In the depths of the 2008 financial crisis, when once-mighty banks floundered and global markets teetered, Singapore’s GIC quietly shifted its gaze from battered real estate to emerging technology. Within a few short years, the pivot not only recouped substantial losses but positioned the fund to capture outsized gains in the post-crash recovery. It was a deft response that seemed to embody Albert Einstein’s oft-cited adage that “in the midst of every crisis, lies great opportunity” – and it underscored precisely why many are now looking to sovereign wealth funds (SWFs) for lessons in governance, adaptability, and risk management.

Today’s SWFs manage more than USD 10 trillion in combined assets, according to the Sovereign Wealth Fund Institute (SWFI, 2023), and they wield outsized influence in sectors as varied as infrastructure, biotech, and real estate. While pension funds or hedge funds may share certain aims, SWFs stand apart in their blend of government mandate, multi-generational time horizons, and sophisticated governance frameworks that weather short-term volatility. From Norway’s Government Pension Fund Global (GPFG) to Abu Dhabi’s ADIA, their proven resilience has begun to captivate a different audience: ultra-high-net-worth (UHNW) families – whether operating through sprawling family offices or handling wealth privately – who are eager to replicate the SWF model’s agility without the weight of a government apparatus.

A Worldwide Tapestry of Strategies

It would be misleading to lump all SWFs under one banner. In the Middle East, funds such as Abu Dhabi’s ADIA or Qatar’s QIA often stem from oil surpluses and seek to diversify national economies away from energy. In Asia, Singapore’s GIC and Temasek have cultivated reputations for forward-leaning investments in technology and innovation. Europe’s marquee fund, Norway’s GPFG, is the standard-bearer for transparency and ethics, divesting from companies involved in severe environmental or human rights violations.

For wealthy families, these variations are anything but trivial. Studying them reveals how distinct regulatory contexts and cultural norms can influence portfolio strategies – an insight worth exploring by those who manage inheritances, closely held businesses, or philanthropic ventures across multiple regions. Indeed, some well-known family offices – including Cascade Investment (linked to Bill Gates) and others – have openly acknowledged drawing on the multi-generational governance style of top-tier SWFs to shape their own investment philosophies (Financial Times, 2015).

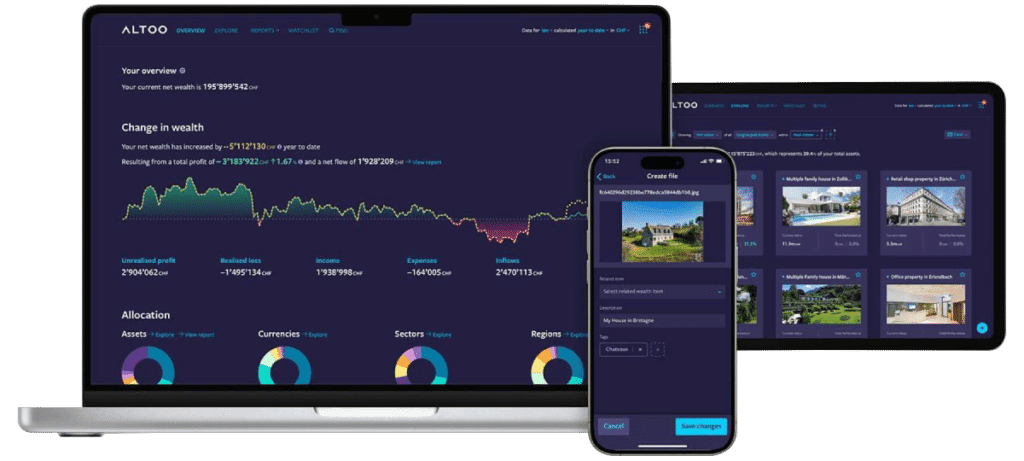

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

The Underestimated Tech Edge

Not long ago, many viewed SWFs as lumbering giants, locked into conservative real estate and bond holdings. That perception has changed markedly over the past decade. Driven by competition and a recognition that digital innovation is crucial for gaining an informational edge, major funds – from Singapore’s GIC to Kuwait’s Investment Authority – have adopted sophisticated analytics, automated risk modeling, and real-time performance dashboards (World Economic Forum, 2023).

In practical terms, this tech transformation can translate into tangible outperformance. Norway’s GPFG has recorded average annual returns of roughly 5–6 percent since its inception in the late 1990s, while GIC has registered a 20-year annualized real rate of return of 4.3 percent (Government Pension Fund Global Annual Report 2022). Though macroeconomic forces always play a role, many analysts argue that data-centric oversight helps these funds pivot away from overexposure or jump quickly on undervalued assets – a dynamic equally relevant to wealthy families aiming to fortify their holdings against surprises.

Risk Management Beyond Spreadsheets

The 2020 global pandemic was a stress test for any institution that ventures beyond government bonds. SWFs like GIC and the Kuwait Investment Authority responded by ramping up positions in stable sectors such as healthcare, then selectively pouncing on undervalued equities once markets wobbled (IMF Working Paper, 2021). The contrast between that proactive posture and a more static, paper-driven approach could not be clearer.

Private wealth holders – particularly those juggling investments in public equities, private companies, property, or even art collections – face a similar imperative. According to Deloitte, next-generation “wealthtech” platforms now enable families to run near-instant liquidity checks, stress tests, and worst-case scenario simulations. Rather than discovering a glaring risk gap after the fact, they can reallocate or rebalance swiftly. The outcome is a family version of the SWF’s crisis playbook: pivot as needed, capitalize on downturns, and avoid calamities that come from slow, reactive decision-making.

