01 What a family office is and does

A family office is a private entity dedicated to managing the financial affairs of one wealthy family (a single family office) or several (a multi-family office). Unlike banks or third-party asset managers, family offices operate independently and answer directly to wealth owners.

Historically, family offices were created to look after the wealth of ultra-high-net-worth families. But the modern-day family office often does far more, discretely taking care of anything for which wealth owners do not have capacity, knowledge, skills, or simply interest. Securities portfolios, real estate, yachts and art collections, inheritances, mergers and acquisitions, tax planning, and mediation between different generations of family members are just a few examples.

Most family offices prioritise the preservation of assets, optimising the transfer of wealth to future generations. According to the findings of a survey of family offices by private investment funds Terra Nex and Middle East Best Select, family offices emphasise pursuing carefully selected investment opportunities: Almost two thirds of the players surveyed favoured direct investments or individual investments. Many family officers have entrepreneurial backgrounds and take a creative, hands-on approach to their work.

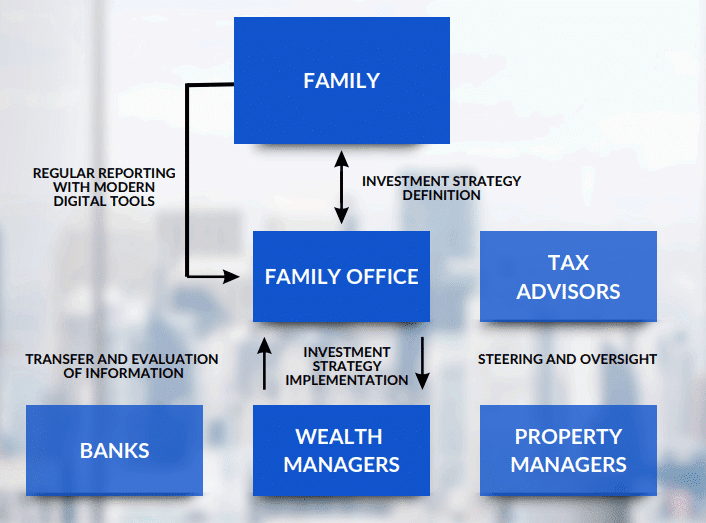

Where a family office fits into a wealthy family’s financial affairs.

Graphic: Altoo

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

02 Why to create a family office

Entrepreneurial families face increasingly complex business, legal, and tax challenges when it comes to building and structuring wealth to benefit family members for generations to come. They often value independent advice from professionals acting exclusively in the family’s interests.

A family office can be an ideal source of such advice, helping family members address their unique challenges with a level of personalisation unavailable from other types of financial service providers when it comes to preserving, growing, and transferring wealth. In addition, a family office can be:

- A central link within a family governance structure. It can be the first point of contact for questions relating to the strategic direction of the family’s business and succession planning strategies — or when external mediation is needed in family disputes.

- A “gatekeeper” for family members, helping to free up their time and meet their needs for security and discretion.

03 Envisioning and setting up a family office

Like so many things in life, starting with the end in mind is essential for successfully launching a family office. When envisioning a family office, key questions to ask yourself are:

- What services does my family most need?

- Should the family office itself actively manage assets? If so, assets in which classes?

- Should the family office have an influence on the family business? Or should the family office operate independently of the business?

- Will the family office serve other families? If starting out as a single family office, is there a possibility that more families will be served in the future?

Once you’ve answered these questions and formed an initial vision of your family office, it is time to start taking your first steps towards setting it up. Here are some recommendations to guide you in doing so:

- Set a limited number of priorities. The point of having a family office is to receive better, more personalised services than are available elsewhere. It is unrealistic, however, to be better at anything and everything from a “standing start.” One of the most common reasons family offices fail is lack of focus. Choose the most important core competencies to build initially before thinking bigger.

- Ensure adequate reporting. Family office decision-making is only as good as the data and metrics it relies on. Reporting should encompass all assets in the portfolio, including nonbankable ones like properties and private equity. A sophisticated digital wealth platform like Altoo’s can provide advanced monitoring and reporting capabilities with minimal manual effort, as information from assets across the family’s portfolio flows into the platform automatically for analysis and visualization.

- Focus on two to four asset classes. Initially, direct family officers to manage the types of assets that are most important to your family. Here, management does not necessarily involve hands-on, day-to-day efforts. Family officers may, for example, delegate responsibilities to specialists and closely monitor their results.

- Hire for the right expertise. Family office teams should excel in both the development and implementation of investment strategies. Aim to bring in expertise that covers the selection and negotiation of asset management mandates, particularly with respect to the negotiation of fees. The team should also be able to ensure legally compliant tax optimisation of investments. Switzerland is often considered the true European hub for family offices, for which there is a mature market for such services and the industry is primed for future growth. Famous wealth owners from not only Switzerland but also Germany, Italy, Greece, and France have set up their own family offices in Switzerland, often hiring portfolio managers with banking experience who prefer working in a smaller team.

- Hire for the right ethics. There is no room for conflicts of interest in a family office. Above all, family officers should display discretion and loyalty in handling your financial affairs.

Takeaway

Establishing a family office is a sophisticated undertaking that demands strategic vision and an unwavering commitment to your family’s unique needs and aspirations. By tailoring its services to preserve, grow, and transfer your wealth, a well-structured family office becomes far more than a financial entity — it evolves into a cornerstone of your legacy, safeguarding it for generations.