New Altoo Wealth Management Platform feature optimizes future cash flow assessment and liquidity

Zug, Switzerland – March 25, 2024 – Altoo AG, a fintech that empowers investment professionals, family offices and individual ultra-high-net-worth clients to conveniently oversee their wealth, and Divizend GmbH, a technology company that develops solutions for dividend investments and related tax issues, have announced a collaboration that automates and enhances the cash flows of shares and bonds held by clients using the Altoo Wealth Management Platform.

The newly launched automated forecasting feature for upcoming dividend payments on security holdings is designed to help Altoo clients optimize future cash flow assessment and liquidity. Dividend payments are automatically predicted for all holdings, while automated tracking within the Altoo platform makes it easy for investors to ensure all planned cash flows are included in their forecasts.

“We are always looking for new ways to take the complexity out of wealth management,” said Ian Keates, CEO at Altoo. “Working with Divizend allowed us to not only reduce effort for our clients, but also increase the accuracy of their future cash flow forecasts. It also is a testament to the great things that can be accomplished through partnerships.”

Altoo and Divizend are considered rising stars in the Swiss fintech market, most recently being named among the top five Growth Stage Start-ups of the Year in the Swiss FinTech Awards. Chosen by an independent jury of 20 fintech experts, the awards recognize outstanding Swiss fintech start-ups “which have a successful product on the market, a working business model and clear signs of (exponential) growth.”

Both organizations are also members of the Swiss OpenWealth Association, which aims to connect financial institutions, WealthTechs and other service providers to better define, maintain, and operationalize global API standards that enable Open Finance use cases. This new collaborative forecasting solution is an example of how OpenWealth members are working to combine best in class solutions to provide superior client experiences.

“Dividend forecasting can be extremely challenging for investors, but it is an important building block in forward-looking financial planning, as dividends and their well-founded forecast represent the income of the future. Divizend has a dividend database with the 20,000 most important dividend stocks of the highest quality. It also includes specific dividend tax parameters. ” said Thomas Rappold, CEO and Co-Founder at Divizend. “We are thrilled to partner with Altoo to automate the process for their clients, and help these individuals optimize their liquidity planning through improved forecasting.”

Additional Resources:

Altoo Insights: Insights | Altoo AG

Newsletter Subscription: Subscribe | Altoo AG

Media Inquiries: Media Hub | Altoo AG

ABOUT ALTOO

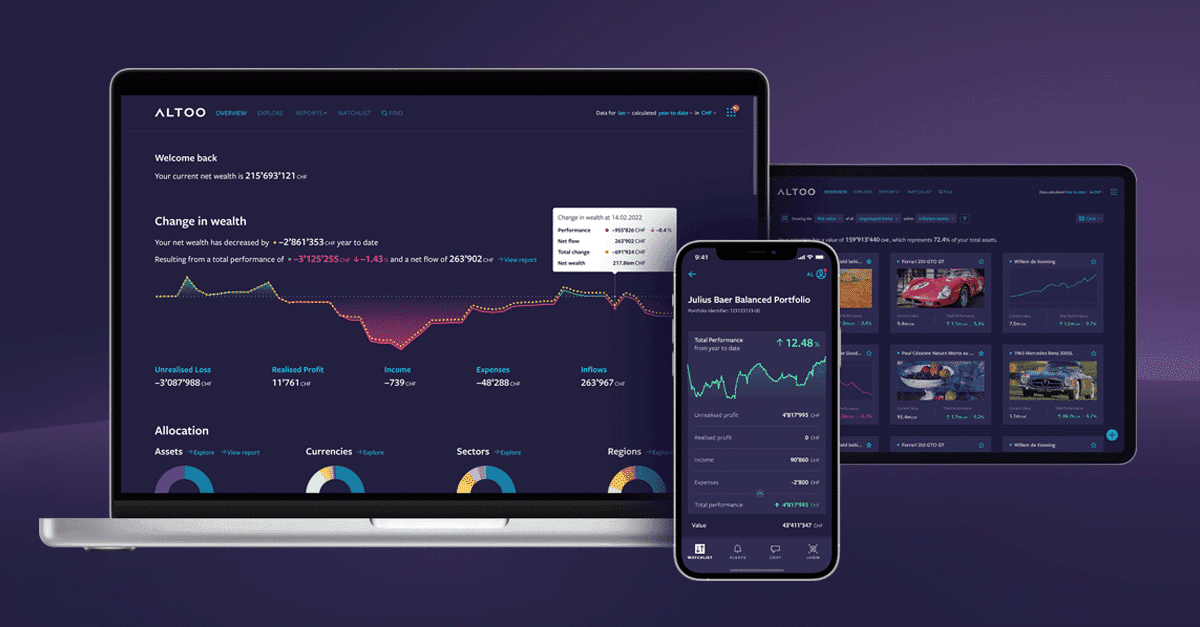

Altoo is a wealth management fintech with headquarters in Zug, Switzerland. The Altoo Wealth Management Platform aggregates wealth data from multiple sources to deliver comprehensive wealth analysis, performance and reporting. Founded in 2017, Altoo has clients in more than 20 countries and is recognized as an industry-leading provider of digital wealth management services. For more information, visit www.altoo.io.

Media Contact: press@altoo.io

ABOUT DIVIZEND

Divizend is a wealth-tax FinTech platform used to reclaim foreign dividend withholding taxes. The company’s B2C software helps private investors to reclaim their taxes by automating the withholding tax refund process. Its platform is the central place for investors striving for high dividend earnings, as they will find only the most relevant insights, research, analytics, and tax services.

Media Contact: info@divizend.com

Media Assets

We think you might like

Our Head of Business Development, Cosimo Violati, was interviewed by the Family Capital Magazine on the benefits of the Altoo Wealth Management Platform for family wealth. You can read the transcript of this article below. Partner Content: Altoo wealth platform provides a secure home to build your digital wealth legacy The Altoo Wealth Management Platform […]