The global family office market has reached $20.13 billion in value and is projected to hit $27.61 billion by 2030. This growth reflects a fundamental shift in how ultra-high-net-worth families approach wealth management, moving from simple stewardship to strategic value creation across generations.

If you’re using Excel spreadsheets for wealth management, you may have wondered about the value of a wealth management platform, and at what point it makes sense to investigate the options.

Philanthropy has always played a crucial role in shaping communities and driving positive change. As time rolls on, each generation’s philanthropic priorities and approach to giving evolve. Understanding these differences and bridging the gap between older and younger generations is crucial for nonprofits to grow their supporter base and drive meaningful change.

Return on investment (ROI) is the profit earned on an investment divided by the cost of that investment. Although this calculation fails to directly account for the time value of money – an important consideration as some investments take longer to return profits than others – it offers a quick, useful way to estimate the future success of a given project. How can you apply this concept when evaluating potential investments into new technology? What factors should you bear in mind? Here we outline our suggestions.

As digitalisation reshapes the global economy, a trend of so-called crypto philanthropy has emerged. Involving cryptocurrencies such as Bitcoin and Ethereum, this innovative concept provides a borderless and bureaucracy-free alternative to traditional philanthropy and is poised to take on a powerful role in charitable giving.

Whether you are overseeing a private foundation or a public charity, it is essential to have effective practices in place to ensure the responsible stewardship of your organisation's resources. By implementing best practices in foundation asset management, you can maximise the impact of your philanthropic efforts and safeguard the long-term sustainability of your foundation.

Understanding the key differences between charity and philanthropy is essential for high net worth individuals seeking to make a meaningful impact with their contributions. Both approaches have their merits and can complement each other in a comprehensive giving strategy. In this comprehensive article, we explore the definitions of charity and philanthropy, their implications, and the ways in which they shape our society.

Philanthropy dates back to Greek society. According to the US financial media website Investopedia, Plato instructed his nephew in his will to use the proceeds of the family farm to fund the academy that he founded in 347 B.C. The money helped students and faculty keep the academy running.

