A Jewel in the Skyline

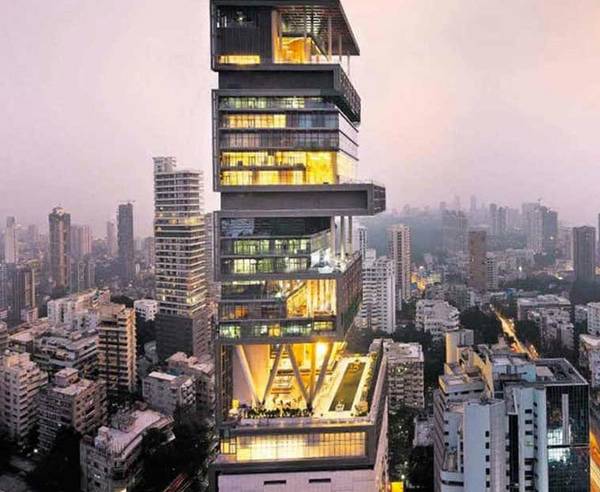

Antilia’s towering presence on the Mumbai skyline is a sight to behold. With its luxuriously high ceilings, this 27-storey mansion is as tall as a typical 60-storey high-rise building. The top six floors serve as a private home for Ambani and his family, providing them with infinite privacy and comfort. But Antilia is more than a residence; it is a symbol of wealth, power and architectural grandeur.

The Extravagant Features

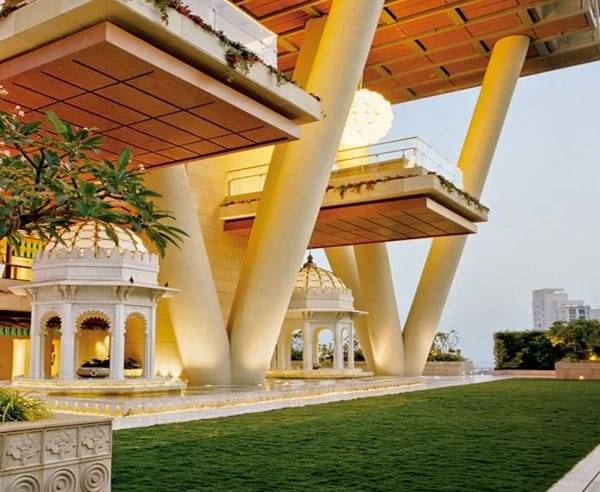

Step inside Antilia and you’ll be greeted by a world of extravagance and indulgence. From guest suites to a temple, a beautiful cream parlour to a spa, a ballroom to a cinema and a six-storey garage, Antilia leaves no stone unturned when it comes to luxury. But it is the Snow Room that really sets this mansion apart. Imagine walking into a room filled with artificial snow, where freezing temperatures provide a respite from Mumbai’s scorching summers.

A Unique Layout

Antilia’s layout is a testament to architectural brilliance and meticulous attention to detail. Spread over 400,000 square feet, the mansion is a labyrinth of carefully crafted spaces. No two floors are alike, ensuring a sense of uniqueness and exclusivity throughout the residence. The design incorporates elements inspired by nature, with the lotus and the sun as recurring motifs. Crystals, marble and mother-of-pearl adorn the interior, adding a touch of elegance and sophistication.

Marvel of Design and Construction

The design and construction of Antilia has been nothing short of extraordinary. Two renowned architectural firms, Perkins&Will and Hirsch Bedner Associates, were hired to bring Ambani’s vision to life. The development plan was approved by the Brihan Mumbai Municipal Corporation in 2003 and construction began in 2006. Leighton Asia was initially responsible for the project, which was later completed by B. E. Billimoria&Company Ltd. The architects made changes to the layout and design concepts as the building took shape, ensuring a seamless blend of aesthetics and functionality.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

The Cost of Extravagance

Antilia’s price tag is staggering, even by UHNWI standards. With estimates ranging from $1 billion to $2 billion, this residence is a true testament to its owner’s immense wealth. It exceeds the value of London’s Buckingham Palace, which is technically owned by the government. As a private residence, Antilia is the most valuable in the world. Its sheer size and opulence make it a symbol of the aspirations and achievements of the world’s elite.

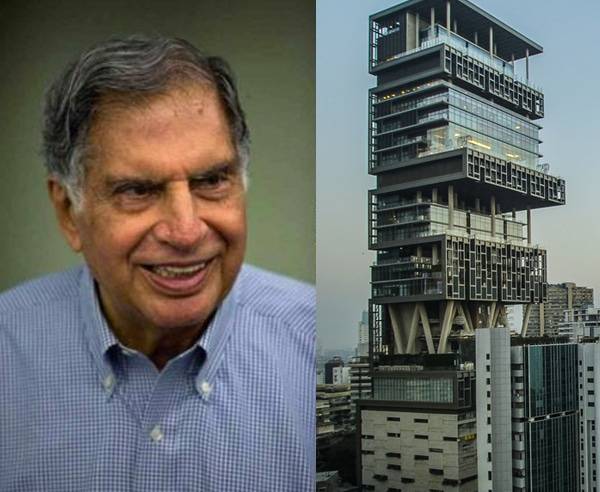

Incidents and Public Reaction

Public reaction to Antilia has been mixed. Some see it as a symbol of the lack of empathy among the ultra-rich, while others see it as a testament to the achievements and progress made by individuals who have attained immense wealth. Ratan Tata, former chairman of the Tata Group, expressed his concern about the gap between the wealthy and the less fortunate and emphasised the importance of using one’s wealth to make a positive impact on society.