From the client experience perspective, however, assuring well-diversified UHNWIs that their allocation strategies are on track is a significant challenge for wealth managers relying on manual workflows.

These strategies can take many forms depending on growth goals and risk tolerances. For example:

- Strategic asset allocation involves setting a long-term investment plan and designing a portfolio to maintain fixed percentages of certain asset classes.

- Tactical asset allocation is a more dynamic approach, where a portfolio is adjusted to increase exposure to types of investments expected to perform well in the short term.

- Core-satellite allocation combines elements of both of the above approaches. Strategic, relatively conservative “core” assets are chosen to ensure steady long-term growth. At the same time, a smaller portion of the portfolio is in tactical, riskier “satellite” assets predicted to outperform the market.

Even so, all asset diversification strategies have at least one thing in common: Behind each one is a wealth owner who wants peace of mind that the plan is being executed.

Using spreadsheets to provide UHNWIs with this peace of mind is an outdated approach and highly time-consuming for all involved parties. Reporting metrics differ among various asset types held with multiple banks and custodians, making the manual gathering, analysis, and interpretation of portfolio data a tedious exercise. Typically, advisors taking this approach can provide their well-diversified UHNWI clients with a snapshot of their total wealth composition only a few times per year and after several hours of effort.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

In theory, quarterly reviews of allocation mixes should be enough to reassure UHNWI clients that their diversification strategies are holding up. In practice, today’s UHNWIs would like to receive such assurances far more often – and with little or no advance warning. Similar to how global cellular network coverage is not necessary until it is, on-demand access to comprehensive yet easily understandable portfolio breakdowns is not necessary until it is.

Fortunately, technological solutions are available to help put this current asset allocation information at clients’ fingertips with minimal human effort. Here is a brief overview of these solutions and what they can offer UHNWI clients.

Behind the scenes: API connectivity and automated data processing

The more relationships with banks and other financial institutional relationships a UHNWI has, the longer it takes their advisors to manually consolidate data from these institutions. Doing so is often a question of logging into online portals, downloading statements, copying statement data into spreadsheets or building up data channels to various custodians.

Online portals are not the only way to access client data. Many institutions support application programming interfaces (APIs), which are essentially “pipes” through which UHNWIs can authorise the automatic transfer of data to trusted third parties.

For complex portfolios, the key advantage of APIs is that they enable data from multiple sources to be consolidated in near real-time into a single, centralised location.

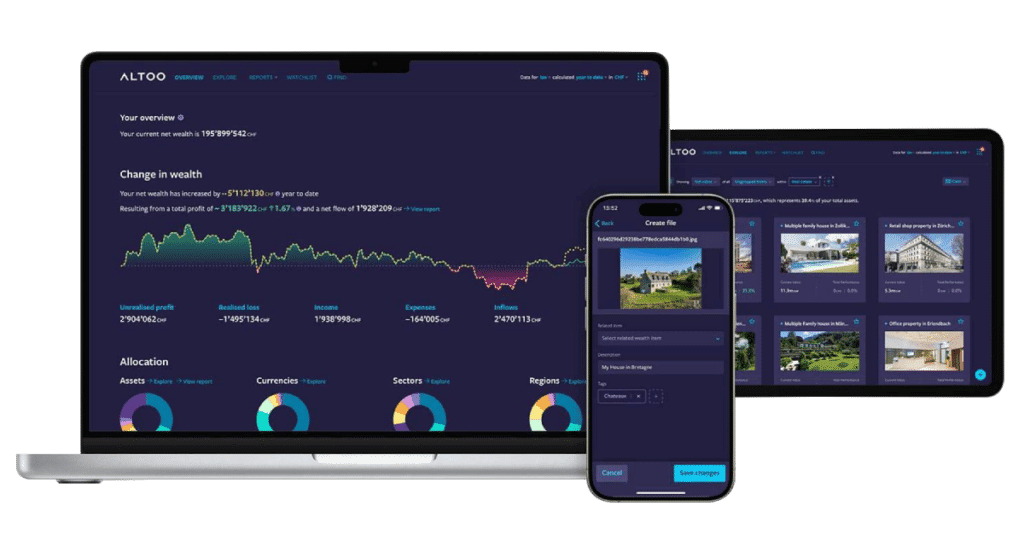

Ideally, this centralised location will be a platform that automatically optimises the incoming data for analysis, runs a wide range of asset-specific analytical processes, and visualises the results in intuitive dashboards. These dashboards can provide as much or as little detail as required, from the overall portfolio mix to the performance of individual holdings.

Since the data is handled continuously, all relevant information is updated in near real-time. Notifications can be promptly sent to clients regarding changes in markets, allocations, balances, asset values, and more. If such a change signals a need to rebalance a portfolio in line with an asset diversification strategy, the portfolio’s owner will be informed within minutes.

In addition to automation functionalities, a sophisticated platform of this type will also have advanced features for tracking and organising workflows around non-bankable assets, which are almost always present in an UHNWI’s total wealth.

On clients’ screens: Diversified portfolios, simplified anytime

By automating the entire process of gathering, analysing, and visualising data on clients’ diverse assets, UHNWI advisors can provide a wide variety of near real-time insights into even the most complex wealth.

What types of reporting and monitoring capabilities can automated data flows make accessible to clients on demand? A comprehensive set of examples can be found in the Altoo Wealth Platform, a solution that enables wealth owners and their advisors to easily understand the individual and aggregate performance of investments across multiple bankable asset classes:

- Equities: Tracking and benchmarking for both performance and fees, visibility of total exposure, and much more.

- Private equity: Tracking investments, commitments, and transactions; fund performance since inception; performance comparisons and measurement according to metrics like IRR, TWR, TVPI, RVPI, and DPI.

- Cash and cash equivalents: Liquidity management and planning; forecasting cash flows and dividends.

- Fixed income: Tracking of upcoming events; notifications of expiry dates; expense tracking; automatic FX conversions for comparing bonds issued in different currencies.

The platform also helps advisors streamline the UHNWI client experience in monitoring, geographically filtering, and optimising international portfolios of non-bankable assets like:

- Real estate: Modules for tracking expenses, P&L, and valuations for individual properties. Secure, on-platform messaging facilitates task assignments to property managers.

- Artwork and other collectibles: All items can be viewed in a single gallery together with valuations.

For wealth items in both bankable and non-bankable asset classes, all kinds of documents can be safely stored and attached. Examples include asset allocation agreements, fee agreements, performance reports, purchase contacts, and insurance policies.

Leveraging API connections to over 3,500 financial institutions and available 24/7 via both the web and a dedicated mobile app, the Altoo Wealth Platform makes it simple for wealth managers to visually, accurately, and promptly help clients zoom out to see the big picture of their wealth and zoom in to see how particular assets are performing.

Takeaway

Effective asset diversification should not lead to a poor client experience, where wealth owners must wait weeks or months to confirm that their allocation mixes are on target. Sophisticated technology can automate data flows to make comprehensive portfolio insights available almost instantly. Wealth managers can quickly leverage this technology – without the significant upfront costs or time investments associated with in-house solution development – by partnering with an industry-focused platform provider like Altoo.

This article was originally published in the Client Experience Toolkit 2024 created by The Wealth Mosaic. Check the media page regularly to stay up to date on our press work.