What is the best way to involve each other in our family’s financial affairs? Where are our family members and wealth located? How complex is our overall financial picture? How a wealthy family answers these questions can help determine whether it makes sense to build a family office or not. Below we explore how four families — two who have not formed family offices and two who have, based on publicly available information — appear to have answered these questions and factored them into their wealth management setups.

The Jones Family: Managing Through the Business

Jerry Jones and his family control a $16.1 billion fortune built around the Dallas Cowboys, valued at $10.1 billion and recognised as the world’s most valuable NFL franchise. Rather than establishing a separate family office, the Jones family manages their wealth and investments through the Cowboys organisation itself.

The family’s approach reflects deep operational involvement across generations. Jerry leads as owner and general manager, whilst his children hold key executive roles. Stephen serves as Chief Operating Officer, Charlotte leads as Chief Brand Officer, and Jerry Jr. oversees sales and marketing. Even the grandchildren are involved, with Haley and John Stephen taking on marketing and sales positions within the organisation.

Their investments beyond football, including real estate ventures and technology investments through Blue Star Innovation Partners, are managed within the Cowboys’ existing structure. The family’s philanthropy operates similarly, with the Gene and Jerry Jones Family Foundation focusing on Dallas-Fort Worth area initiatives in arts, healthcare, and youth programmes. These charitable efforts integrate seamlessly with the Cowboys’ community outreach.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

This approach works because the Jones family maintains high involvement in their core business whilst keeping their operations and family members concentrated in Texas. The geographic focus and hands-on management style appear to have made a family office structure unnecessary to achieve the family’s goals.

