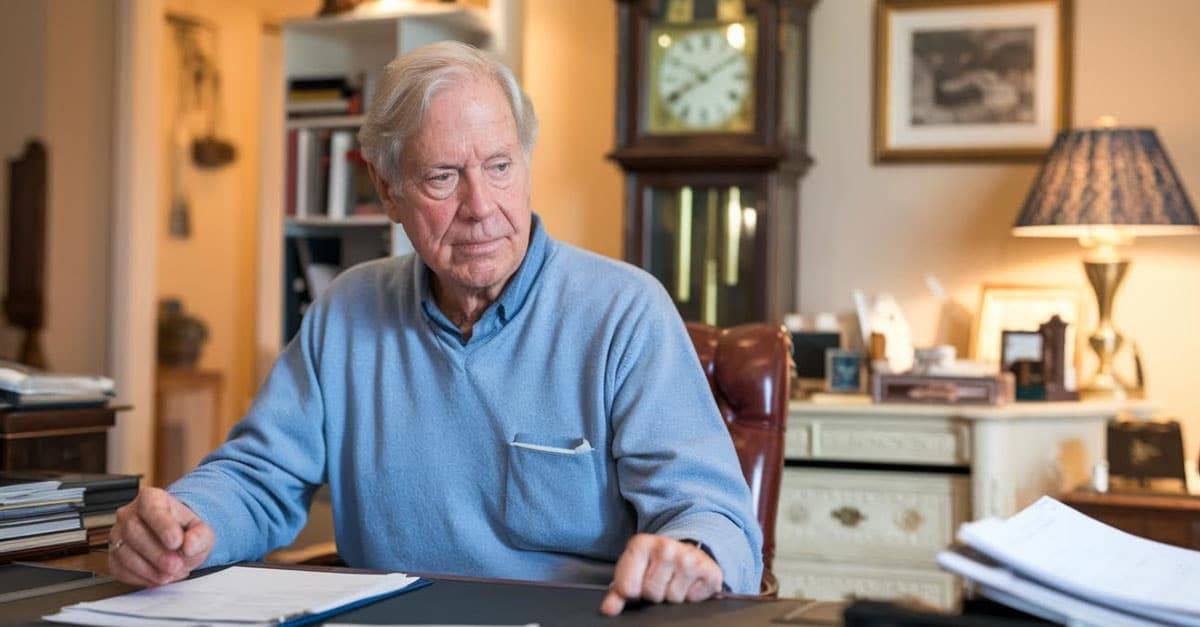

Rick Caruso

Source: Wikimedia

The owner of the Palisades Village Mall is Rick Caruso, a real estate developer with a net worth of approximately $5.8B according to Forbes. As the fire approached his property, he hired a team of firefighters – with their own trucks with hundreds gallons of water – to protect it. The decision was successful; the buildings in the shopping village were some of the only ones left standing in the vicinity.

In 2022 Caruso ran for Mayor of Los Angeles. He lost to current Los Angeles Mayor Karen Bass, whom many commentators believe mismanaged the city’s preparations to prevent the recent devastation. It is widely believed that many of the fire hydrants in the districts worst affected by the disaster ran dry.

UHNWIs frequently turn to private providers for essential services, often starting with familiar areas like healthcare, personal security, and education. Increasingly, however, they are recognizing the importance of a more comprehensive approach that encompasses services traditionally provided by governments such as firefighting – highlighted by the recent Los Angeles wildfire – utilities, disaster preparedness, and environmental monitoring/protection. More information on private-sector services covering these areas is below.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

01 Firefighting

Public firefighting services are typically the first line of defense against fires, relying on publicly funded fire departments and infrastructure. However, during large-scale incidents or in areas with limited public resources, private firefighting services can provide critical supplemental support.