Ethical Governance

Another distinguishing hallmark of many SWFs, though often underplayed, is the emphasis on social responsibility and transparency. Norway’s GPFG meticulously screens out companies suspected of environmental degradation or human rights infractions; Temasek in Singapore places ESG factors at the core of its due diligence. For UHNW families, where reputations can be easily tarnished and philanthropic goals run deep, these models of ethical governance resonate.

As Ian Keates, CEO of Altoo – a digital wealth platform designed to provide a comprehensive view of complex family assets – observes, “Technology becomes the conduit that makes high-level governance both streamlined and transparent. When real-time metrics sit alongside financial performance, you can act swiftly to uphold family values without sacrificing returns.” In the private sphere, many families find that this transparency improves trust among heirs and creates clearer communication channels across generations.

Emulating SWFs Without the Bureaucracy

In seeking to replicate SWF best practices, family leaders often worry about unwieldy committees or legal entanglements. Yet successful governance can be fluid if anchored by a few guiding principles: a clearly stated mandate, a robust system of risk monitoring, a commitment to transparent oversight, and enough liquidity to seize opportunities. Even families without a formal office can adopt these fundamentals.

A handful of globally recognized family offices have pointed to SWF frameworks as their inspiration for pivoting into more transparent and diversified investments (KPMG, SWF´s Riders through the storm, 2014). Some credit a disciplined adherence to scenario testing – routinely employed by major funds like Abu Dhabi’s ADIA – as the secret behind avoiding overconcentration in boom-and-bust cycles. Just as SWFs commit to governance structures that stretch across decades, family wealth managers can design processes to withstand generational transitions, ensuring that short-term market jitters do not derail long-term objectives.

Altoo’s Spin on Institutional Rigor

For affluent families wary of replicating the heft of a national fund, a platform such as Altoo can help bring these institutional principles to life. Its real-time performance view, cross-asset transparency, governance features, and risk simulations stand out as ways to enforce discipline without burying families under paperwork. The approach is reminiscent of what top-tier SWFs already do in-house – only distilled into a platform accessible to families of varying sizes.

Real-world examples from Altoo AG illustrate this point. One multi-generational European family office, documented in Altoo’s ALBAPAZ case study, previously grappled with manual reporting across scattered bank statements and disparate data feeds. After centralizing everything within a single digital interface, the family discovered a worrying currency imbalance that had gone unnoticed amid the spreadsheet chaos. They corrected course quickly, freeing up resources and reinvesting in lower-volatility sectors – a nimble pivot akin to what SWFs also routinely execute.

Institutional Might, Family Insight: How Altoo Translates SWF Strategies for Private Wealth

- Real-Time Performance View

Like an SWF’s continuous market surveillance, Altoo delivers on-demand insights across all holdings, so families can identify trends and risks swiftly. - Cross-Asset Transparency

SWFs diversify globally, and Altoo’s consolidated interface mirrors that approach by pooling banking, real estate, and alternative investments into a single clear overview. - Scenario-Testing & Risk Oversight

Much as SWFs run macroeconomic stress tests, Altoo’s platform enables scenario analysis on a family’s entire portfolio – flagging potential liquidity gaps or concentration risks. - Robust Governance Features

SWFs operate under defined mandates; Altoo’s secure environment and customizable user permissions support similarly disciplined oversight without excessive complexity. - Collaboration & Stakeholder Alignment

Just as SWFs involve multiple agencies or committees, Altoo’s data-sharing functions let UHNW families, advisors, and next-gen members coordinate decisions in real time.

By weaving these institutional-grade processes into a digitized, user-friendly ecosystem, UHNW families can capture the best of both worlds: the stability and foresight of SWFs – and the nimbleness of a private wealth structure.

For more, visit our product page.

Thinking Big, Acting Nimbly

Sovereign wealth funds have also long recognized the importance of diversification beyond traditional equities and bonds. They are venturing into private equity, venture capital, and frontier technologies – a tactic that families are increasingly keen to emulate. Indeed, some SWFs maintain partnerships with specialized tech accelerators, gleaning early insight into emerging fields like AI or green energy. For families, adopting a similar mindset can yield impressive returns, provided that governance and risk monitoring remain robust.

In an environment rife with geopolitical tensions and market uncertainty, applying an SWF lens to private wealth management can be a prudent step. As Keates notes, “Being able to move quickly and decisively, based on accurate and holistic data, might be the single greatest advantage in a volatile world. That capacity is what SWFs have honed, and it’s entirely replicable on a family scale.”

Building a Resilient Legacy

Sovereign wealth funds, born out of government mandates but forged in the crucible of global markets, show that long-term resilience is more than luck. It is a byproduct of meticulous governance, rigorous risk analysis, and the sort of technological sophistication that illuminates problems before they metastasize. Wealthy families – whether they command sprawling offices or oversee investments privately – can profit from these lessons without mirroring an entire bureaucratic apparatus.

They need only to extract the core: a clear governance framework, early-warning risk systems, a commitment to values, and the readiness to adjust quickly when opportunities or threats appear. Such foresight has propelled SWFs through storms that have capsized countless other investors. It may well be the key to ensuring that today’s family fortunes endure – and grow – across generations to come.

Disclaimer: This content is provided for informational purposes only and does not constitute individualized financial advice. We encourage readers to consult professional advisors for personalized recommendations. This article is part of a broader series exploring emerging trends among ultra-high-net-worth individuals and families, reflecting a growing interest in aligning sophisticated governance strategies with private wealth management.