The global family office market has reached $20.13 billion in value and is projected to hit $27.61 billion by 2030. This growth reflects a fundamental shift in how ultra-high-net-worth families approach wealth management, moving from simple stewardship to strategic value creation across generations.

If you’re using Excel spreadsheets for wealth management, you may have wondered about the value of a wealth management platform, and at what point it makes sense to investigate the options.

Philanthropy has always played a crucial role in shaping communities and driving positive change. As time rolls on, each generation’s philanthropic priorities and approach to giving evolve. Understanding these differences and bridging the gap between older and younger generations is crucial for nonprofits to grow their supporter base and drive meaningful change.

Return on investment (ROI) is the profit earned on an investment divided by the cost of that investment. Although this calculation fails to directly account for the time value of money – an important consideration as some investments take longer to return profits than others – it offers a quick, useful way to estimate the future success of a given project. How can you apply this concept when evaluating potential investments into new technology? What factors should you bear in mind? Here we outline our suggestions.

As digitalisation reshapes the global economy, a trend of so-called crypto philanthropy has emerged. Involving cryptocurrencies such as Bitcoin and Ethereum, this innovative concept provides a borderless and bureaucracy-free alternative to traditional philanthropy and is poised to take on a powerful role in charitable giving.

Whether you are overseeing a private foundation or a public charity, it is essential to have effective practices in place to ensure the responsible stewardship of your organisation's resources. By implementing best practices in foundation asset management, you can maximise the impact of your philanthropic efforts and safeguard the long-term sustainability of your foundation.

Understanding the key differences between charity and philanthropy is essential for high net worth individuals seeking to make a meaningful impact with their contributions. Both approaches have their merits and can complement each other in a comprehensive giving strategy. In this comprehensive article, we explore the definitions of charity and philanthropy, their implications, and the ways in which they shape our society.

Philanthropy dates back to Greek society. According to the US financial media website Investopedia, Plato instructed his nephew in his will to use the proceeds of the family farm to fund the academy that he founded in 347 B.C. The money helped students and faculty keep the academy running.

