To preserve your portfolio, you need to effectively manage risks that fall into three broad categories: general market risks faced by all investors, specific risks unique to your individual portfolio, and risks that your heirs may face. Here’s how to manage these risks:

01 Diversify asset classes to protect against market risks

No one can expect to have every investment decision be a winner. Even Warren Buffett has lost money on some investments, such as the one he made into Paramount Pictures. Holding multiple assets across various classes ensures that your overall portfolio value stays up even if a few holdings underperform.

Diversification is the most widely known asset preservation strategy, and there are several established approaches to executing it. For instance:

- Strategic asset allocation involves maintaining a portfolio consisting of fixed percentages of certain asset classes in line with a long-term investment plan.

- Tactical asset allocation involves dynamically adjusting a portfolio to get more exposure to asset classes predicted to perform well over a shorter time horizon.

- Core-satellite allocation is a mix of the strategic and tactical approaches, with lower-risk core assets selected for longer-term growth and high-risk satellite assets chosen for their shorter-term upside potential.

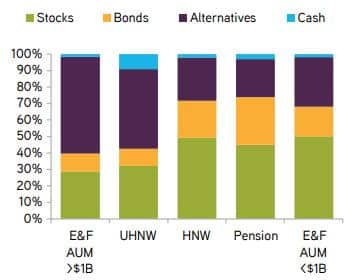

In 2021, private equity firm KKR identified many UHNWIs seeking outsized returns by taking a “barbell” approach to asset allocation, with the overwhelming majority of their wealth in alternative investments (like private equity and real estate) and cash.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Source: KKR, 2001

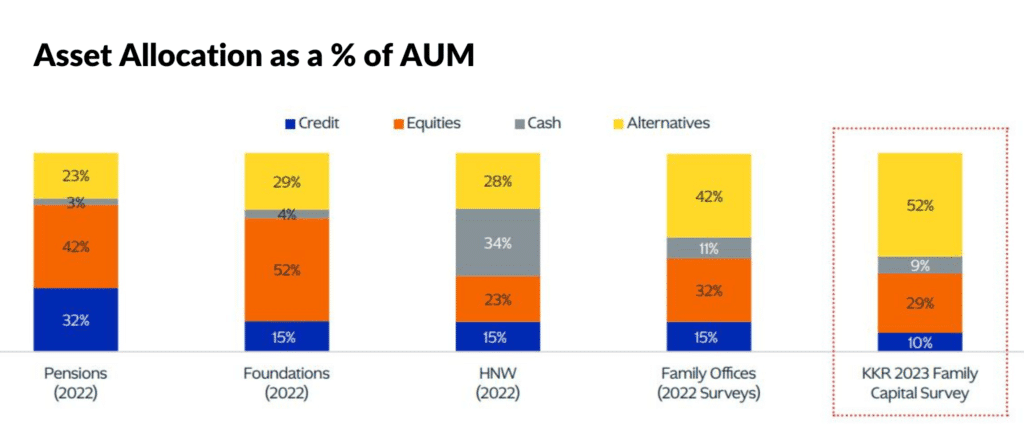

According to KKR, UHNWIs’ preference for alternative investments remained strong through 2023, when the firm found family offices – on which Capgemini said 93% of UHNWIs rely on for value-added services – allocating 52% of their portfolios to assets expected to outperform the market.

Source: KKR, 2023

02 Identify and manage risks associated with specific assets

Once you have determined which types of asset classes to hold in line with a diversification strategy, decisions to hold specific assets often introduce risks that require case-by-case analysis and management. For example:

- Real estate holdings generally have similar characteristics but no two properties are exactly the same. Adequately insuring each property requires an accurate understanding of its age, condition, market value, etc. Some UHNWIs, like Warren Buffett (as suggested by his former business partner Charlie Munger), choose to self-insure their properties. Doing so involves having sufficient financial resources to cover potential losses without relying on an insurance company.

- Currency exchange rate fluctuations can impact the performance of shares in any given company. Hedging against such fluctuations with forwards or option contracts can help mitigate this risk.

- The relative performance of a longer-maturity bond will be particularly hurt by rising interest rates. Holding a mix of bonds with a variety of maturities can protect against this risk.

03 Envision and plan for the preservation of your wealth after it comes into others’ hands

Death or disability are not pleasant topics to consider, but contingency planning is essential to have peace of mind that your wealth will be preserved regardless of whether or not you are in charge of it. While this planning will be highly individualised, as a rule of thumb you should ensure that you have created and regularly review:

- Your will and estate plan.

- A durable power of attorney granting at least one person of trust the authority to manage your financial affairs if you become incapacitated.

Also, note that your wealth is at perhaps its greatest risk of being dissipated when it is no longer under your control. Inheritance taxes and heirs not following the first two asset preservation recommendations outlined above can significantly erode your holdings. To minimise the potential downsides of such unwelcome scenarios, many UHNWIs pursue long-term preservation strategies hinging on:

- The use of trusts in estate planning. Trusts can take many forms, with some able to shield wealth from inheritance or wealth transfer taxes and set out guidelines for distributions and investments to preserve wealth across multiple generations.

- Fostering communication and responsible stewardship among heirs. Shared personal values, financial goals, and expectations will be among your heirs most important tools for preserving the wealth you have built. Formal documentation defining a common approach to wealth management, philanthropy, and conflict resolution can help.