The Big Mac Index is a simple yet powerful tool for understanding macroeconomic trends. To give you more specific insights around how these trends are impacting the value of your portfolio, the Altoo Wealth Platform consolidates data from wherever your wealth is held, automatically analysing it, and displaying up-to-date performance information through intuitive dashboards.

Understanding the Big Mac Index

The Big Mac Index is a non-official tool that assesses and contrasts the purchasing power of various currencies worldwide. Pamela Woodall, an economist, created it and first published it in The Economist magazine in 1986. It does this by using the price of a Big Mac burger from McDonald’s as a standard reference point. The underlying assumption is that the basic elements of a Big Mac – bread, meat, lettuce, and sauce – do not significantly differ across regions and menus.

Examining Global Disparities

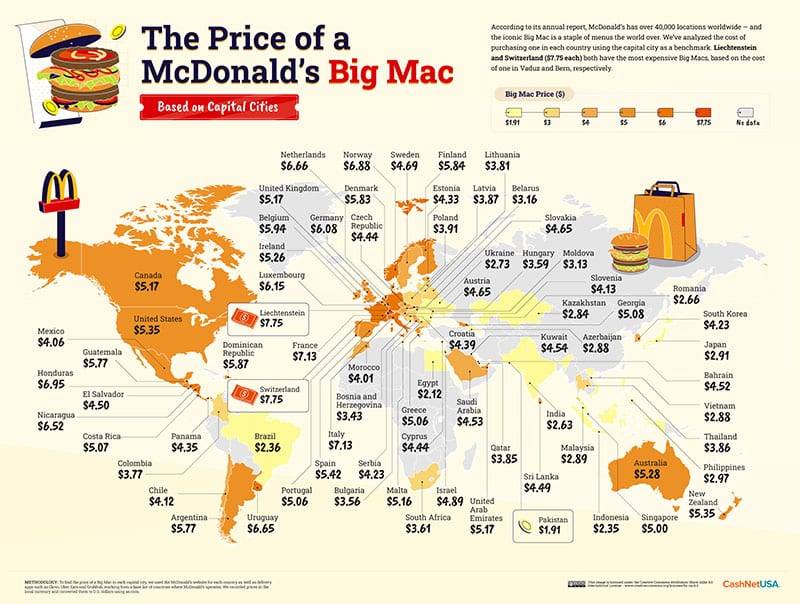

By examining Big Mac prices across various countries, the index reveals the relative strength or weakness of a nation’s currency. In affluent countries characterised by elevated labour costs and greater purchasing power, Big Macs tend to command higher prices. Conversely, in less affluent countries, the cost of a Big Mac is lower, indicative of diminished purchasing power.

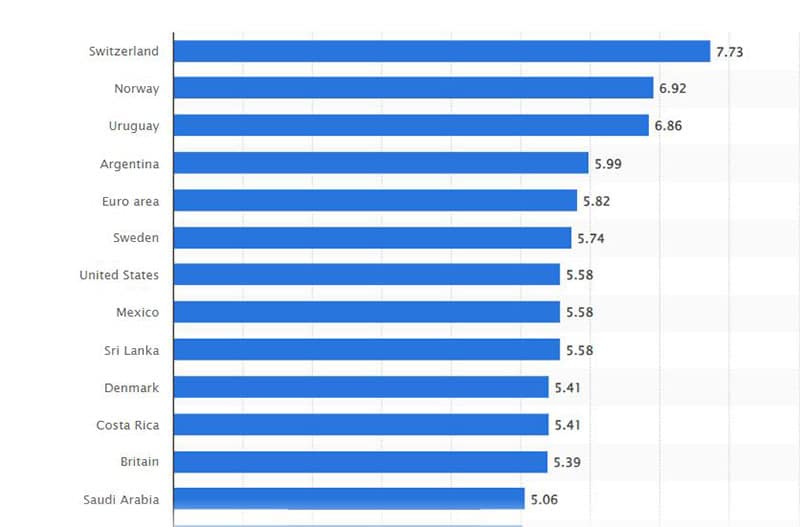

Global Price of a Big Mac as of July 2023

Switzerland boasts the world’s most expensive Big Mac, priced at 7.73 US dollars, showcasing the country’s robust economy and strong currency. Concurrently the cost of a Big Mac was 5.58 dollars in the U.S., and 5.82 U.S. dollars in the Euro area.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

How Has the Big Mac Index Developed in Recent Years?

Many countries have hardly changed their ranking in the Big Mac Index in recent years. Ukraine, Russia and India were already at the bottom of the rankings a few years ago, while Switzerland was always at the top. The Swiss often had the highest dollar prices per Big Mac worldwide and were only relegated to second place by Norway or Israel.

Long-term developments can be seen from the index data of the past decades. For example, the rise of China, which had the lowest price per Big Mac in the world as recently as 1995. The end of the Soviet Union was also reflected in the Economist’s data: at the beginning of the 1990s, current EU member states such as Poland and Hungary were also at the bottom of the rankings.

Limitations and Criticisms

Economists criticise the fact that the price of a Big Mac is not sufficient to compare the purchase price parity. This means that the index could change much more easily than a standardised basket of goods. They also argue that the Big Mac Index does not do justice to various factors that can change the price in different countries. For example, there are major differences in wages or transport costs worldwide, which cannot be taken into account.

Although the burger is sold in standardised form in most outlets, it is not identical everywhere: in India, for example, where the consumption of beef is taboo, it is prepared with chicken. Furthermore, Big Macs are not sold in every country in the world. Many African countries, for example, do not have a McDonald’s branch.

Top Big Mac Alternatives

- A Bread loaf. Some countries do not really eat that much bread, so it won’t work as well as the Big Mac.

- An iPhone 7. The iPhone 7 is currently the most used phone in the world; however, as it is an old model, prices fluctuate depending on where you buy it.

- A Starbucks coffee cup is a similar item, but it will not dethrone the famous Big Mac index.

As you see, there are several alternatives to the Big Mac Index. Also, the Chicken Index, which includes more African countries, takes a similar approach. To mark the 30th anniversary of the Big Mac Index, the iPhone Index was also published, which is intended to provide a new orientation aid on the currency markets. Anyone wishing to compare prices within the EU can also consult the price level index for EU countries.

In conclusion, recognising the drawbacks of the Big Mac Index, alternative methods have emerged to measure global wealth disparities. However, the Big Mac Index remains popular due to its simplicity and widespread recognition.

Despite its limitations, the Big Mac Index provides a unique perspective on global economic disparities and wealth distribution. By analysing the price differences of a familiar fast food item, we gain insights into the purchasing power and relative strengths of currencies worldwide. While it may be an informal tool, its long-standing popularity and yearly updates indicate its usefulness as a starting point for understanding international economies.

So, the next time you enjoy a Big Mac, remember that it can offer more than just a tasty meal – it can also provide valuable insights into our globalised world.