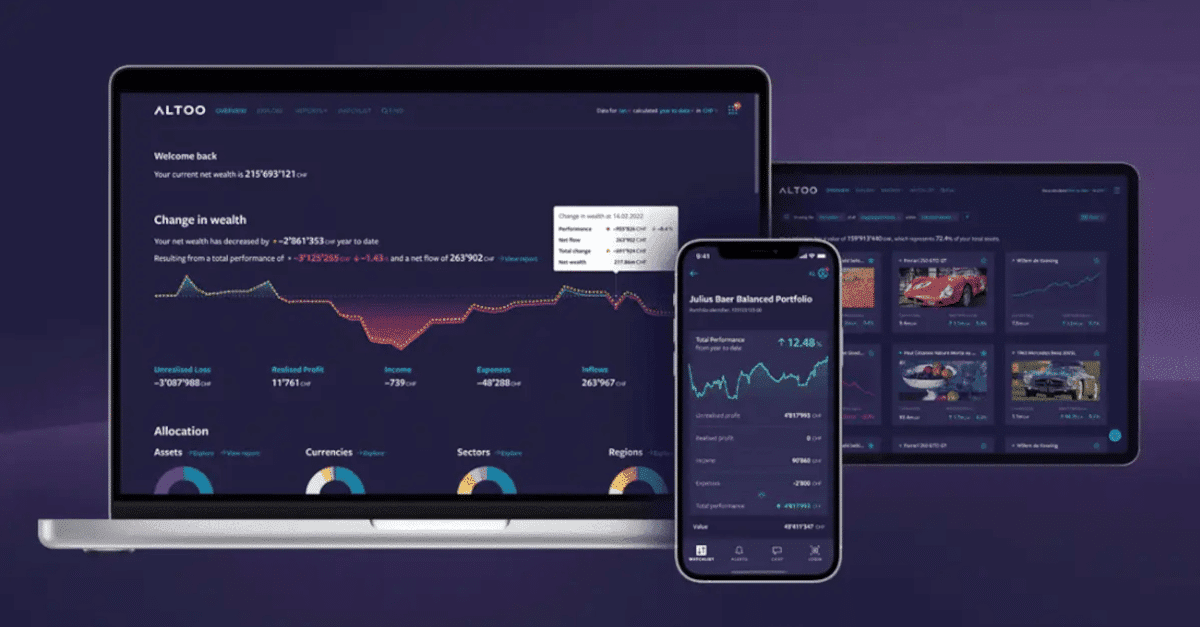

Portfolios of ultra-high-net-worth individuals (UHNWIs) stand out for their multifaceted nature. Managing these vast and diverse assets requires not only precision but also a broad perspective that includes every aspect of each investment. The Altoo Wealth Management Platform, a Swiss startup, offers effective solutions in asset management and consolidated digital reporting. The Altoo's revolutionary methodology simplifies the complex pattern of UNWI portfolios, delivering clarity and insight via advanced technology. This article delves into the world of UHNWIs and investigates how The Altoo Platform sets the benchmark for efficient, effective portfolio management.

Significant advancements in digital technology are driving an enormous shift in the wealth management industry. This transformation is altering the way wealth management services are delivered, with major implications for trusts and foundations.

Artificial intelligence (AI) has emerged as a transformative force in many industries, and philanthropy is no exception. AI's potential to revolutionise philanthropic efforts by streamlining processes, improving decision-making, and facilitating research is increasingly recognized.

Market dynamics, technological advancements, and changing client needs are what keep the asset and wealth management landscape in flux. The year 2024 brings forth a host of trends that redefine how individuals and businesses approach managing their assets and securing their financial futures.

Private foundations have demonstrated an unwavering commitment to philanthropy despite economic uncertainties and market downturns. The recently released 2023 Report on Private Philanthropy highlights trends within these foundations and provides valuable insights into their impact on charitable causes.

Swiss entrepreneur and philanthropist Hansjörg Wyss has made a remarkable impact in the fields of business and philanthropy. With a net worth estimated at more than $4.7 billion, Wyss has dedicated his wealth to causes close to his heart, particularly environmental protection, health care, and scientific advancement.

To preserve and grow family wealth across generations, families often turn to innovative digital solutions that provide a comprehensive view of their assets. Traditionally, the responsibility of managing family wealth has been passed down through generations, often resulting in challenges and the potential dissipation of wealth. However, with the rise of digital solutions, families now have powerful tools to navigate these complexities and preserve their wealth for generations to come.

European foundations, with their substantial endowments and unwavering commitment to social good, offer valuable opportunities for NGOs seeking funding. In this comprehensive guide, we explore the top ten philanthropic powerhouses in Europe, examining their mission, impact, and endowment size. Driven by a commitment to social good, these foundations disburse billions of dollars annually to support various causes and initiatives.

In the world of philanthropy, there are standout figures whose impact goes far beyond their fame. Oprah Winfrey, J.K. Rowling, and Leonardo DiCaprio are prime examples. In this article, we'll explore the inspiring stories of these three remarkable celebrities who have used their success to make a positive difference in the world.

We think you might like

Capital gains taxes are assessed on a yearly basis. Investment losses can be “harvested” to offset gains, but markets do not organise themselves around calendar-year planning. Losses appear and disappear throughout the year as volatility creates opportunities that disappear long before a year-end review begins. Purpose-built technology enables what manual year-end processes cannot: continuous monitoring that captures opportunities as they emerge.

In early March 2026, senior leaders from across the financial sector gathered in Zurich for a discussion hosted by NZZ Finanzplatz on the future of artificial intelligence in finance. Among the participants was Ian Keates, CEO of Altoo AG. What became evident during that exchange was not enthusiasm for another technological cycle, but a recognition that something more structural is underway. Artificial intelligence is already embedded across the industry. The more pressing question is how institutions retain control once it begins to influence financial decisions in meaningful ways. Here, Ian shares his thoughts on the impact of AI in the

Private markets now represent nearly 30% of the average family office portfolio. Yet many family offices are not systematically tracking performance or predicting cash flows across these investments. Institutional investors treat private equity, venture capital, and other illiquid assets as measurable, forecastable components of total portfolio strategy. They automate what family offices often accomplish through quarterly manual reconciliation, spreadsheet calculations, and reactive cash management. Purpose-built technology is closing this gap, bringing institutional-grade automation to family office scale without requiring institutional-scale resources.

In case you missed it

Capital gains taxes are assessed on a yearly basis. Investment losses can be “harvested” to offset gains, but markets do not organise themselves around calendar-year planning. Losses appear and disappear throughout the year as volatility creates opportunities that disappear long before a year-end review begins. Purpose-built technology enables what manual year-end processes cannot: continuous monitoring that captures opportunities as they emerge.