According to the National Wildfire Suppression Association, an American organization with over 300 members providing fire safety services, over 40% of firefighters in the United States are employed in the private sector. Information on private-sector firefighting in Europe is more limited, but several companies like Danish multinational Falck are active in the sector – primarily serving as government contractors. In the United States, it is more common for private firefighting companies to serve insurance companies and occasionally wealthy individuals in addition to governments.

For UHNWIs, private firefighting services can offer several key advantages:

- Rapid response. Private companies can often deploy resources more quickly than public agencies, especially during widespread emergencies when public resources are stretched thin.

- Targeted protection. Private firefighters can focus specifically on protecting a client’s property, implementing tailored defense strategies.

Specialized equipment and expertise. Private companies may possess specialized equipment or expertise in areas such as wildfire suppression or high-value asset protection.

02 Utilities

Governments typically play a significant role in the provision of essential utilities like electricity, water, and sewage treatment. Utility companies often operate as regulated monopolies, ensuring consistent service and managing large-scale infrastructure. However, for UHNWIs seeking greater control and resilience, private utility solutions offer compelling alternatives.

While contracting a completely independent, large-scale private utility provider is generally not feasible due to infrastructure requirements and regulatory constraints, UHNWIs can achieve significant independence through:

- Off-grid solutions. Solar power systems, combined with battery storage, can provide reliable electricity independent of the public grid. Similarly, private wells, water purification systems, and self-contained sewage treatment facilities can ensure water security and sanitation.

- Backup power systems. Installing robust backup generators can provide emergency power during grid outages, safeguarding essential systems and maintaining comfort.

- Private microgrids. For larger estates or communities, private microgrids can offer a more sophisticated and resilient approach to power distribution, allowing for local generation and management.

These solutions not only enhance resilience but can also contribute to sustainability goals and reduce long-term operating costs.

03 Disaster preparedness

Government agencies typically provide disaster preparedness information, evacuation orders, and emergency shelters during large-scale events. However, for UHNWIs, a more comprehensive and personalized approach to disaster preparedness can significantly mitigate risks.

Private disaster preparedness services can include:

- Customized evacuation plans tailored to specific properties and family needs, including pre-arranged transportation, secure destinations, and communication protocols.

- Private emergency shelters and bunkers providing safe and secure refuge during disasters, equipped with essential supplies and life support systems.

- Pre-arranged contracts with emergency response and recovery firms for rapid access to resources and expertise for post-disaster cleanup, rebuilding, and logistical support.

- Advanced warning systems that leverage private weather forecasting services, sensor networks, and real-time data analysis to provide early warnings of impending disasters.

These proactive measures can provide peace of mind and significantly enhance safety and security during emergencies.

04 Environmental monitoring and protection

Growing awareness of environmental risks and increasing emphasis on environmental, social, and governance factors are driving demand for private environmental monitoring and protection services. These services address concerns related to personal health, regulatory compliance, and responsible environmental stewardship.

Private options include:

- Private air and water quality monitoring systems that can provide real-time data on air and water quality within and around a property, enabling proactive measures to mitigate risks.

- Private environmental remediation and cleanup services for addressing environmental contamination or pollution issues on a property, ensuring compliance with regulations and protecting human health.

- Private land management and conservation services. For larger estates, these services can ensure responsible land stewardship, protect natural resources, and enhance biodiversity.

Investing in these services not only protects personal health and property value but also demonstrates a commitment to environmental responsibility, aligning with the growing global focus on sustainable practices.

Tracking Investments in Resilience with Altoo

Typically, resilience-oriented investments like those outlined above will be linked to specific assets, especially real estate holdings. For example, a contract with a private firefighting company will concern a specific property to be protected. The expenditure should therefore be factored into cashflow or upkeep calculations for the property. The Altoo Wealth Platform can make the process of keeping these records – and all records associated with the property – fast and easy, with all figures clearly presented and available for analysis in intuitive dashboards. The service contract itself can also be digitally stored alongside other important documentation regarding the property like insurance policies and rental agreements.

To learn more, please contact us for a demo!