The Johnson Family: Centralised Control at S.C. Johnson

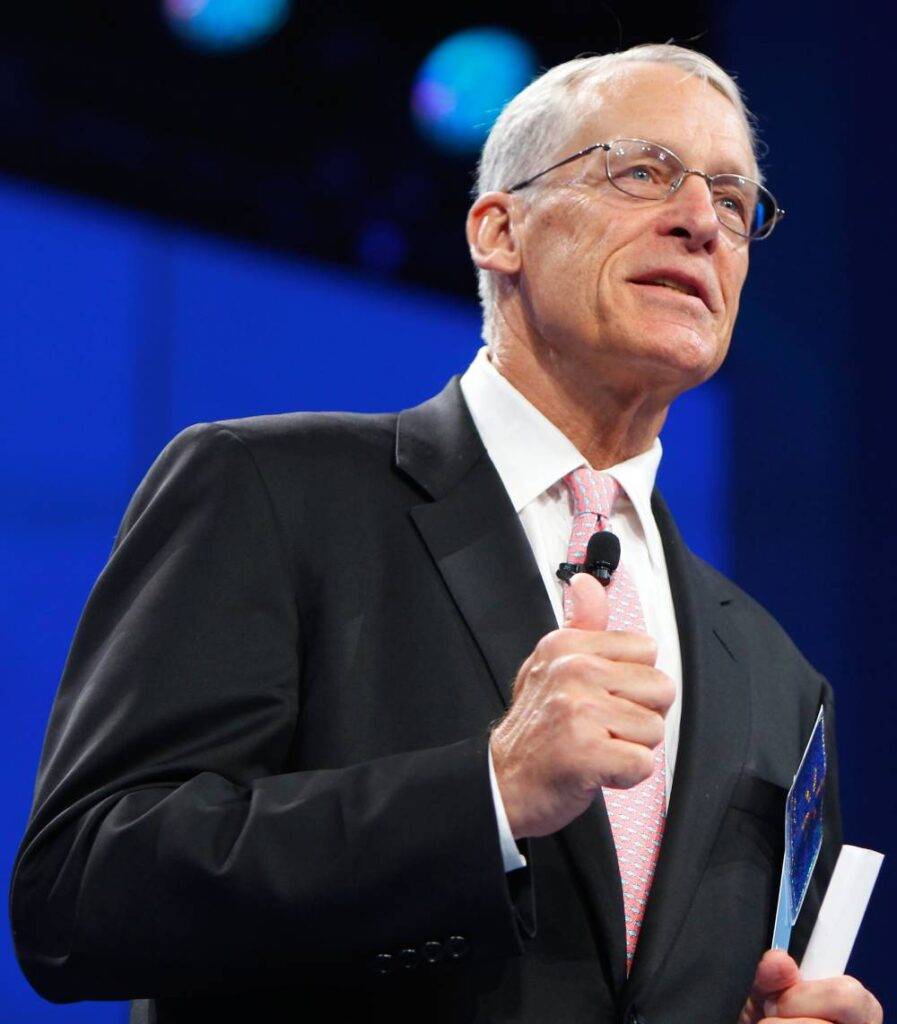

H. Fisk Johnson and his family represent another approach to managing substantial wealth without a family office. The Johnson family controls a $37 billion fortune through S.C. Johnson & Son, the consumer goods company behind brands like Windex, Ziploc, and Raid. The company generates $10.5 billion in annual revenue and has remained family-controlled for five generations.

Fifth-generation family members maintain direct control through leadership and board positions. H. Fisk Johnson serves as CEO, whilst Helen Johnson-Leipold and other family members hold board roles or leadership positions within the Wisconsin-based company. This centralised structure allows the family to manage their wealth directly through the business itself.

The S.C. Johnson Foundation handles the family’s philanthropic activities, focusing primarily on U.S.-based initiatives, particularly in their home base of Racine, Wisconsin. The foundation emphasises community development and sustainability, areas that align closely with the company’s business values and operations.

Despite S.C. Johnson’s international sales reach, the family’s centralised management approach and U.S.-focused philanthropic efforts allow them to operate effectively through the existing business structure. As with the Jones family, the geographical concentration of decision-making and the deep involvement of family members in day-to-day operations appears to have made a family office unnecessary for the Johnson family.

The Walton Family: Complex Wealth Requires Structure

The Walton family, currently including Walmart founder Sam Walton’s children Alice, Jim, and Rob, presents a different picture entirely. With $432 billion in combined wealth stemming from their Walmart holdings, they represent one of the world’s wealthiest families. Walmart itself generates $650 billion in annual revenue as the world’s largest retailer, but the family’s wealth extends far beyond the core business into global real estate and private equity investments.

Unlike the Jones or Johnson families, Walton family members maintain limited operational involvement in Walmart. Rob and Jim Walton served on the board. This structure necessitates professional wealth management through Walton Enterprises, a family office that coordinates the family’s complex investment portfolio.

The scale of the Walton family’s philanthropic activities also demands professional coordination. The Walton Family Foundation operates globally, funding education, environmental, and community development initiatives that span multiple countries and require sophisticated management separate from Walmart’s corporate philanthropy.

The combination of limited operational roles, global investment complexity, and international philanthropic scope appears to have made Walton Enterprises essential for managing the Walton family’s wealth effectively.

The Gates Family: Diversified Wealth and Global Impact

Bill Gates’ family, which includes three children he had with former wife Melinda, illustrates perhaps the clearest case for family office necessity. With a $133 billion net worth derived from Microsoft and extensively diversified global investments, Gates operates in a completely different environment from his early Microsoft days.

Gates no longer holds an operational role in Microsoft, having transitioned away from day-to-day involvement to focus on philanthropy and investment activities. Cascade Investment, a multi-family office founded by Bill Gates, manages a diversified portfolio spanning real estate, private equity, and other investments across multiple geographies and asset classes.

The scale of Gates’ philanthropic activities through the Gates Foundation, with its $67 billion endowment, requires sophisticated professional coordination. The foundation funds global health, poverty alleviation, and education initiatives that operate in dozens of countries and require complex regulatory and tax management.

