Efficiency and Transparency

For wealth managers, the ability to make informed decisions aligned with their clients’ financial goals is a key success factor. Timing and precision are paramount, and wealthtech solutions can add significant value by automatically aggregating and analysing vast amounts of financial data quickly and accurately.

With data entry, reconciliation, and other routine portfolio management tasks automated, wealth managers can focus on devoting their creativity and human touch to client relationship building, strategic planning, and other higher-value aspects of their business. For clients, these digital solutions provide real-time visibility of their investment portfolios, fostering trust and confidence.

Purity and Clarity of Data

Markets will always be changing, but the supreme importance of reliable, accurate data will remain the same in the investment business. Every wealth manager knows that erroneous or outdated information can lead to flawed analyses and misguided strategies, not to mention erosion of client trust.

A proper portfolio management system ensures data purity in order to avoid tainted insights. As the old IT saying goes: garbage in, garbage out.

Wealth Aggregation: Simple, Dynamic, and Secure Beyond Compare. Discover the Altoo Wealth Platform!

To maintain data clarity, rigorous data governance, validation, and monitoring practices are required. Automated data reconciliation, regular audits, and adherence to data management best practices are essential here.

Portfolio Wealth Management with the Altoo Wealth Platform

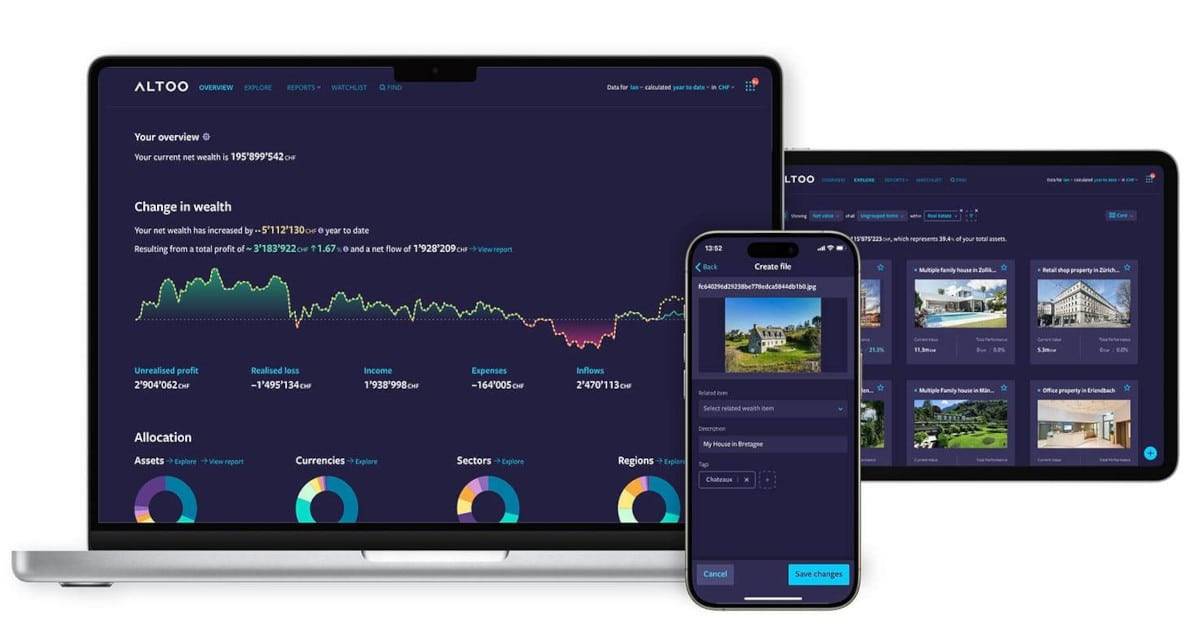

The Altoo Wealth Platform provides comprehensive portfolio management solutions for both investment professionals and their ultra high net worth clients. It securely brings together data on both bankable and non-bankable assets into a single place to provide comprehensive, intuitive, and up-to-date overviews of entire portfolios, with advanced analytics and reports just a few clicks away.

To experience it for yourself, please contact us!