The Challenges of Managing Diverse Asset Portfolios

Private individuals and those managing their wealth may need to consolidate portfolios that include equities, real estate, private enterprises, and various forms of alternative investments. While this diversification is advantageous for risk management and possible profits, it adds major complexity to portfolio management. Each asset class has its own set of characteristics, market conditions, and reporting requirements, making portfolio management extremely difficult.

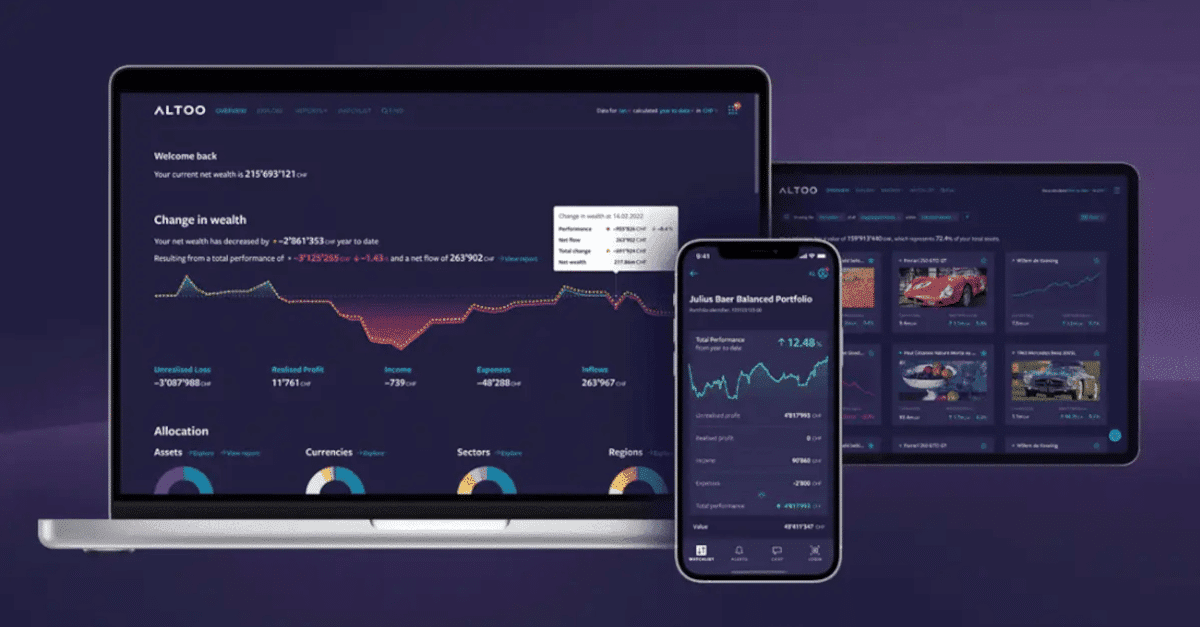

As a result, there is an increasing demand for more complex, integrated reporting systems that can meet the needs of diverse portfolios. Such solutions should not only integrate data from diverse asset classes but also provide the analytical capabilities required for effective portfolio management and decision-making. This is where advanced digital reporting solutions, such as those provided by The Altoo Wealth Platform, come into play in meeting the increasing needs of wealthy clients and those managing their wealth.

Real-Time Reporting and Its Necessity

Real-time reporting is essential for effective asset management. UHNWI portfolios, which frequently include a varied range of assets such as equities, real estate, and private equity, necessitate a management style that can respond to quick market changes and also provide a unified, complete view. Real-time reporting successfully satisfies these requirements.

One of the primary advantages of real-time reporting is its ability to quickly adjust to unpredictable market circumstances and dangers. The growing client needs, as well as complex legal constraints in wealth management, make advanced reporting capabilities critical for investment firms. Real-time data, which enables instant insights and adjustments, is critical for businesses to maintain a competitive advantage. It represents a significant shift from previous methodologies, such as Excel-based reporting, which frequently fails to meet the dynamic needs of modern wealth management.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Because of these limitations, Business Intelligence (BI) reporting has grown in popularity. The global business intelligence market was valued at $27.11 billion in 2022 and is expected to increase to $54.27 billion by 2030. BI reporting provides interactive dashboards that can contain real-time data, allowing clients to better customise and engage with their financial information. However, the integration of BI reporting systems with underlying portfolio management and trading tools is a difficulty. It is critical to ensure that these systems consistently bring in the essential underlying data for complete BI reports.

The Altoo Wealth Platform with its integrated reporting solution comes into play here. Altoo combines data from multiple sources to provide a thorough analysis that meets the needs for accuracy and latest information. Altoo gives a holistic view of an individual’s wealth by combining data into a single, interactive platform, enabling more informed decision-making and efficient management of different portfolios.

Tackling the Challenges of Alternative Investments

Alternative investments like private equity, hedge funds, and real estate complicate wealth management reporting. Accurate, timely, and comparable data is vital but difficult to obtain for these investments. Most alternative asset data is unstructured and undigitized, making management challenging. Asset owners sometimes use many data transmission formats, such as PDFs, emails, and phone calls, without a standardised approach for classifying information throughout the asset lifespan.

