The target point for investment opportunities has typically been South Africa. According to Forbes Advisor, South Africa has suffered a mixed performance over the last five years, ending the period down by more than 15%. There was a confluence of drivers ranging from political noise, electric power outages, and COVID-19 disruptions weighing on the market.

Natural Resources and Green Energy

Natural resources represent key assets for African economies. Natural capital accounts for 19% of Africa’s total wealth compared to 7% for Latin America and the Caribbean and 3% for developing Asia. From 2011 to 2020, African forests increased the global carbon stock by 11.6 million kilotons of CO2-equivalent net emissions, while carbon stocks in forests outside Africa declined by 13 million kilotons.

In recent years, in Africa, there has been increasing investment from Gulf countries in the infrastructure, telecoms, and agriculture sectors. The governments look to external sources of funding for large development projects. These sources include sovereign wealth funds, state-owned private enterprises, and development funds. Parts of Africa also offer significant potential for growth in solar power, with relatively cheap land and high levels of sunlight.

Europe is ramping up its domestic renewable energy capacity to meet net-zero emission targets, but supply constraints remain an issue. The EU is looking to Africa to meet the shortfall in renewable energy production. The energy transition requires substantial investments in solar and wind generation capacity, critical areas of development for the EU. It will involve mining and processing significantly higher amounts of ‘green’ metals.

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

Some of the largest mining companies in the world are located in South Africa. The country has abundant supplies of natural resources. These export-oriented businesses are making long-term investments particularly attractive.

Political Instability and Energy Crisis

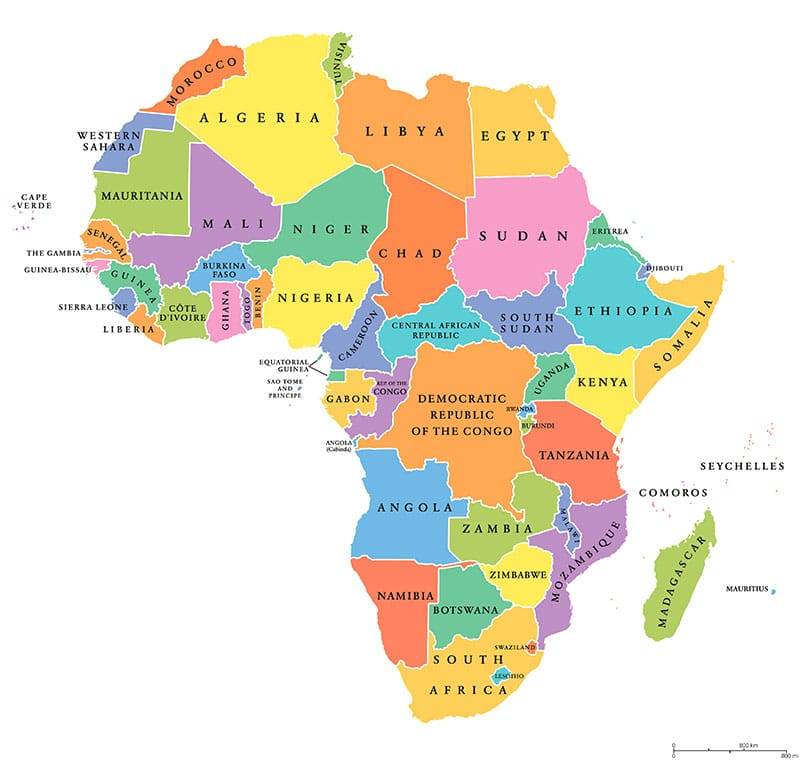

Africa entered 2023 with public debt averaging 55%, its highest level in over a decade. The global crisis is affecting investment in Africa more than in other regions. The average inflation rate for the continent was projected to reach 15.5% in 2023—the highest level in 27 years—with peaks above 15% in 11 African countries. The continent has the disadvantage of a concentration of wealth across a small number of countries. Investors may be concerned by the potential insolvency risk of countries with high public debt in the region. Zambia, Mali, Ghana, and Lebanon have defaulted on their sovereign debt in the last few years. As the Forbes Advisor notices, there are fears that Tunisia and Egypt may follow suit.

Political instability is also an issue on investors’ minds. The unrest is present in parts of the region, including South Africa and Niger. Moreover, stock markets are not as well regulated as in developed economies, and there is a risk that reforms to foreign ownership regulations will be paused or even reversed.

Resource-rich countries can try to capitalise on global demand to bolster energy security and transition towards greener forms of energy in 2023. Strained public finances, caused by the pandemic and the Russia-Ukraine war, will incentivize many governments to try and extract greater benefits from their natural resources. Foreign operators are likely to be subject to continued state intervention in the natural resource sector in Guinea, Cameroon, and Ghana; fewer tax exonerations in Burundi, Congo, and Liberia; and increased efforts to boost local mineral processing in Zimbabwe, Guinea, DR Congo, and Zambia.

South Africa presents yet another interesting opportunity. Its access to a broad range of metals, many of which have a role to play in the energy transition, is making it the continent of the future. The private sector-driven investment in renewables will enable a gradual return to electricity security, now in crisis, allowing South Africa to grow out of its public sector utility challenges.