The combination of global wealth diversification, minimal business involvement, and massive philanthropic operations creates complexity that appears to be handled optimally through professional family office management. Cascade Investment provides the structure necessary to coordinate these activities whilst maintaining the flexibility Gates needs for his evolving priorities.

Decision Point: Family Involvement

When examining these four families, the nature of family involvement emerges as a primary factor they seem to have considered when approaching wealth management.

Involvement — whether through a family office or not — of members of a wealthy family in its financial affairs appears to be a clear priority. Over 85% of family offices surveyed in the Campden Wealth/AlTi Tiedemann Global Family Office Operational Excellence Report 2025 said they were actively encouraging or inviting next-generational involvement.

The question then becomes exactly how to structure this involvement. The Jones and Johnson families prefer direct operational roles in the family business. In contrast, the Walton family’s board-level oversight approach and Gates’ philanthropy-focused involvement favour family office structures that provide coordination flexibility. Their family offices provide the professional structures needed to coordinate activities that would overwhelm a traditional corporate finance department.

Consider how your family members prefer to engage with wealth management. If they are willing and able to provide hands-on operational control, managing wealth through the family business may suffice. If they prefer strategic oversight whilst delegating operational details, a family office structure can provide suitable coordination capabilities.

Decision Point: Geographic Complexity

Geographic and family distribution factors play crucial roles in family office formation decisions, as demonstrated by the contrast between localised and global approaches. The Jones family’s Texas-centric operations and the Johnson family’s Wisconsin base allow them to manage wealth within existing business structures because their operations, family members, and philanthropic focus remain geographically concentrated.

The Walton family’s global investment portfolio and the Gates family’s international philanthropic activities create cross-border tax, legal, and operational complexities that require professional navigation. When families operate internationally or have members dispersed across multiple countries, a family office can provide the unified structure needed to manage these complexities effectively.

Evaluate your family’s geographic footprint honestly. If your operations, family members, and charitable interests remain primarily within one country or region, existing business structures may provide an adequate organisational framework. If you’re dealing with international investments, global family distribution, or cross-border philanthropic activities, a family office can serve as a unifying structure that simplifies rather than complicates your operations. Campden Wealth found that supporting non-domiciled family members (those resident outside the primary jurisdiction of the office) is a high priority for 85% of family offices and the number one priority for 58%.

Decision Point: Scale and Complexity of Wealth Management

The relationship between wealth scale and family office necessity becomes clear when comparing these families’ approaches. The Jones and Johnson families’ fortunes of $16.1 billion and $37 billion, respectively, are substantial but remain largely tied to their core businesses. Both families have opted to manage their wealth through existing corporate structures.

The Waltons’ $432 billion in combined wealth and the Gates family’s $133 billion fortune both involve extensive diversification beyond their core businesses. Their portfolios include complex alternative investments, multiple asset classes, and global holdings that appear to require sophisticated professional management not tied to any single business.

Consider your wealth diversification goals and the current complexity of your finances. If your wealth remains primarily concentrated in your core business with modest external investments, managing through the business may prove more efficient. If you’re pursuing diversification into alternative investments, global real estate, or complex financial instruments, a family office can provide the specialised expertise and coordination these assets require.

Supporting the Right Structure for Your Family

A family office represents a strategic middle ground between informal family wealth management and the constraints of formalised business roles. It provides structure beyond ad-hoc arrangements whilst offering more flexibility than requiring all family members to take active business positions.

Wealthy families who take the family office approach are therefore often seeking this flexibility along with the ability to support a highly diversified portfolio. They can rely on an advanced digital reporting and monitoring solution like the Altoo Wealth Platform to bring clarity to the complexity of their financial affairs. Designed to be easily usable by wealth owners and their advisors — not corporate finance departments — it provides family office stakeholders with near real-time visibility of the performance of all the various bankable and non-bankable assets in their portfolios.

Ready to explore how technology can support your family’s approach to wealth management? Contact us for a demo of the Altoo Wealth Platform today.