Wealth creates complexity, and Altoo’s Wealth Platform provides solutions: Holistic asset transparency, performance insights, sound information for strategic decision-making – all in one place, safe and secure. A modern approach to wealth management.

Do you remember the days in Private Banking, when everyone had just one bank account and one advisor? Even for most average banking customers, those days are long gone. And for the more wealthy individuals, wealth management has become much more complex.

Today, access to information via internet, better education and more transparency in products enable consumers to choose best-in-class solutions with several providers, instead of going with a one-stop-shop, like in previous days. It has also become common for High Net Worth Individuals to invest in various asset classes, including non-bankable assets such as Real Estate, Private Equity or Art, and to work with multiple specialized advisors. With increasing complexity, keeping track and managing financial affairs has become a real challenge.

Traditional wealth management tools are outdated

How to keep track of wealth data? For many years, Excel spreadsheets were the preferred solution – and for many, that’s still the case today. But Excel-based wealth management is inefficient, cumbersome, and prone to errors.

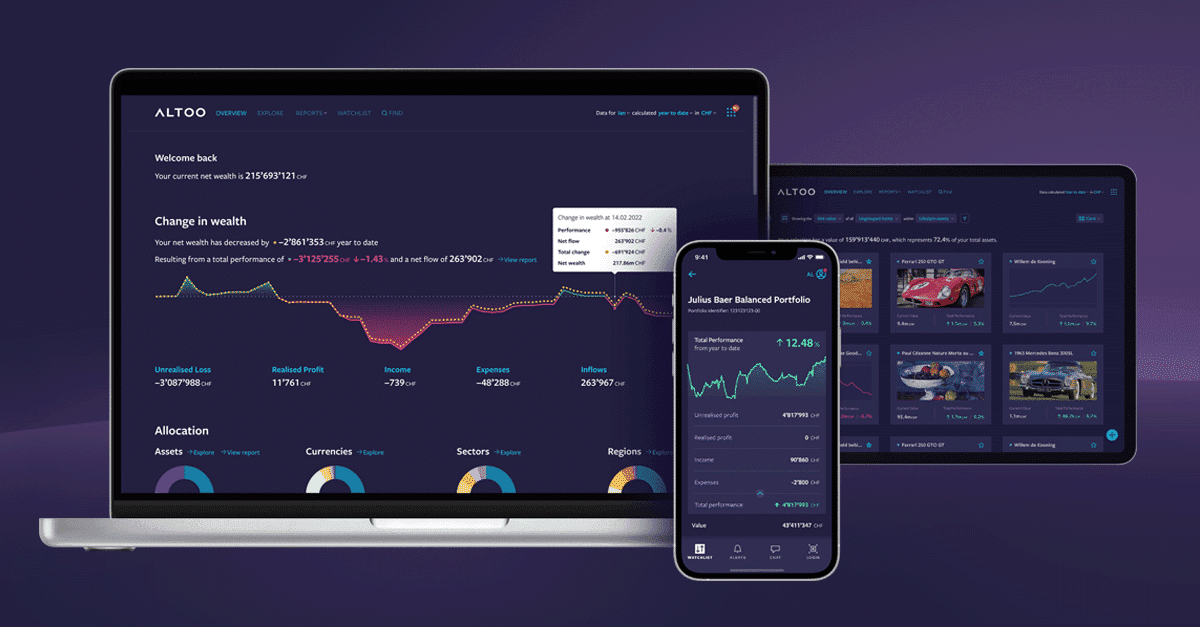

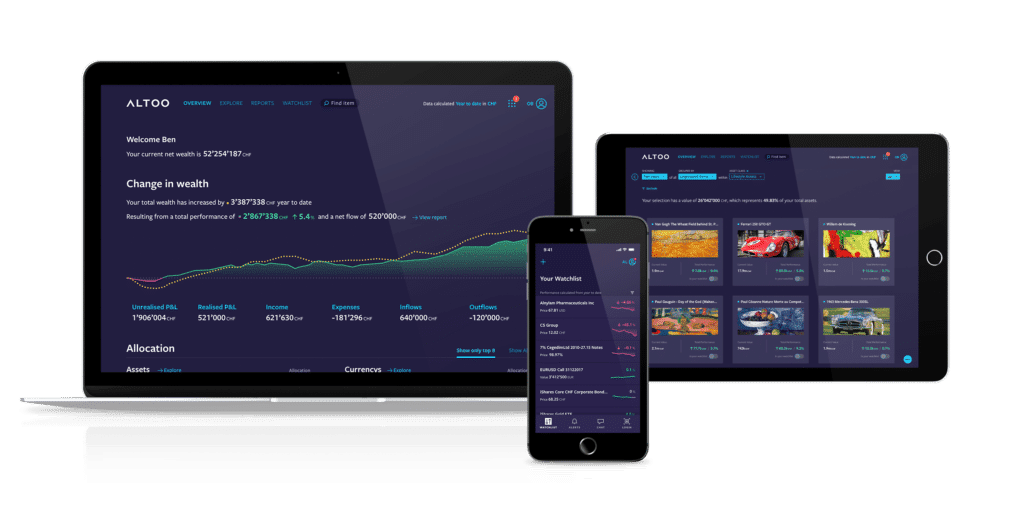

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

It also exposes HNWIs to substantial risks. If all data is stored in one single file – and managed by only one person – it might get lost in case this file, or the responsible person, suddenly becomes unavailable. Instead, data needs to be stored in a secure place where the next generation family members and advisors can get access if necessary. It also becomes increasingly crucial to be able to access data from everywhere – especially nowadays, as the COVID-pandemic forces advisors and their clients to work from home.

Having all data in one place and instantly available also enables fast decision-making in turbulent market situations. If the stock market crashes, the last thing anyone will want to waste their time on is gathering bits and pieces to get an overview.

Altoo provides one single financial cockpit

The Altoo Wealth Platform provides a more modern approach to wealth management. It gathers all client’s wealth data across multiple platforms and displays them in an intuitive way. Its interactive design allow users to view their wealth in an easy-to-digest format. Altoo also enables users to add all kind of asset outside of the banking world, and to upload, store, and manage related documents such as contracts or insurance policies.

Even better, Altoo is not only a data aggregator but also a tool to actively collaborate within your network. Users can grant advisors access to selected assets on the platform and use a secure messaging feature to communicate with different stakeholders in a encrypted way. For example, an Altoo user could upload mortgage documents for a specific property and grant his real estate and tax advisors limited access only to the assets they are servicing. He can then use the platform to assign tasks to his advisors, without ever having to leave the secure platform environment.

In short: Altoo provides one holistic solution for consolidating and managing wealth, making the life of wealth individuals much simpler. All data is stored in a Swiss-based data center, adhering to the highest data protection and cybersecurity standards.

Outlook: the benefits of open banking

Wealth platforms are a new technology. Due to the lack of standardization for accessing financial data or private banks, the cost of providing and using these technologies are still significant. Therefore wealth management platforms are today mostly a tool for wealthy private individuals and Family Offices. However, as technology advances and costs decrease, such platforms will become available to a broader user base.

Especially the trend of open banking will eventually enable affluent customers using wealth platforms as well. It will further increase the collaboration with banks and other financial service providers, providing access to financial data, allowing fintechs to provide new kind of services to their clients, allowing them to get a better handle on their finances. Technology will reshape the relationship with our wealth.

So are you done with managing complex wealth on spreadsheets?

You can find out more about how the Altoo Wealth Platform can simplify managing complex wealth and move away from those error-prone and risky spreadsheets, or you can contact us here via our website and arrange for a live demo.