Consultancy PwC predicts that assets under management in Ireland will grow from 3.66 trillion euros in 2022 to 6 trillion euros in 2027, equal to a 10.3% compound annual growth rate. In the last decade, the number of Irish billionaires has fallen from nine to eight. However, the number of people with 47 million euros or who are worth over 4.7 million euros has more than doubled, according to Oxfam, an organisation focusing on the alleviation of global poverty.

Spirit of Entrepreneurship

The figures show there are 1435 people in Ireland with 46.6 million euros or more, up 119% in the last 10 years, according to the Irish news portal breakingnews.ie. More than 20.500 people are now worth over 4.7 million euros, representing an increase of 118% on previous data. The top 1% of Irish society owns 27% of the country´s wealth.

“If you look at the backdrop of our most recent history, it’s astonishing how Ireland looks and feels from a wealth point of view,” says Keith Ryan, head for Ireland at Julius Baer, Switzerland’s second-biggest bank, to the Financial Times (FT). He attributes the country’s changing fortunes not just to strong economic growth based on the international investment Ireland has attracted, particularly in the tech and pharma industries, “but also [to] a genuine spirit of entrepreneurship that has been hugely successful.”.

Avid Savers

In the past, those with USD 1 million and more in assets looked to larger financial centres such as London or Switzerland for wealth advice. But with rising numbers of Irish people with abundant income not tied up in property, there has been a growing opportunity for a domestic industry. “What we have seen over the past few years is an increased demand for those services. because of accumulated wealth in the country,” says Ian Quigley, head of investment strategy in Ireland at London-based RBC Brewin Dolphin, “whether that’s on the investment side or on the financial planning side.”

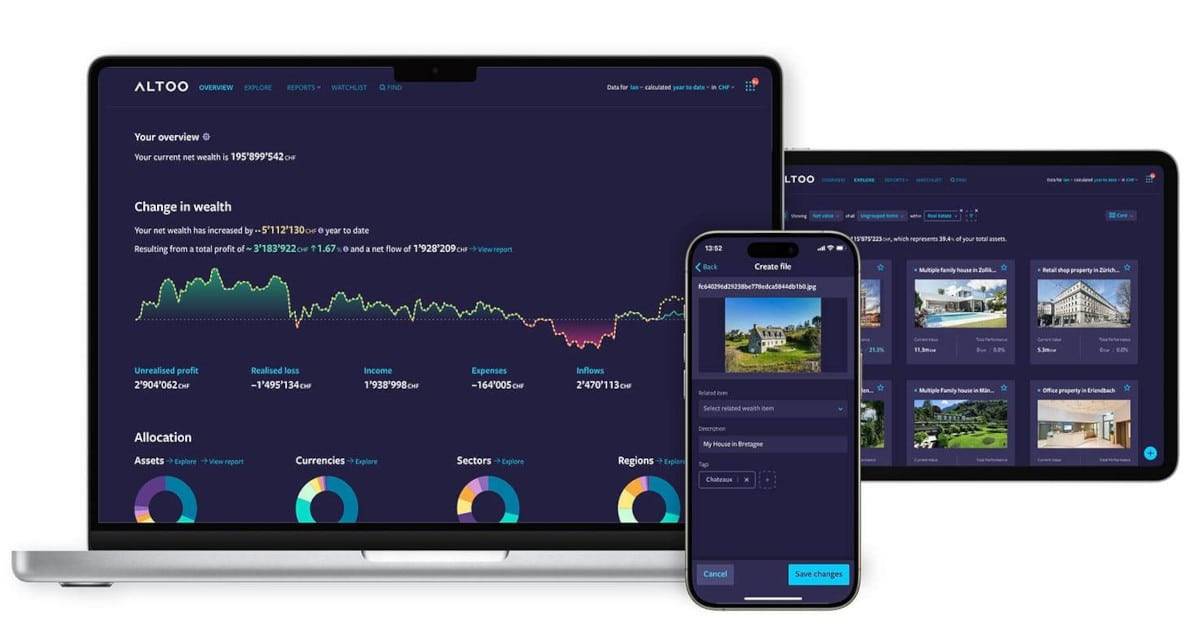

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

During the country’s boom in the 1990s, clients were more focused on property. Long-term financial planning and the construction of diversified portfolios have only really taken off since the financial crash. Still, Ireland is a nation of avid savers. Irish households save more than they spend and are still adding to their deposits. „They are adding to wealth at a slower rate,” says Peter Culhane, statistician at the Central Statistics Office, to FT. Many of the increasingly affluent Irish plough their savings into bank deposits or buy and improve property. Financial investment only accounts for a small share of people’s wealth. “Our competitors are cash and the housing market,” according to Mike O´Sullivan from wealth management company Unio.

Good Environment for Investors

Julius Baer has notched up 30% compound annual growth in assets under management in Ireland for the past five years, and the trend is continuing this year. The expanding business has more than doubled its staff, and the bank moved into a new office in central Dublin in July 2023.

According to EY, Ireland is one of the most attractive destinations in Europe for investments in life sciences, technology, and global business services. The pro-business environment, availability of skilled talent, and political stability remain key differentiators for overseas investors. The country ranks 10th in Europe, and 80% of respondents to the EY Europe Attractiveness Survey 2023 believe the country’s appeal will improve or remain the same over the next three years. The new generation of Irish investors is seeking sustainable investments. As new ESG reporting requirements apply to European companies arising from the EU Corporate Sustainability Reporting Directive (CSRD) and equivalent regulations, Ireland’s strong position in both digital technology and global business services presents an exciting proposition to take the lead in implementing this new reporting framework, according to the EY report.