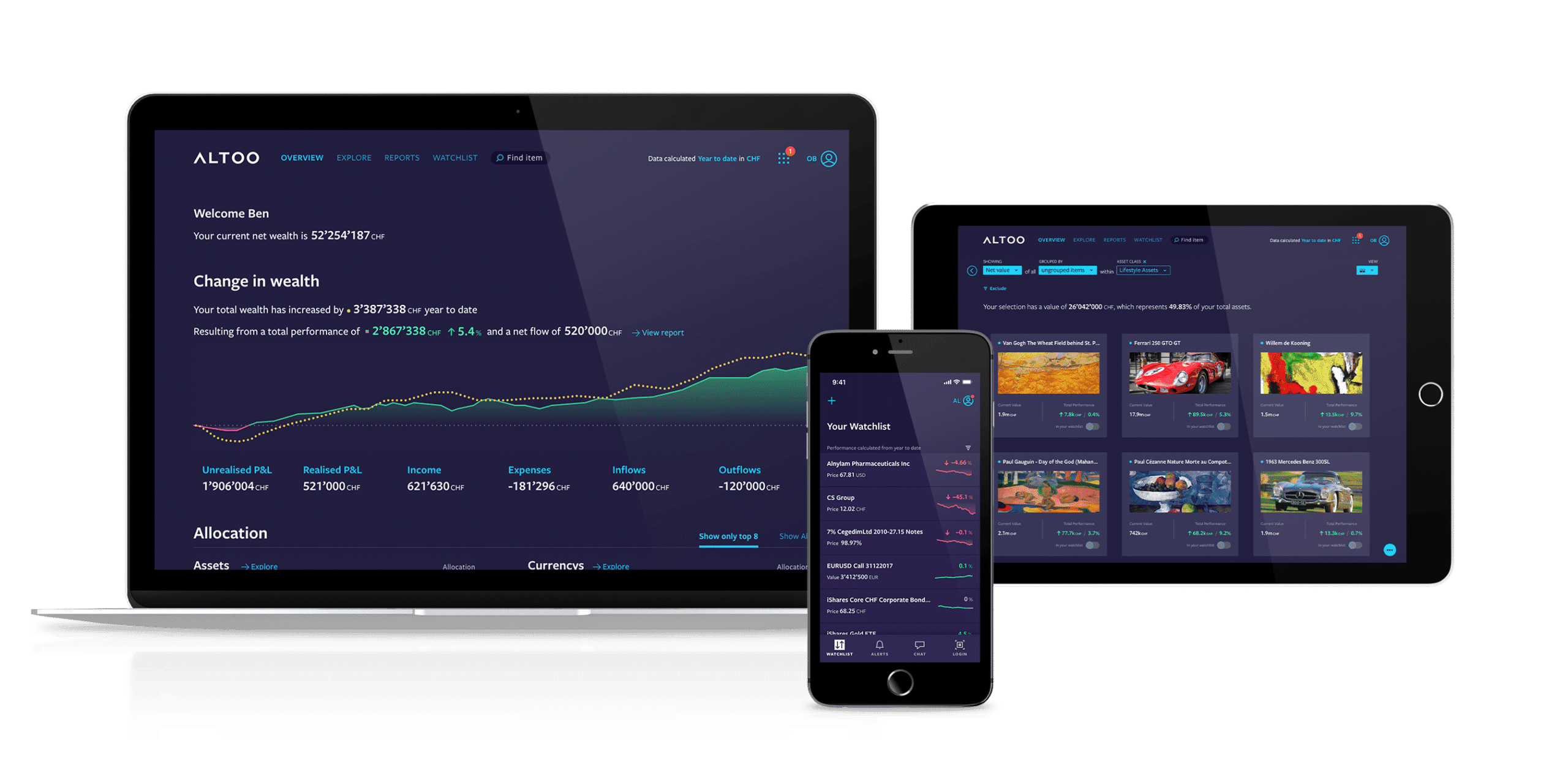

Instead, what you want is one tool that allows you to have all your data and documents stored, secured, and organized in one place. A tool that gathers all your data across multiple platforms and accounts and presents it to you with customizable graphs, tables, and statistics. You want easy-to-digest formats and automated real-time data. Excel spreadsheets can’t make any of that happen. Altoo can!

In short: Altoo is a digital wealth management platform that provides a holistic solution to simplify complex wealth. Altoo is much more than just a data aggregator: It enables you to share selected data with multiple advisors and to communicate via a secure internal messaging service.

Build your family office

Back to your liquidity event: Over the next months and years, you will be looking for different ways to deploy your capital. That might be startup investments, real estate, stocks, or philanthropic projects. Altoo enables you to keep track of everything in one place.

You will also need professional help. Instead of relying on only one bank or one adviser – as it was common in the past – Altoo enables you to easily onboard different advisors, banks, investment products, and services to your single financial cockpit. That means you can choose your partners according to a best-in-class approach and still keep control and have maximum transparency.

Altoo gives you the technological platform to build your own family office, something a larger liquidity event will make necessary. Everyone in your family office – advisors, family members, or asset managers – can connect to Altoo, with you managing the access rights and making the final decisions.

Wealth is complex, and it always will be. But Altoo can simplify this complexity by empowering individuals and families to take charge and keep effective oversight. Just like becoming wealthy, sustaining wealth is about making smart decisions and smooth delegation. Altoo makes both easy.

Do you need to need to think about an upcoming liquidity event?

You can find out here about how the Altoo Wealth Platform can reduce complexity after a liquidity event, or you can contact us here via our website and arrange for a live demo.