What you need to know

- The significant transfer of wealth to millennials and Gen Z is driving the shift away from traditional manual methods to digital wealth management solutions.

- As more companies digitise, cybercrime is rising, making security a high priority for protecting financial information.

- The benefits of digital wealth management platforms far outweigh the disadvantages, making the concept of a paperless family office a not-so-distant future.

In recent years, several factors have influenced the behaviour of wealth owners. Apart from geopolitics, significant shifts of wealth from one generation to the next, an increase in cyber-security breaches and rapid developments in technology have been major drivers.

Change drivers

As the great wealth transfer unfolds, the year 2023 began marking for the first time how the number of billionaires who inherited wealth surpassed those who have amassed it. The passing down of fortunes from boomers to the next generations means family wealth is now increasingly in the hands of millennials and Gen Z, who have different expectations from their parents.

“Today, the majority of wealthy clients expect simple and user-friendly digital solutions available around the clock,” says Ian Keates, CEO of Altoo. In Top Trends Driving Change in Wealth Management podcast, Keates explains that recent research reveals that the more wealth a client has, the more digital affinity they have, not the other way around.

Supporting his observation, a 2023 EY Global Wealth Management Report found that a significant majority of investors (77%) consider it essential to have a complete online view of their financial position. Additionally, 65% of investors want the ability to personalise how they receive and view reporting.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

Emerging from this trend to digitise, Altoo, a digital wealth management platform, was founded in Switzerland in late 2017. Backed by angel investors, who saw the potential of the technology, they decided to build out a digital platform.

Security as a priority

As with great wealth comes great responsibility, digitising significant wealth requires even tighter security measures. According to the latest McKinsey report, cybercrime has steadily increased as more companies rely on technology. The survey found that 32 out of 37 financial organisations highlighted cybersecurity as a high priority in their risk management strategies.

“It’s not one little thing. It’s the many things that we check in our security management system,” says Stefan Thiel, the Chief Technology Officer. In What Makes a Secure Digital Wealth Management Solution podcast, Thiel describes how Altoo goes about ensuring that it meets the highest security standards.

All its sensitive data is encrypted and the platform is hosted in a Swiss certified data centre. In addition to ticking over 1600 security checks, Altoo only employs Swiss residents and systematically conducts black box and grey box testing to find vulnerabilities in its platform. Simply put, black box and grey box testing means that Altoo tries to hack into its own system frequently to ensure that the platform stays as robust and reliable as a Swiss watch.

Exploring a paperless family office

Given the recent trends and heightened need for security, the pros and cons of wealth management platforms like Altoo still have far more significant benefits for streamlining complex family office wealth. Below are some of their advantages:

Simplifying complexity: As family office portfolios grow in diversity and size, traditional Excel spreadsheets become cumbersome to update. A digital platform can help automate data entries and updates, making tracking the performance of multiple investments easier.

Real-time data: The dynamic nature of financial markets requires real-time data to make informed decisions. Digital platforms provide access to real-time data, allowing family offices to monitor their portfolio’s performance on a daily basis and make more timely decisions.

Increased accuracy: Going digital eliminates the risk of human errors in data entry, reduces the potential for data overwriting, and significantly reduces the threat of data corruption. This is achieved through automated data population and secure, sophisticated data management practices.

In addition, digital wealth management platforms offer dynamic tools for visualising portfolio performance and tracking financial goals. By integrating with banks and other financial institutions, they streamline the wealth management workflow and eliminate the need for paper reports and spreadsheets, ultimately helping family offices become “paperless”.

Five features for family offices

In providing a simple and secure digital wealth management platform, Altoo has incorporated the following five features for family offices:

01 Consolidation of assets

Family offices need to present consolidated reports to clients in a clear way. Altoo offers a platform to consolidate assets and provide daily valuations so that family offices can make quick decisions based on market changes and trends.

02 Collaboration

Effective wealth management for family offices requires collaboration and transparency. Altoo’s platform facilitates networking among stakeholders, enabling shared access to financial reports, investment updates, and strategic insights.

03 Security

With cybercrime on the increase, it is crucial to prioritise the security of financial information. As a Swiss-based fintech company, Altoo implements advanced security measures to protect against cyber threats and ensure the safety of financial information.

04 Ease of use

Family offices serve clients across generations as well as interact with various financial institutions. Altoo’s platform offers an intuitive interface for better asset management.

05 Intelligence and analysis

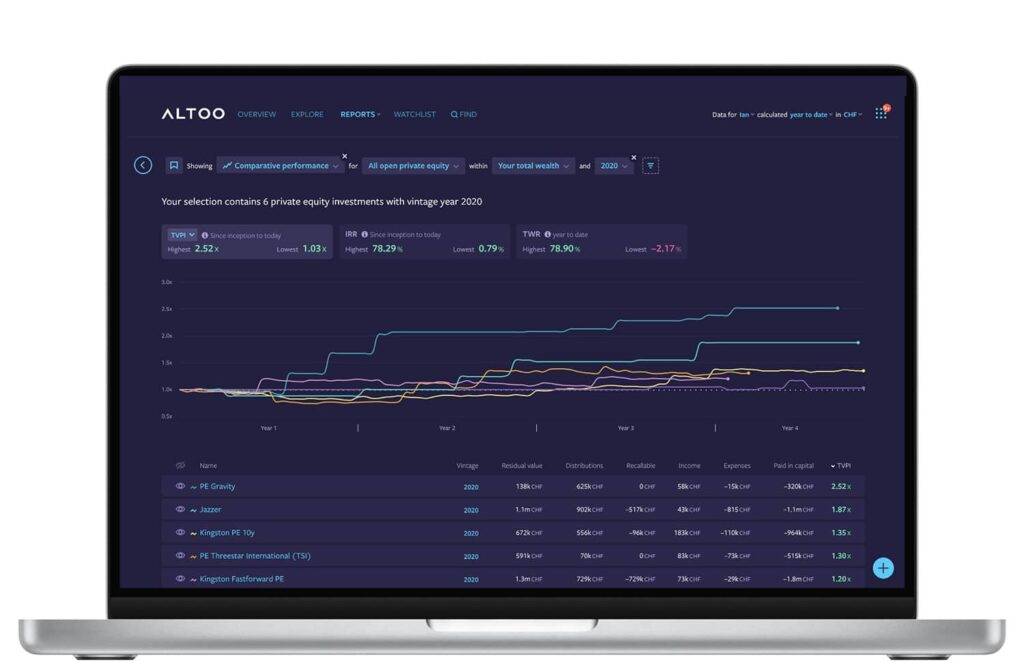

Platforms should be analytical tools for informed investment decisions. Clients have all their assets valued daily and, therefore, also have control over short-term changes. A digital wealth management platform should provide deep insights and forward-looking analyses. Altoo gives a comprehensive overview of assets to analyse performance and compare investments.

To sum it all up

The transfer of wealth between generations and the advancements in technology are accelerating the demand for simplified and secure digital solutions for managing wealth. Wealth management platforms, with their ability to integrate with financial institutions and automate data entries, streamline workflow and eliminate the need for paper reports, making the concept of paperless offices a reality. Altoo’s journey and evolution into a reliable fintech for family offices demonstrates how modern wealth management is changing to meet the needs of its clients.

About Altoo

Altoo enables affluent individuals and their families to conveniently centralise and engage with their entire wealth. This solution surpasses mere data collection and analysis. It serves as a secure digital hub for overall wealth, thoughtfully crafted to provide user-friendly daily functionality, facilitate comprehension of, and proficiently handle the crucial and intricate components of wealth.

This article was originally published on andSimple.