What impact will artificial intelligence and automation have on the client experience? How can business models be transformed from within? In a hyper-connected world, wealth managers wanting to remain in business must inevitably address these questions and many more like them. Successfully doing so starts with forming a mental model for arriving at the right answers.

The Primary Importance of Agile, Client-Centric Thinking

The Primary Importance of Agile, Client-Centric Thinking

The wealth management value chain is not what it used to be. In the past, wealth managers were often information gatekeepers. Today, networking technology has made more information instantly accessible anywhere and has enabled innovative competitors to disrupt traditional business models. In response to these changes, wealth managers must embrace a new approach that prioritises agility and client-centricity.

An agile, client-centric mindset is a modern wealth manager’s most valuable asset when embarking on the journey to a successful future. Cultivating such a mindset involves paying close attention to shifting client needs and finding innovative ways to meet them. The focus is on solving problems, not selling products.

The ability to think this way – while striking an effective structural, operational, and cultural balance between the status quo and innovation – is therefore the key competence of the wealth manager of the future. It is not easy. Every client is different; designing a structured model for matching offerings to individual life circumstances requires focused effort.

Top Competencies Supporting Wealth Management Client Centricity

Top Competencies Supporting Wealth Management Client Centricity

To translate a client-centric mindset into business success, wealth managers should focus on developing the following broad competencies identified by the Hochschule für Wirtschaft Zürich.1

- Core expertise. Successful wealth managers seek to continuously expand their occupational skills in order to address clients’ increasingly complex financial concerns.

- Critical thinking. The all-around ability to form well-reasoned, objective judgments using information from a variety of sources forms the basis for finding creative solutions to disruptive challenges.

- Flexibility. As wealth management practices evolve, successful wealth managers will be open to exploring and embracing new models that deliver the most value for clients.

- Self-awareness. Good emotional intelligence is key to good personal relationships and providing personalised services.

- Digital literacy. Proficiency in utilising and adapting to emerging technological tools is the key to leveraging their potential.

Among these complementary competencies, digital literacy stands out due to its ability to revolutionise client interactions, streamline operations, and enhance service delivery.

Investing time in acquiring technological capabilities not only enhances efficiency but also frees up time to build the wide-ranging skill set expected of today’s wealth managers.

Digital Literacy for Client-Centric Wealth Managers

Digital Literacy for Client-Centric Wealth Managers

Yesterday, wealth management success was measured in terms of firm revenue growth. Today, wealth management success boils down to satisfying increasingly technology-savvy clients. In 2023, EY found 77% of wealth management clients saying that it was important to have a complete online view of their financial positions.2

With good digital experiences becoming increasingly important to more clients than ever, wealth managers are now expected to leverage technology to:

- synthesise clients’ own wealth data and make it understandable to them, and

- involve clients in decision-making tailored to unique needs and circumstances. Here, digital tools can help free up advisors’ time to focus on crafting and communicating personalised strategic recommendations.

A wealth firm leveraging such technologies can effectively transform itself from within, empowering its people to empower clients. Clear, directly communicated, and data-driven insights allow clients to:

- easily understand the logic behind recommendations and

- trust that advice aligns with their interests, not just those of an executive at the top of the firm’s hierarchy.

Here is a breakdown of how the wealth management business has evolved and the digital capabilities to prioritise in response:

Wealth Management Firms

Yesterday

Today

Priority

Strategic objective

Maximise firm profits

Maximise client value

Delivery of superior digital experiences

Key strategic enabler

Cost efficiency

Shared incentives and goals

Transparent communications

Hierarchy

Vertical

Flat

Agile, secure networking

Team priorities

Execution of defined tasks

Engagement, loyalty, holistic advice

Automation of routine tasks

Workflows

Inflexible, task-oriented

Flexible, goal-oriented

Data consolidation, analysis, and visualisation

Decision-making authority

Centralised, top-down

Decentralised, meritocratic

Proactive delivery of personalised, data-driven insights

STRATEGIC OBJECTIVE

Yesterday

Maximise firm profits

TODAY

Maximise client value

PRIORITIES

Delivery of superior digital experiences

KEY STRATEGIC ENABLER

Yesterday

Cost efficiency

TODAY

Shared incentives and goals

PRIORITIES

Transparent communications

HIERARCHY

Yesterday

Vertical

TODAY

Flat

PRIORITIES

Agile, secure networking

TEAM PRIORITIES

Yesterday

Obedience, execution of defined tasks

TODAY

Engagement, loyalty, holistic advice

PRIORITIES

Automation of routine tasks

WORKFLOWS

Yesterday

Inflexible, task-oriented

TODAY

Flexible, goal-oriented

PRIORITIES

Data consolidation, analysis, and visualisation

DECISION AUTHORITY

Yesterday

Centralised, top-down

TODAY

Decentralised, meritocratic

PRIORITIES

Proactive delivery of personalised, data-driven insights

Leveraging Partnerships to Quickly Add the Right Digital Capabilities

Leveraging Partnerships to Quickly Add the Right Digital Capabilities

Sophisticated digital tools can help translate agile, client-centric thinking into real-world success. But it can take wealth management firms considerable time to build such tools in-house, let alone decide which ones to build in the first place.

