Altoo AG, a fintech empowering ultra-high-net-worth individuals, family offices, and investment professionals to easily understand every aspect of the complex wealth under their care, announced that its commitment to client satisfaction and innovation has taken the company to new heights in 2024. The company made further progress in implementing its business development strategy and consistently pushed ahead with its innovation projects for the Altoo Wealth Platform.

High satisfaction among growing client base

Since the start of this year, Altoo has welcomed new clients in six countries across three continents and maintained an industry-leading client retention rate.

The substantial growth momentum was primarily attributed to the first six months of the year, which saw a double-digit increase in new clients. The company received an impressive 98% customer satisfaction score from respondents to a survey conducted this March. The ability to effortlessly view all of their assets in one place was rated by 93% of respondents as the Altoo Wealth Platform’s main selling point and the top benefit of utilising this digital wealth management solution. In addition, 64% of respondents indicated that Altoo’s servicing team exceeded or greatly exceeded their expectations.

Besides the continuous growth and investment into the platform Altoo welcomed various new team members to support the continued growth and ensure service and support levels remain as high as of today with expected additional asset volume and overall clientele.

Enhancements to the flagship product

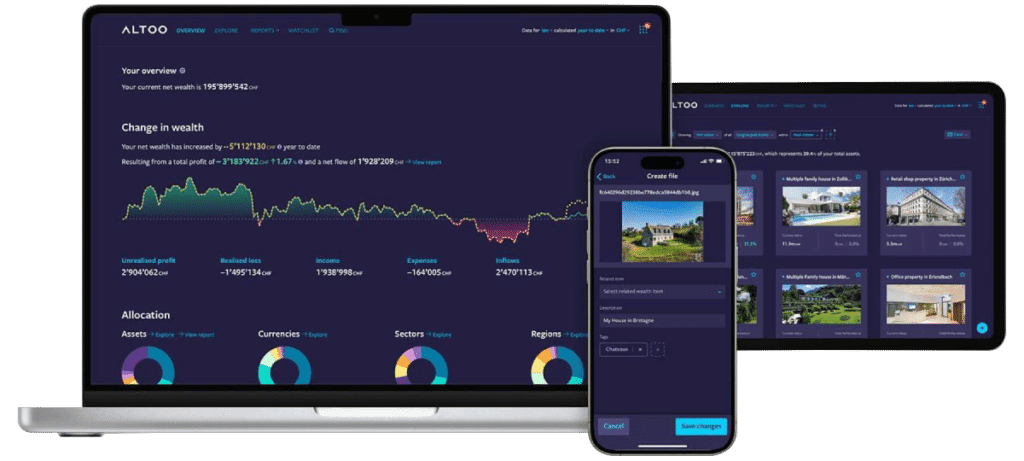

As of this May, the Altoo Wealth Platform – the company’s primary offering, recognised by Forbes for four years running as one of the best family office software solutions – featured automated dividend forecasting. Altoo clients now have an easy way to incorporate upcoming securities dividend payments into their cash flow and liquidity planning. This new feature is one of over twenty technical improvements rolled out during the first half of this year, including enhanced capabilities for monitoring cash flows as well as tagging and filtering asset records.

“These recent upgrades are the latest examples of how we strive to put clients’ needs at the center. Our primary goal is to make managing complex assets simple for our clients. We want to continuously deliver an even better user experience and strengthen our foundation for future innovation,” explains Ian Keates, CEO of Altoo AG.

Meeting industry and client communication needs

Under the guidance of Ian Keates, a highly experienced technology leader and strong advocate for open finance solutions, Altoo AG has been actively focusing on business development plans, striving to meet the needs of its industry community, and increasing awareness about digital wealth management solutions.

The company attended the Europe Investment Family Office Summit 2024 in Lausanne, Switzerland, and the SFO Week in London, to talk about important industry issues besides connecting to peers and customers.

To continue finding new ways to apply Altoo knowledge, the Altoo Insights Podcast series debuted this March. Its goal has been to shed light on the influence that digitalization and affluent individuals’ evolving expectations have on the wealth management industry. In particular, in the first episode, Ian Keates stressed the importance of investing in modern technology to improve and personalise the client experience.

100% Swiss-developed and hosted

Altoo is a wealth management fintech founded in 2017 and headquartered in Zug, Switzerland. The company’s flagship product, the Altoo Wealth Platform, aggregates wealth data from multiple sources to deliver comprehensive wealth analysis, performance and reporting. It is a modern and sophisticated, highly secure, SaaS platform, 100% Swiss-developed and hosted. Altoo AG was named among the best providers of Family Office Software by Forbes Magazine and a Top 5 Growth Startup at the Swiss Fintech Awards in 2023. Constantly seeking new ways to simplify complex wealth for clients in over 20 countries, Altoo AG recently partnered with Divizend GmbH to optimise the Altoo Wealth Platform’s cash flow and liquidity planning features.

Stay up-to-date with Altoo by visiting our company news site and exploring the media page for the most recent press releases.