Across 2025 surveys, family offices say the same thing in different words: geopolitics now tops the list of risk drivers. In its 2025 Global Family Office Survey, BlackRock reports that 84% of family offices say political uncertainty is the most important issue shaping allocations and turning overall sentiment negative for the first time since 2020 (Source: 2025 Global Family Office Survey BlackRock, Press release). UBS reaches a similar conclusion: a global trade war ranks as the biggest investment risk for 2025 and more than half of asked family officers fear major geopolitical conflict (Source: UBS Global Family Office Report 2025). In this mood, it is only obvious that speed, clarity and jurisdictional control are the edge.

What changed, and what that means for you

Regulation now moves at the speed of politics. A new sanctions list can freeze a counterparty. Tariffs can compress operating-company cash flows. Capital controls can trap liquidity. Residency or travel changes can complicate everything from refinancing to probate. If assets, accounts, entities and documents live in different places, your ability to act lives in different places too.

The antidote is not another spreadsheet, it is a single operating picture:

- Complete ingestion: securities, cash, private funds, direct stakes, real estate, art and collectibles, loans and the entities that own them.

- Jurisdiction intelligence: every line item tagged by country, custodian/seat, governing law and payment rails.

- Documents where they matter: titles, pledges, insurance, powers of attorney and board resolutions attached to the specific asset or entity.

- Role-based visibility: principals, heirs, trustees, CFOs and counsel see only what they need, with an audit trail.

- Local control: if your family prioritises Swiss privacy norms, insist on infrastructure produced, hosted and resident only in Switzerland.

Myths that slow you down (and what to do instead)

“Our private-bank portal shows everything.”

It shows bankables. It rarely shows non-bankables or maps exposure by jurisdiction. Build a full register.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

“A spreadsheet is enough.”

Spreadsheets don’t deliver live feeds, granular permissions, audit trails or breach alerts.

You need rules and logs.

“Cloud means data is everywhere.”

It doesn’t have to. You can choose a platform built and hosted exclusively in a safe country such as Switzerland.

Beyond statements: turn data into dialogue (and decisions)

Periods of turbulence often lower internal resistance to change, creating a window to implement larger, overdue shifts. Recent HBR research underscores this point: during uncertainty, leaders who limit themselves to pilots and “small wins” often lag those who pursue bigger, coherent moves – because external shocks relax organizational veto points. Classic evidence supports the same conclusion: companies that balanced selective cost discipline with bold investment were far likelier to outperform after recessions than those that only slashed or only spent. (Source: Harvard Business Review).

Health care offers a clean example. Virtual care languished for years in committees, the pandemic forced clarity and accelerated adoption across leading hospital systems, proving the utility and unlocking scale. The family-office analogue is obvious: stop debating the perfect architecture and consolidate now.

Also keep in mind that wealthy families do not want stacks of PDFs. They want a single, living picture which is updated in real time, explorable, and transparent on costs, risk and progress. Consolidated reporting is how you move from “What do we own?” to “What do we do next?”

| Theme | Why It Matters For Wealthy Families | What “Good” Looks Like In A Consolidated Platform | Conversation It Unlocks |

|---|---|---|---|

| Beyond statements | Fragmented reports hide the true picture. | One holistic view of all assets (bankable + non-bankable), entities, and liabilities. | “Here’s the full balance sheet and how parts work together.” |

| Multi-dimensional analysis | Risk isn’t just allocation—it’s geography, currency, factors. | Lenses for asset mix, country, currency, factor risk; stress tests & scenarios. | “Under a tariff/FX shock, here’s the impact and our plan.” |

| Personalised reporting | Different roles need different views. | Role-based slices, tailored visuals, narrative notes per stakeholder. | “Each of you sees what you need … no oversharing.” |

| Data quality & audit | Bad data destroys trust. | Reconciliation, validation rules, periodic audits, full activity logs. | “Here’s the audit trail … who saw/changed what, when.” |

| Engagement & relationship metrics | What gets measured improves. | Portal usage, report opens, meeting cadence, consolidation trends. | “Engagement is up; consolidation followed.” |

The Operator Playbook: seven moves that compound

When the world speeds up, your first win is knowing exactly what you own, where it sits, and who can move it.

01 Inventory by jurisdiction

Build a jurisdiction-first register. Tag every asset, account and security by country, custodian and legal owner. Add settlement location, governing law and payment rails (SWIFT/SEPA/local). Record counterparties (relationship managers, trustees, lawyers) so you know who can act. When a headline drops, you sort exposure in seconds.