The challenge grows as these investments diversify. Real estate debt servicing requires different data than buyout monitoring. Tracking private market asset classes is challenging due to the absence of industry standardisation and unique data features. Asset owners often struggle to manage many papers and lack data normalisation.

The integration of consolidated reporting technologies improves operational efficiency and reporting quality to address these issues. Manual data entry caused problems in invoicing and customer performance reporting due to the lack of proper technology for data formation and processing. Digital wealth platforms have changed reporting capabilities in many ways. Implementing new collection and performance reporting tools have mainly increased operational efficiency as one of the

The Role of Advanced Analytics in Investment Management

The financial landscape has evolved to necessitate advanced analytical techniques, particularly in areas such as private equity and hedge funds. Because of the complexity and uniqueness of these investment classes, precise analytics and cost breakdowns are required to correctly assess their performance and risk profiles.

The Need for Specific Analytics in Private Equity and Hedge Funds

Private equity and hedge funds are famous for their elaborate investing structures and techniques. This depth demands the use of sophisticated analytical tools capable of separating and assessing numerous components, such as fees, carried interest, and performance measurements. Understanding these factors is critical for investors attempting to determine the true cost and value of their investments. Advanced analytics aid in separating these components, providing a detailed view of the performance and potential hazards of the assets.

Solutions in Advanced Analytics

Companies such as Altoo often offer a variety of analytical tools that allow investors to:

- Analyse Performance Drivers: Using advanced analytics, investors may investigate the elements that influence private equity and hedge fund performance, such as market movements, portfolio company performance, and sectoral developments.

- Fee Transparency: Given the frequently complex fee structures connected with alternative investments, The Altoo’s solutions are likely to provide precise breakdowns of fees and expenses, providing for a more accurate understanding of investment costs.

- Risk Assessment: Advanced analytics are critical for detecting and assessing the risks connected with these types of investments. This covers, among other things, market risk, liquidity risk, and counterparty risk.

- Customised Reporting: Reports that are tailored to the individual needs and interests of investors, providing insights into areas such as asset allocation, return on investment, and comparative benchmarks.

Digital Reporting Tools: Meeting the Needs of the Next Generation

Digital reporting technologies have completely changed the face of family office reporting, ushering in a new era of efficiency, transparency, and strategic decision-making.

Data Collecting and Reporting Simplified

The introduction of automated data entry has reduced the necessity for manual data entry and heavy spreadsheet use. Family offices can now automate data gathering from diverse sources, such as financial institutions, assets, and real estate holdings, allowing them to provide complete reports. This automation results in more timely and accurate financial position insights.

Insights and Visibility in Real Time

Modern technology allows family offices to access real-time financial data, which is critical for making timely and educated decisions. This capability extends beyond the typical quarterly or annual reporting cycles, enabling continuous monitoring of portfolio performance, risk exposure, and market trends. Such adaptability is essential in today’s fast-paced financial market.

Improving Communication and Transparency

Transparency and communication inside family offices have improved because of digital reporting systems. They enable the development of customisable dashboards and portals through which stakeholders can receive customised information, investment updates, and performance measures. This level of transparency is critical for encouraging open discussions and promoting clarity on financial strategies and goals.

Advanced Risk Management and Compliance Features

Family offices are concerned about regulatory compliance and risk management. Advanced technological solutions provide powerful capabilities for tracking compliance and assessing risk. These solutions help family offices manage complicated regulatory settings more efficiently by monitoring investments, guaranteeing loyalty to regulations, and sending notifications for potential deviations.

Consolidated Reporting Strategy

The Altoo Wealth Management Platform excels at consolidated reporting. The platform is more than simply a data gathering and reporting tool; it also acts as a safe digital home for the entire wealth portfolio, merging multiple assets and investment data into a unified whole.

Key Features of the Altoo Wealth Platform

Access to Wealth Data Around the Clock

The Altoo Platform gives users 24-hour access to their full fortune, including both bankable and non-bankable assets. Users may make informed judgements at any moment since they have constant access to updated and unified wealth data.

Wealth Reports Simplified

Recognising the often complex and time-consuming nature of traditional wealth reports, The Platform was created with simplicity in mind, eliminating complex industry standards in favour of a more straightforward approach that improves understanding and decision-making.

Detailed Investment Analysis

Users can access full information about their funds and direct investments, analyse performance, and compare different private investments at the same time. The software allows for the effective management of open commitments and allows for modification to correspond with specific investment strategies.

Integration of Multiple Banks and Asset Classes

The Altoo Platform can link critical wealth information, papers, and contacts to assets while tracking changes over time. This connection is critical for managing complicated portfolios that span many institutions and asset types.

The Altoo Wealth Platform integrated digital reporting solutions are a game changer in the difficult area of wealth management. Altoo provides its clients with the tools they need to navigate today’s dynamic financial landscape efficiently and confidently. It addresses the challenges of diverse asset portfolios by providing real-time reporting capabilities, tackling the complex nature of alternative investments, and incorporating advanced analytics. The Platform is recognised for its innovation in the wealth management sector, ushering in a new era of transparency, effectiveness, and informed decision-making.