Consolidation via Mergers and Acquisitions (M&A)

One of the most notable trends in the wealth management industry is increased consolidation through mergers and acquisitions. The wealth management industry witnessed a record number of M&A deals in 2022, marking the 10th consecutive year of increased deal activity. While deal flow has declined slightly in 2023, strategic acquirers and private equity-backed consolidators continue to expand their reach in the industry. However, family offices and independent registered investment advisors (RIAs) that are acquired may see a temporary freeze in technology spending.

As acquirers, private equity firms often seek to reduce costs at RIAs and family offices, which can result in a pause in technology investments. This pause in technology spending can impact the onboarding process of new technology platforms, potentially hindering the efficiency and growth of wealth management firms. It is crucial for family offices and other wealth management companies to ensure that their acquirers recognise the importance of technology to their operations and client engagements. By addressing technology spending in the terms of the deal, firms can mitigate the risk of a long-term freeze and ensure a smooth transition.

Access to Centralized Data

Wealthtech providers offer practice and portfolio management ecosystems that consolidate data from disparate sources within the financial services industry into a single, centralised repository. This centralised data repository empowers advisors and wealth managers with real-time insights that can improve decision-making, strengthen client engagement, and automate reporting and analysis processes. By securely sharing data across these platforms, advisors can make data-driven recommendations to their clients and identify non-traditional products that can be incorporated into client portfolios.

In addition, centralised data repositories enable wealth management practices and wealthtech platforms to optimise their operations by identifying bottlenecks and using artificial intelligence to automate workflows. This streamlines processes, improves efficiency, and enables wealth management firms to deliver a more seamless and personalised experience to their clients.

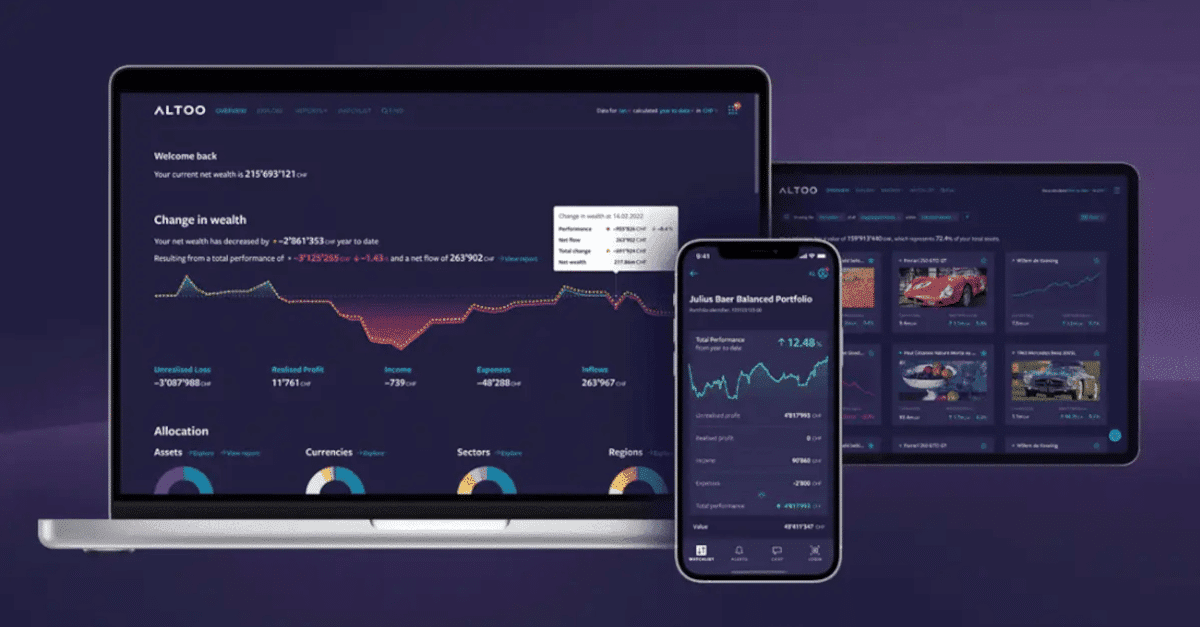

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Blurring of Platform Differentiators

In recent years, there has been a proliferation of wealthtech solutions and platforms that market themselves as “end-to-end” tools capable of addressing all aspects of wealth management. The rise in wealthtech providers and the emphasis on digital unification to satisfy a wide range of client needs are driving this trend. While these platforms offer a wide range of functionality, it can be challenging for advisors and wealth managers to identify the best fit for their specific businesses and client needs.

When evaluating potential wealthtech providers, it is critical to conduct thorough due diligence and carefully evaluate the platforms and their intended goals. Advisors and wealth managers should begin by identifying their primary pain points and selecting vendors that specialise in addressing those specific needs. While some vendors may expand their offerings beyond their core strengths, it is important to recognise the expertise of their initial solution. By selecting the right wealthtech platform, advisors can streamline operations, improve the client experience, and drive business growth.

Cybersecurity and Data Privacy

As wealth management companies increasingly rely on technology to manage client data and conduct business operations, cybersecurity and data privacy have become critical concerns. With the growing threat of cyberattacks and data breaches, it is imperative for wealth management firms to implement robust security measures to protect sensitive client information. This includes implementing encryption protocols, multi-factor authentication, secure data storage, and regular security audits.

In addition, wealth management firms must comply with relevant data privacy regulations, such as the European Union’s General Data Protection Regulation (GDPR), to ensure the lawful and ethical handling of client data. By prioritising cybersecurity and data privacy, wealth management firms can build trust with their clients, protect their reputations, and mitigate potential financial and legal risks.