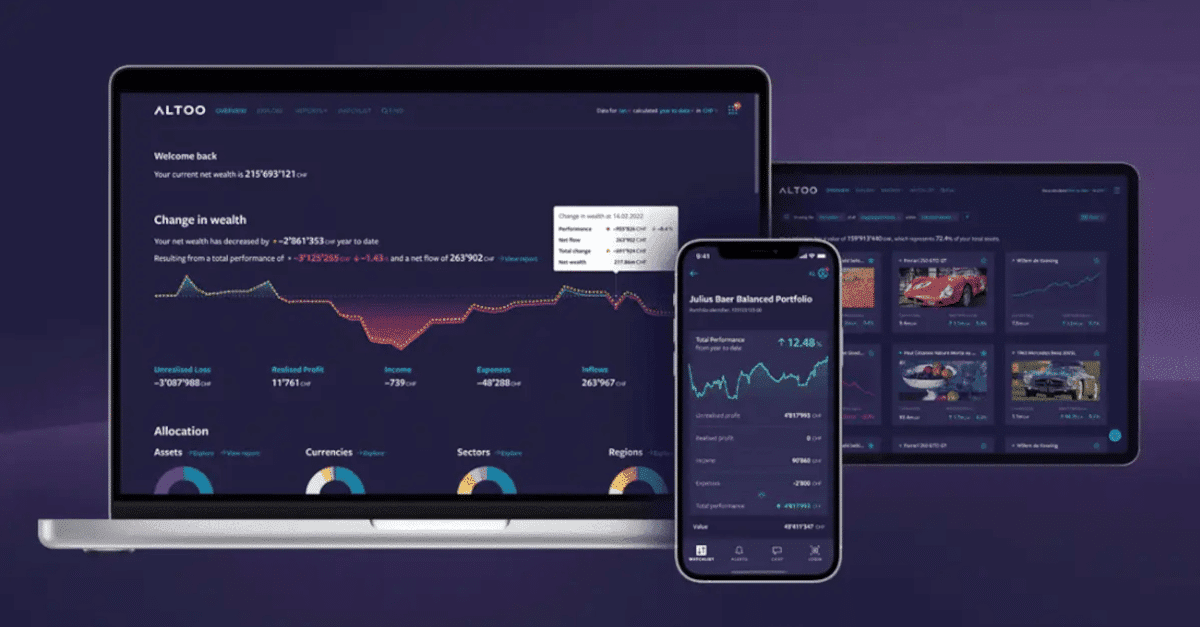

Portfolios of ultra-high-net-worth individuals (UHNWIs) stand out for their multifaceted nature. Managing these vast and diverse assets requires not only precision but also a broad perspective that includes every aspect of each investment. The Altoo Wealth Management Platform, a Swiss startup, offers effective solutions in asset management and consolidated digital reporting. The Altoo's revolutionary methodology simplifies the complex pattern of UNWI portfolios, delivering clarity and insight via advanced technology. This article delves into the world of UHNWIs and investigates how The Altoo Platform sets the benchmark for efficient, effective portfolio management.

Significant advancements in digital technology are driving an enormous shift in the wealth management industry. This transformation is altering the way wealth management services are delivered, with major implications for trusts and foundations.

Artificial intelligence (AI) has emerged as a transformative force in many industries, and philanthropy is no exception. AI's potential to revolutionise philanthropic efforts by streamlining processes, improving decision-making, and facilitating research is increasingly recognized.

Market dynamics, technological advancements, and changing client needs are what keep the asset and wealth management landscape in flux. The year 2024 brings forth a host of trends that redefine how individuals and businesses approach managing their assets and securing their financial futures.

Private foundations have demonstrated an unwavering commitment to philanthropy despite economic uncertainties and market downturns. The recently released 2023 Report on Private Philanthropy highlights trends within these foundations and provides valuable insights into their impact on charitable causes.

Swiss entrepreneur and philanthropist Hansjörg Wyss has made a remarkable impact in the fields of business and philanthropy. With a net worth estimated at more than $4.7 billion, Wyss has dedicated his wealth to causes close to his heart, particularly environmental protection, health care, and scientific advancement.

To preserve and grow family wealth across generations, families often turn to innovative digital solutions that provide a comprehensive view of their assets. Traditionally, the responsibility of managing family wealth has been passed down through generations, often resulting in challenges and the potential dissipation of wealth. However, with the rise of digital solutions, families now have powerful tools to navigate these complexities and preserve their wealth for generations to come.

European foundations, with their substantial endowments and unwavering commitment to social good, offer valuable opportunities for NGOs seeking funding. In this comprehensive guide, we explore the top ten philanthropic powerhouses in Europe, examining their mission, impact, and endowment size. Driven by a commitment to social good, these foundations disburse billions of dollars annually to support various causes and initiatives.

In the world of philanthropy, there are standout figures whose impact goes far beyond their fame. Oprah Winfrey, J.K. Rowling, and Leonardo DiCaprio are prime examples. In this article, we'll explore the inspiring stories of these three remarkable celebrities who have used their success to make a positive difference in the world.

We think you might like

For family offices, it’s all too easy for diversification strategies to become operational liabilities. When there are multiple custodians, asset classes, and jurisdictions, the structures meant to protect wealth can obscure it. Unfortunately, the persistence of spreadsheet-based consolidation is a symptom of an infrastructure gap. Fortunately, family offices can learn from how institutional investors address this gap.

Markets don't wait for quarterly reviews. Risk management shouldn't either. Institutional investors monitor risks continuously — but not by having their people watch screens continuously. Family offices can achieve the same proactive oversight through automated monitoring technology that tracks multiple risk factors and notifies portfolio managers the moment thresholds are breached.

You know the value of your private equity stakes, your real estate holdings, your venture capital commitments. But do you know when those assets will demand — or return — capital? The difference between reactive improvisation and proactive planning isn't sophisticated treasury management. It's treating your consolidated wealth intelligence as a strategic asset. Purpose-built technology transforms fragmented holdings into forward-looking liquidity forecasts, turning cash flow management from crisis response into competitive advantage.

In case you missed it

Fintech companies are introducing innovative methods to understand and manage even the most diverse portfolios. If you’re considering working with one of these financial industry newcomers independently – that is, not through one of your banks or other institutional service providers – you should ask four basic questions about their data security. This article explores these questions and provides guidance on evaluating the responses.