Not so long ago, the “wait and see” approach served wealth managers fairly well when it came to adopting new technologies. Many forms of digital innovation, for example mobile apps, could be kept at a safe distance until their teething troubles had been solved by others.

Times have changed. New digital financial ecosystems are forming, and the risk of being edged out by faster-moving, more innovatively-minded competitors is too big to ignore. Only firms that can understand the new landscape and turn it to their advantage will find their places in the financial systems of the next century.

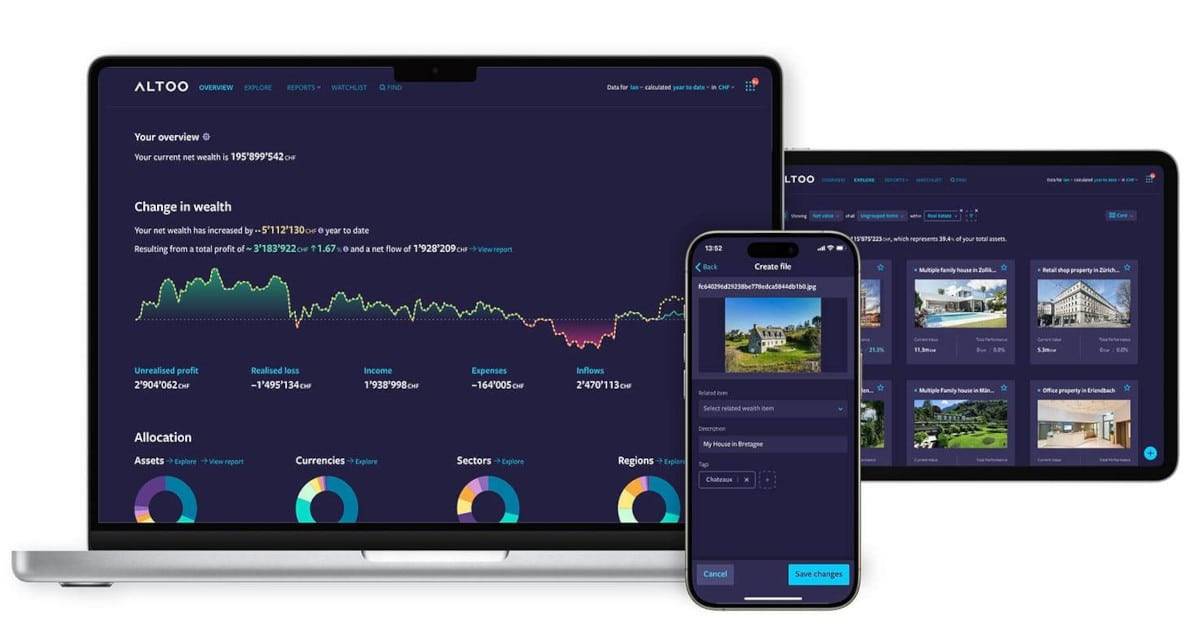

How can wealth managers rapidly add the digital capabilities they need to execute on the client-centric strategic paradigm? Through partnerships with specialised third-party technology providers like Altoo, whose digital wealth platform was named among the best family office software in 2023.3 The same year, BCG identified a trend of wealth management firms increasingly exploring third-party tech and operational solutions for freeing up time to focus on value-adding capabilities, lowering upfront capital expenditures, and gaining greater flexibility to execute operating-model changes.4

The Altoo Wealth Platform is designed to support particular processes and operations that help wealth managers efficiently leverage hybrid advisory models that blend the use of digital tools with human advice. For example, Altoo automatically consolidates clients’ wealth data from sources across their entire portfolios with immediate analysis and visualisation of this data for quick, easily understandable insights around asset allocation, performance, and more. Secure, one-stop messaging is available to facilitate communications with clients and other stakeholders. Wealth managers can be taking full advantage of these advanced digital capabilities in just a few days with the help of dedicated onboarding specialists.

Portfolio

management

Asset

allocation

Data

dashboards

Portfolio

monitoring

Comprehensive

reporting

Charting

and research

Takeaway: Start Building Digital Capabilities with the Client-Centric End in Mind

The transparency and omnipresence of information in the digital age have led to greater client expectation for fast, accurate, personalised, and transparently communicated solutions to their financial challenges.

The successful wealth managers of tomorrow will meet these expectations through a combination of technology and social skills. Wealth managers can invest in building a wide range of digital capabilities, but focusing on technology solutions designed primarily to help meet client expectations will bring the highest returns. These solutions help wealth professionals take ownership of the client value creation process through personalised engagement, providing accurate data-driven advice based on multiple perspectives and information sources.

ACTIONABLE INSIGHTS

Strategically, prioritise meeting the expectations of tech-savvy clients.

Today’s clients want superior digital experiences and personalised, data-driven advice.

Tactically, focus on building client-centric digital capabilities.

Think first about client benefits when identifying which digital capabilities are most valuable to build.

Operationally, partner up to quickly acquire these capabilities.

The time required for in-house tech development can often lead to a competitive disadvantage.