02 Build a trade-war dashboard

Surface tariff/export-control sensitivities, cash buffers by jurisdiction and FX swings. Pre-agree alert thresholds (drawdowns, FX moves, liquidity levels) so decisions are not made on adrenaline. Keep the view simple and relentless: what’s at risk, how much, and what we do if X happens.

03: Link documents to assets

Attach KYC, title, insurance, pledge and lending covenants, and transfer templates to the assets they govern. Keep board resolutions and PoAs ready. Action should be one click, not a scavenger hunt; every file should live next to the asset it unlocks.

04 Give the right people the right view

Principals, heirs, trustees, CFOs and counsel don’t need the same access. Use role-based permissions and read-only slices. Keep discussion threads attached to the asset or entity so context never gets lost in email.

05 Stress-test people mobility

Map where principals and heirs live and travel. Confirm available payment rails and liquidity in those places. Identify trusted local counsel. The goal is not prediction, it is readiness when rules shift mid-trip.

06 Automate breach alerts

Define policies for allocation drift, counterparty credit, margin and country limits. Add triggers for sanctions, capital controls and tax changes. Route alerts to an owner (with a backup) and track time-to-acknowledge and time-to-resolve so the process improves.

07 Set a quarterly jurisdiction review

Each quarter, confirm custody locations, entity seats and residencies, reconcile with policy, log decisions and the reasons. Over time, that log becomes institutional memory and your best defence against avoidable surprises.

Why you need a Swiss platform (and why Altoo fits)

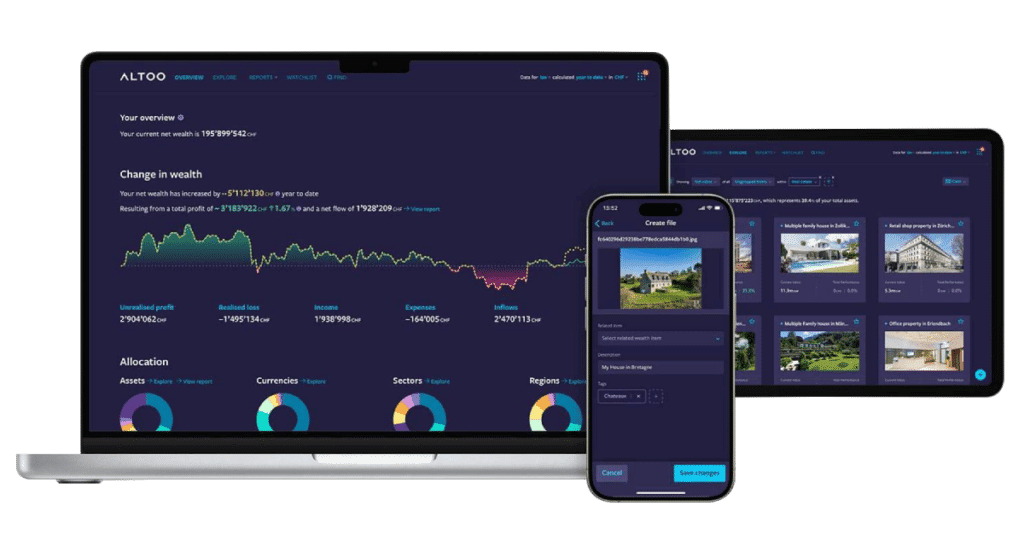

Families want digital consolidation without exporting their lives across data borders. That’s the logic of choosing a system produced, hosted and operated in Switzerland. The Altoo Wealth Platform positions itself as a secure digital home for total wealth—built for owners, family officers and advisers to collaborate in real time.

Main strengths (in plain terms):

- Swiss-resident private cloud operated in-country by an in-house team (smaller attack surface, clear oversight).

- Strong authentication, including three-factor for sensitive flows in multi-family contexts.

- Encryption and secure document storage tied to the asset/structure it governs.

- Role-based access with logging so every view and change is attributable.

- Breadth of ingestion so private funds, directs, real assets, art and loans sit next to brokerage feeds—plus the documents and contacts that unlock action.

One useful download

To help you brief stakeholders and set cadence, download Elite Wealth: The Art of a Successful Family Office. This is your concise companion for conversations with principals and heirs.