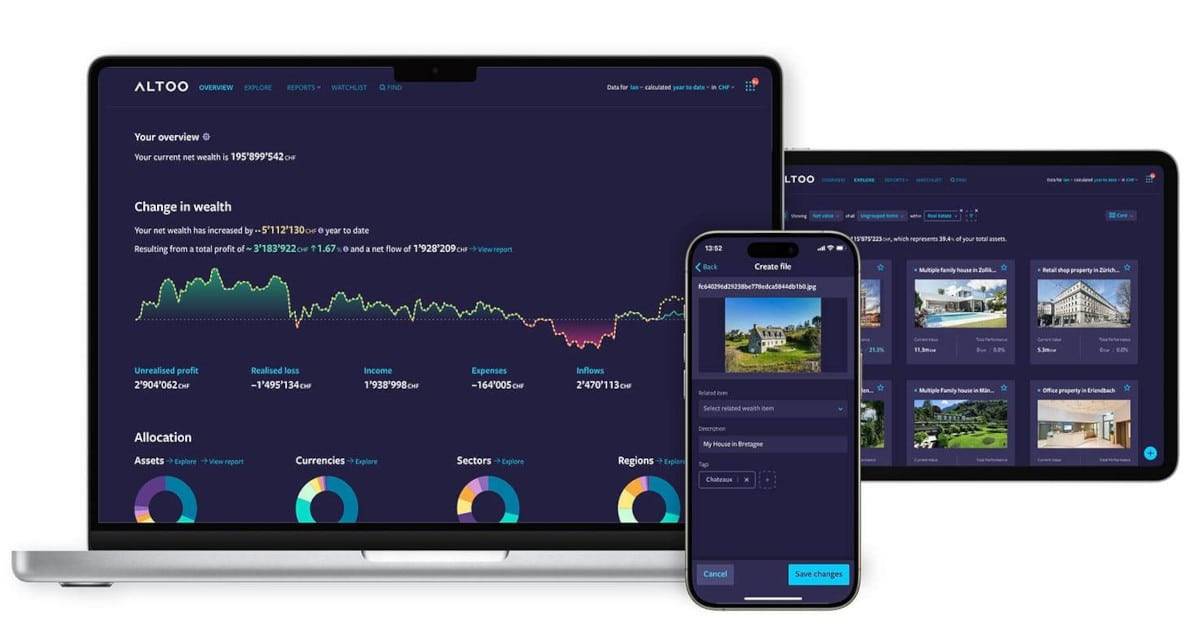

If you entered any of these markets early, you have some impressive gains to see. The Altoo Wealth Platform can help you view them all in place along with expenses, lease agreements, mortgage documentation, and more for each of your properties.

01 Hong Kong: The Pinnacle of Real Estate Prices

Topping the list of the most expensive city to buy a home in 2023 is Hong Kong. With a staggering house price to annual income ratio of 18.8, it’s no surprise that owning a home in this bustling metropolis comes at a premium.

According to CBRE’s latest Global Living Report, the average price of a home in Hong Kong is $1.254 million, making it the city with the highest average home price in the world. The average salary in Hong Kong is $55,928 per year, reflecting the city’s status as an international business hub with high wages.

The scarcity of land in Hong Kong, coupled with a population density of 6,300 people per square kilometer, has fueled demand for housing and led to skyrocketing prices. To address the housing shortage, plans were announced in 2019 to build an artificial island at a cost of around $80 billion. However, the environmental impact of such a project has raised concerns.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Regardless of where your real estate is, you can easily monitor the values and expenses of each of your properties with the Altoo Wealth Platform.

02 Sydney: A High Price for Coastal Living

Sydney, Australia’s iconic city, takes second place on the list of most expensive cities to buy a home in 2023. With a house price to annual income ratio of 13.3, it is clear that owning a home in this vibrant coastal city comes at a significant cost. The average price of a house in Sydney is $834,906, although prices vary by area. The eastern suburbs boast an average house price of $2,123,595, while the outer west sees an average price of $576,695.

The average wage in Sydney is $60,355 per year, and the city has a population density of 433 people per square kilometer. Sydney’s coastal lifestyle and employment opportunities make it a highly desirable location, further driving up property prices, especially in areas close to the coast.

03 Vancouver: A Canadian Gem with High Housing Costs

Vancouver, Canada’s stunning city nestled between mountains and the Pacific Ocean, ranks as the third most expensive city to buy a home in 2023. With a home price to annual income ratio of 12.0, buying a home in Vancouver requires a significant financial commitment. The average home price in Vancouver is $1,170,700, while the average salary is $45,201 per year.

Vancouver’s popularity as a destination for both locals and immigrants contributes to its high real estate prices. The city offers opportunities in various industries, including software development, video game development, animation, and trade. Vancouver’s population density is 5,749 people per square kilometer, and over 40% of the population are immigrants born outside of Canada.

04 Honolulu: Paradise Comes at a Price

Honolulu, located on the beautiful island of Oahu in Hawaii, ranks fourth on the list of most expensive cities to buy a home in 2023. With a home price to annual income ratio of 11.8, owning a home in this tropical paradise is a luxury. The median home price in Honolulu is $799,779, while the median salary is approximately $74,000.

Strict zoning regulations and limited available land contribute to the high cost of housing in Honolulu. As a small island with a population density of 5,791 people per square mile, demand for housing exceeds supply. Honolulu’s booming economy, driven by tourism and business, attracts people who add to the competition and drive up prices.

05 San Jose: Silicon Valley’s Expensive Real Estate

San Jose, the capital of California’s Silicon Valley, secures fifth place on the list of most expensive cities to buy a home in 2023. With a home price to annual income ratio of 11.5, buying a home in this tech hub requires a significant investment. The median home price in San Jose is $1,320,000, while the median income is $110,000 per year.

San Jose’s relatively small size and limited available land for housing contribute to the high prices. The city covers only 466.1 square kilometers, with much of the land occupied by office buildings and other developments related to the technology industry. San Jose’s proximity to the coast and desirable climate add to its appeal and drive up housing costs.

Regardless of where your real estate is, you can easily monitor the values and expenses of each of your properties with the Altoo Wealth Platform.